via Molly Smith

The recent weakness in the leveraged loan market isn’t a passing trend, and the asset class is set to perform even worse next year as the U.S. economy edges closer to a downturn, according to Gershon Distenfeld of AllianceBernstein LP and Eaton Vance Management’s Kathleen Gaffney.

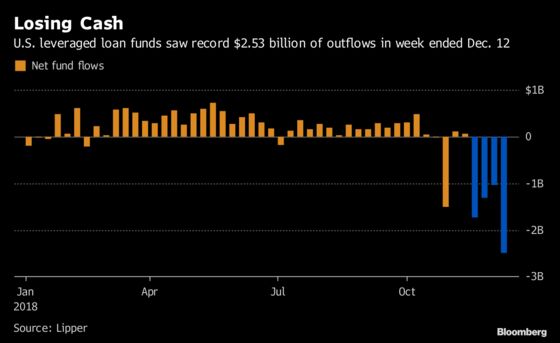

While the risky debt has outperformed amid frenzied buying this year, cracks in investor demand are starting to emerge. U.S. leveraged loan funds saw a record outflow of $2.53 billion in the week ended Dec. 12, according to Lipper, and the pain could only worsen from here. A more dovish outlook for upcoming Federal Reserve rate hikes erodes the incentive to buy loans: their floating rate nature is seen as a hedge against rising rates.

“Having outflows that are 2 to 3 percent of the market is scary. What happens if we get 10 or 15 percent?” Distenfeld, co-head of fixed income at AllianceBernstein, said on Bloomberg TV Friday. He has long been skeptical of the market. “I’m worried if this continues, we’re going to start hearing some liquidity fund issues from open-ended mutual funds.”

In addition to rising rates, loans have also been supported by demand from collateralized loan obligations, repackaged corporate debt that has made up “most of the appetite” for loans, according to Gaffney, co-director of investment-grade fixed income at Eaton Vance. CLOs have been on a feeding frenzy for much of this year, but in the wake of recent widespread market volatility, the demand has waned, even causing some investors to pull offerings.

“When that changes and you’re seeing that supply demand come out of balance, who are you going to attract?” Gaffney said on Bloomberg TV. “The ones that are going to come in are probably more like me, total return, that are looking for much bigger discounts than that market has seen since 2008.”