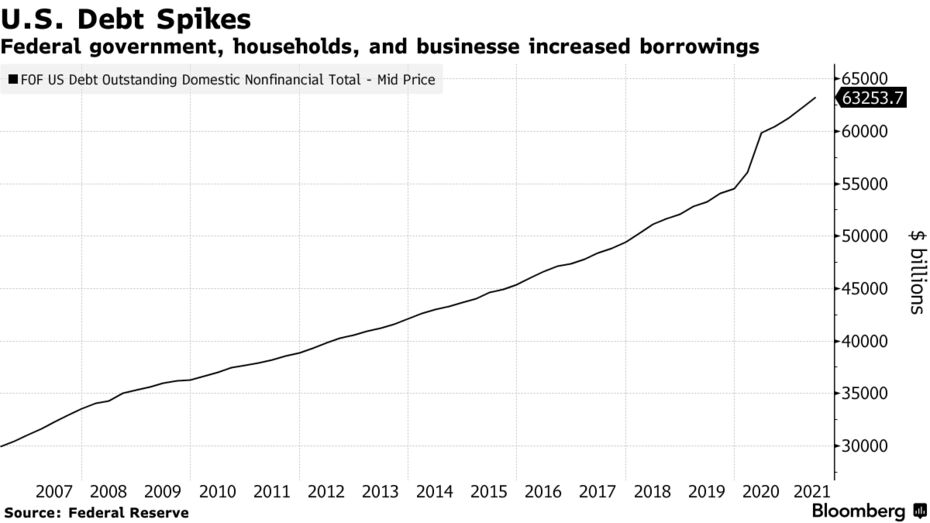

The U.S. went on a borrowing binge last year and the hangover could make it harder for the Federal Reserve to fight inflation without crashing the economy.

Corporate debt has surged $1.3 trillion since the start of 2020 as borrowers took advantage of emergency Fed action as the pandemic spread, slashing interest rates and backstopping financial markets to keep credit flowing. More debt held by more companies suggests potential risks as borrowing costs rise from currently low levels.

That could create financial stability concerns for Fed Chair Jerome Powell and his colleagues as they debate removing pandemic support in the face of what a report Friday showed were the hottest price rises in almost 40 years. And a tough task: Not since Alan Greenspan’s time has the U.S. central bank tried to navigate the economy back to price stability from too-high inflation.

Powell’s challenge is to try to curb price pressures without large costs to employment or growth, a move that would likely anger both political parties and blotch his record with the first Fed-assisted hard landing since the 1990-1991 downturn.”

The Fed’s Financial Stability Report on Nov. 2 noted that key measures of vulnerability from business debt, including leverage and interest cover ratios, were back at pre-pandemic levels.

To be sure, big firms that used the opportunity to issue longer-dated bonds at lower rates have strengthened their balance sheets.

Source: Moody’s Investors Service

The Federal Reserve is laying the groundwork for the start of a cycle of interest-rate hikes that the bond market warns might be unusually constrained in how far it can go, setting the two on a collision course where one will eventually have to give.

The Treasuries yield curve — or the spread between short-term and long-term interest rates — looks set to be the flattest at the beginning of a Fed tightening cycle in a generation if the central bank begins raising its benchmark overnight rate in mid-2022 as now forecast. The two-year, 10-year spread is about 83 basis points, with futures indicating 55 basis points in June.

The problem facing Powell and The Fed is that they are stuck in a trap. They can’t raise their target rate more than just a little (say 50 basis points) and shrinking their enormous balance sheet is really their only option. And that may fail if the 10 year Treasury yield starts to rise too rapidly or gets too high.

Here is one of the traps facing Powell and the Gang after their Covid printing splurge: dying M2 Money Velocity.

It will only get worse as Congress and the Biden Administration keep spending like drunken ORCs from Lord of the Rings. Particularly when the Penn-Wharton Budget Model finds that Build Back Better will reduce the long-term GDP by 2.8 percent, reduce wages by 1.5 percent, and reduce work hours by 1.3 percent. The only thing it will expand is government debt, by 25 percent.

The Washington DC spending Gollums need to control their urges.