US homebuilders have been euphoric about their prospects. Unfortunately, the recent report from the Mortgage Bankers Association (MBA) raises a few questions about sustainability of the housing boom.

Mortgage purchase applications on a seasonally-adjusted basis peaked in January and have experienced a downward trend in 2021.

Homebuilder confidence (purple line) surged after the Covid outbreak with the epic money printing by The Federal Reserve (green line). Home price growth (yellow line) is raging. But with the slowing of The Fed’s money printing, will mortgage purchase applications and home price growth continue?

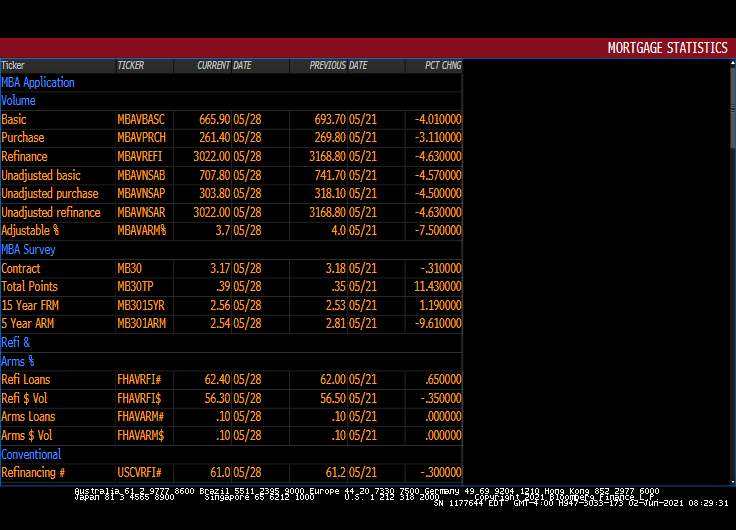

Here is the MBA’s statistics for the week ending 05/28. Red across the board.

House price-to-rent ratio is higher today than during the iceberg-like housing bubble of 2005/2007.

Let’s see if the red hot housing market can avoid hitting an iceberg.