by Sven Carlin

The stock is trading at a 90% discount to the combined net present value of the two lithium projects it owns.

Junior miners have mostly equity as currency and might easily over promise to push their respective stock prices up.

Lithium Americas expected production costs in Argentina are 30% lower than Orocobre’s current production costs on what is practically the same asset.

On the upside, if all goes well, you can expect $500 million in free cash flow from 2025 onward. Not bad when compared to the current market cap of $318 million.

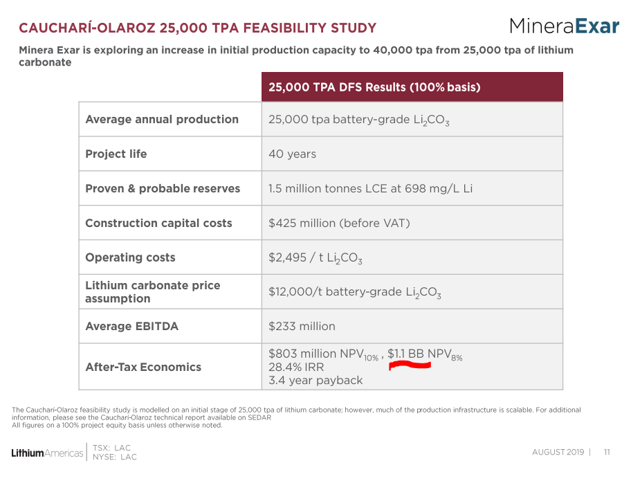

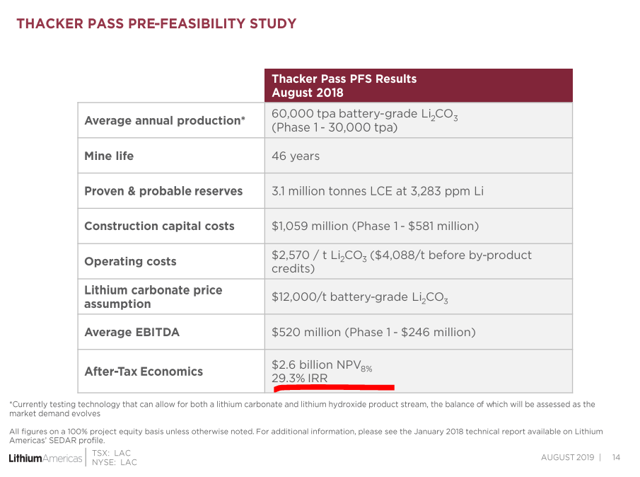

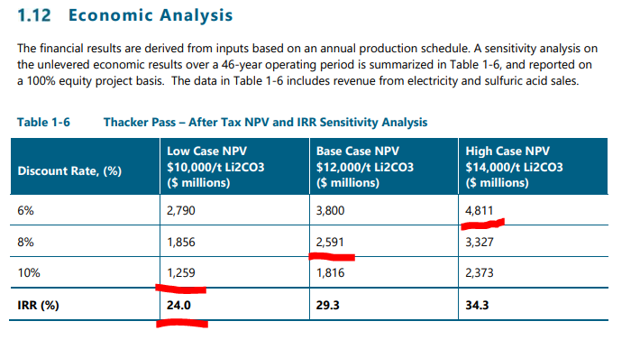

Lithium Americas (LAC) is developing two lithium projects, the Cauchari-Olaroz brine asset in Argentina and the Thacker Pass clay-stone asset in Nevada with very interesting economics. The net present value at a 10% discount rate (current value of future cash flows minus cash outflows) is $1.1 billion for the Argentinian project of which LAC owns 50% and $2.6 billion for the Thacker Pass project owned 100%.

Source: Lithium Americas

The combined net present value for LAC’s projects is $3.15 billion or $35 per share. Compare that to the current market cap of $318 million and you get a discount of 90%. Whether it is justified or not will be discussed in this article.

Cauchari Olaroz should be up and running in 2021 and Thacker in 2022. However, a decision has still to be made for Thacker despite the extremely positive pre-feasibility study.

Source: Lithium Americas

I’ll first discuss the risk and reward of the two projects and then end with a valuation and investment thesis for the stock.

