Where will the next financial crisis come from?

The short answer is: We don’t know.

We can, however, look for vulnerabilities in the system that, if left untreated, can develop into problems.

What do we mean by a vulnerability? It is an area of weakness that can amplify and spread an unexpected economic shock, increasing the level of risk to the financial system.

Imagine the impact of an earthquake on a house built on sand, as opposed to bedrock. In the financial world, cracks in the bedrock can arise from high levels of debt and mismatches of institutions’ risk factors such as currencies or the maturities of their exposures.

One such weak spot is the debt level in US corporations and the risks investors in their securities take.Lending to heavily indebted companies with weak credit ratings is on the rise and may be a widening crack in the system.

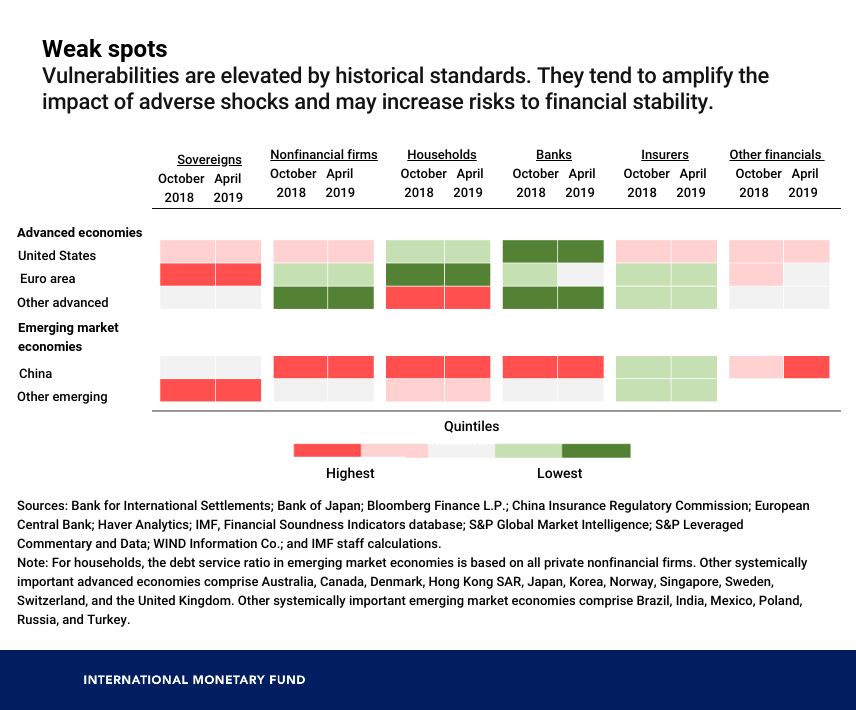

This and other vulnerabilities are reflected in the Chart of the Week on a five-point scale ranging from lowest (dark green) to highest (red) for six sectors and five country groups. The chart shows the distribution of vulnerabilities across six sectors in five regions. It was constructed using dozens of indicators going back up to two decades. You can read all the details in the Online Annex to the April 2019 Global Financial Stability Report.

The chart shows that vulnerabilities are elevated in several sectors by historical standards. Government debt in the euro area remains one of the most serious vulnerabilities dogging the global financial system and is also elevated in the United States and many emerging market countries. In advanced economies outside the euro area, household borrowing is high. In China, vulnerabilities are high in several sectors, including nonbank financial institutions.

Knowing where vulnerabilities are high or rising can help policy makers take steps to protect their financial systems, as well as the global financial system. Steps may include having banks raise more capital, reducing levels of public debt, or imposing curbs on borrowing by households or corporations. But data gaps remain an important obstacle to a comprehensive vulnerability analysis and should be filled.