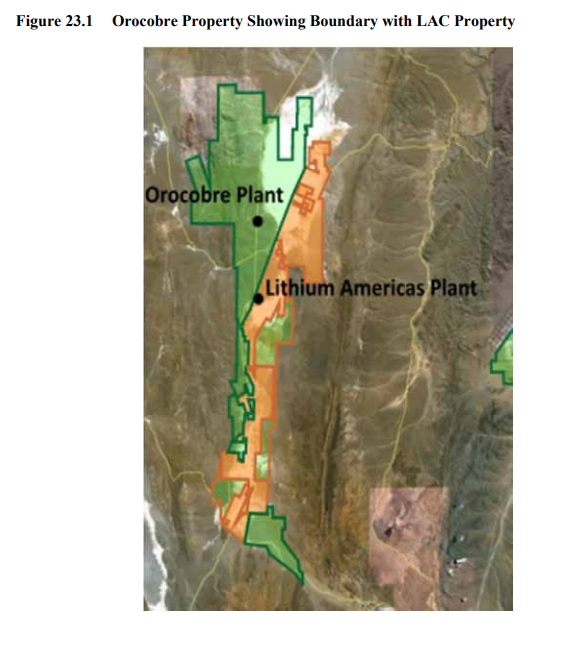

Argentinian brine project adjacent to Orocobre

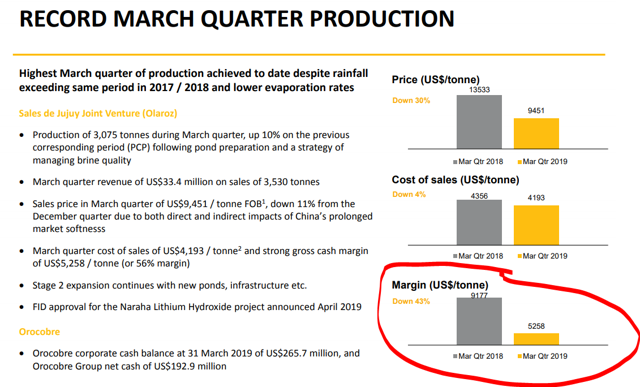

The Cauchari-Olaroz plant is close to Orocobre’s (OTCPK:OROCF) plant so we have an indication of the project’s potential and profitability.

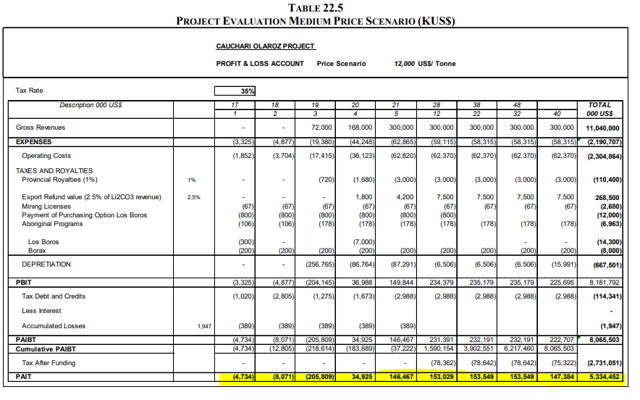

Source: Cauchari Olaroz Technical Report

Orocobre is already producing there with strong margins above 50%, even with the currently subdued lithium prices.

Source: Orocobre presentation

However, LAC is expecting even better margins within their pre-feasibility study. LAC’s expects $300 million in revenue and about $150 million in after-tax profits. This means that the cost of sales should be around $3,000 per lithium ton sold or 30% below Orocobre’s current costs. On top of that, current lithium prices are not at the expected $12,500 per ton but below $10,000.

Source: Cauchari Olaroz Technical Report

If I adjust lithium prices to $10,000 and costs of sales to $4,300, like it is the case with Orocobre’s plant, the operating margin should be $6,700. Add the 35% profit tax applied in Argentina and what you are left with is a $4,335 profit per ton. Plus, there are other taxes, like a 1% royalty, VAT, local taxes, and there might be more taxes in Argentina given that the political environment will probably change after the October elections. My estimate is that LAC will hardly reach the expected profitability on the project.

If I add other related costs and assume after tax free cash flows of $3,500 per sold ton, the average cash flows per year should be around $87.5 million and not $150 million as the technical report estimates.

Source: Cauchari Olaroz Technical Report

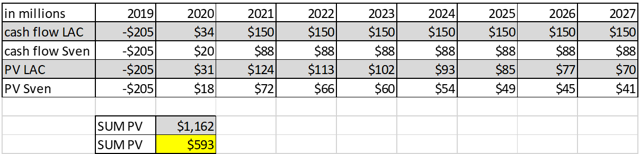

Table 1. LAC’s technical report cash flows and my estimated cash flows (2019-2061)

Source: Author’s estimations

The net present value of Cauchari Olaroz should be around $600 million based on higher operating costs and lower margins. If you add the usual discount for undeveloped projects of around 30%, or even 50%, depending on lithium prices, you soon fall to a NPV of $300 million or $150 million for LAC’s stake.

Lithium Americas – Thacker Pass Project Nevada

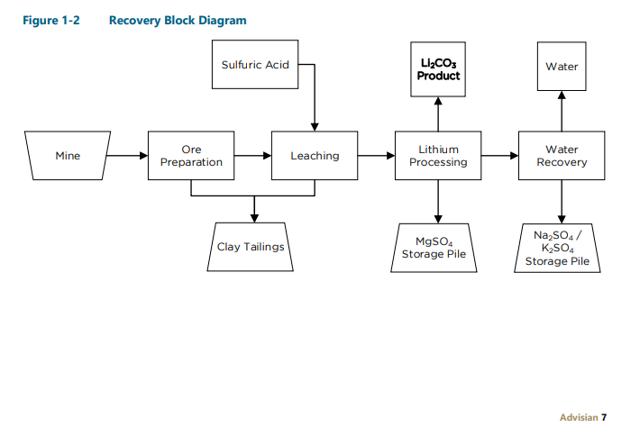

The Thacker Pass Pre-Feasibility Study says it is not precise and that estimations can vary 25% on the upside and 20% on the downside. An investment decision has not yet been made to develop the largest lithium source in the US.

A significant risk is the application of a new lithium recovery process: “A process flow sheet that uses conventional leaching and purification technology has been developed, and replaces the roasting/calcining approach that was considered in a previous technical study (Tetra Tech, 2014).”

This is a good place to comment on the fact that LAC quadrupled the number of outstanding shares over the last half decade. Therefore, all estimations are likely to be stretched towards the positive as the company’s success depends on the stock price for future capital raises.

Source: LAC – Thacker Technical Report

As we don’t have comparable production numbers for Thacker, I will focus on the company’s estimates.

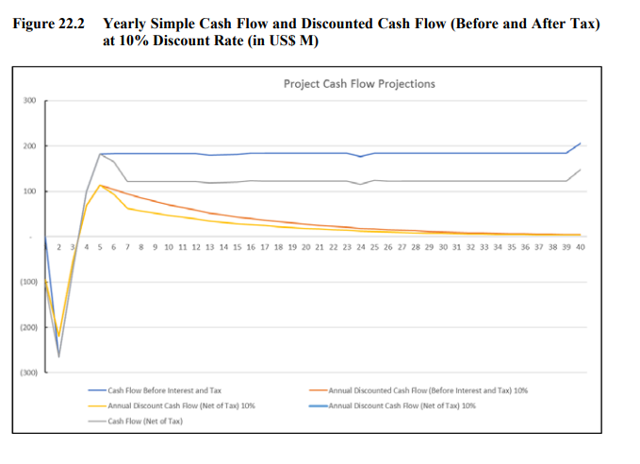

Source: LAC – Thacker Technical Report

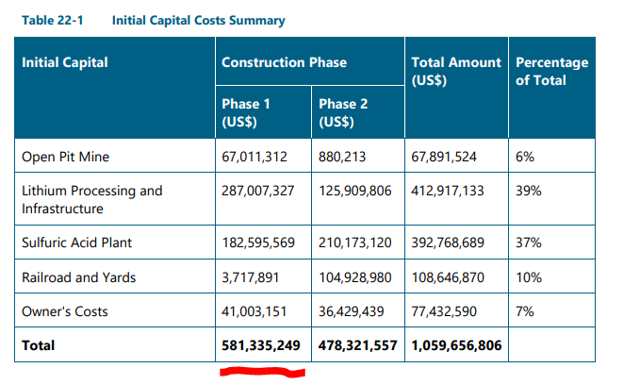

The net present value of the project is highly sensitive to lithium prices. If lithium prices remain at current levels, the present value of the Thacker Pass project is just $1.2 billion. This doesn’t include financing and we know LAC doesn’t have the $581 million required to develop the first phase of the project.

Source: LAC – Thacker Technical Report

Source: LAC – Thacker Technical Report

On top of operational risks, another big risk for investors are lower lithium prices. LAC might not be able to issue equity at favorable terms to finance their projects. It is also hard for a company with a $318 million market capitalization to issue shares to get to an amount of $581 million necessary to develop the Thacker Pass, even if half of the amount could be collected by issuing debt. A 50% dilution would lower the NPV per share from $35 to $22 and therefore lower the potential upside for investors.

It is also always possible that somebody buys the projects or the whole company at a 25% premium on the subdued stock price. This would limit your investing upside while the downside risks remain equal.

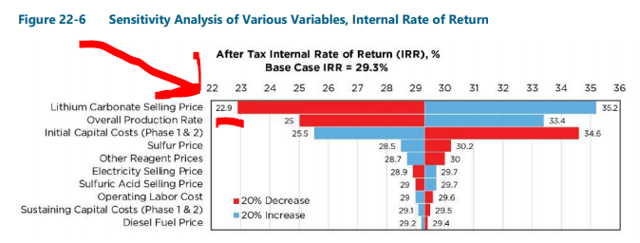

Further, when it comes to developing mining projects, it is really rare that something is done under budget. Plus, when you take a look at sensitivity charts, those always focus on only one variable. The combination of lower lithium prices, higher initial capex, operational issues, possible higher taxes or whatever, significantly changes the initial net present value and internal rate of return.

Source: LAC – Thacker Technical Report

Source: LAC – Thacker Technical Report

At current lithium prices, the IRR is already very close to 20% which is usually a mining threshold that you don’t go under.

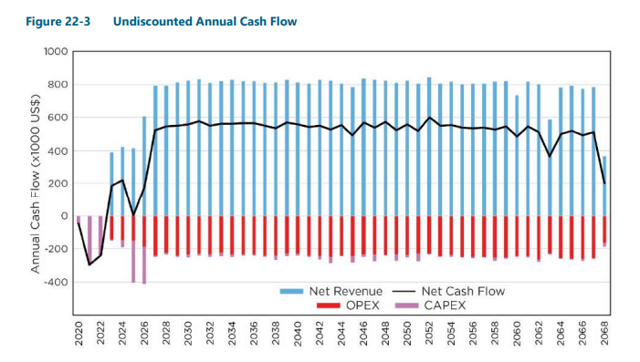

However, with higher lithium prices and no operational issues, the Thacker Pass Project might become a highly profitable project with yearly cash flows of above $500 million per year from 2025 onward.

Source: LAC – Thacker Technical Report

Source: LAC – Thacker Technical Report

Lithium Americas Stock Price potential

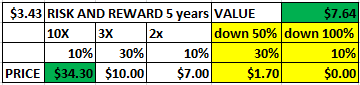

LAC is an extremist an investment. If all goes well, it could deliver a 1000% investment return over the next 5 years. However, if they need to issue many shares to develop the Thacker pass, enter into joint ventures and there are operational issues alongside lower lithium prices, the future potential value quickly drops.

So, this can easily get complicated. I would say there is just a 10% chance that all works well, a 50% chance we see higher lithium prices and the stock returns to where it was, and 40% chance things turn south due to one of the mentioned risks.

Source: Author’s estimates

My conclusion is that LAC is worth around $7 per share but there is also significant potential for permanent loss of capital which excludes this from my personal investing world. To me, Albermarle (ALB) offers similar upside with much less downside. You can read my article on ALB here.