via Zerohedge:

More American renters now believe that owning a home is “financially out of reach”, according to the WSJ.

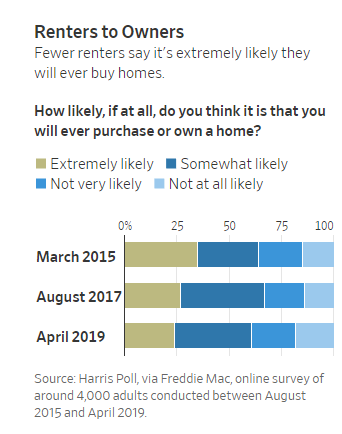

In a new survey set to be released by Freddie Mac, just 24% of renters said it was “extremely likely” that they would ever own a home. This is 11% lower than four years ago. Of those surveyed, 82% said that renting was more affordable than buying, up 15% from February 2018.

44% of renters who moved in the last two years said they could no longer afford their rent.

Freddie Mac’s incoming chief executive David Brickman told WSJ:

“The notion that there’s a housing affordability crisis is not new. But this is really bringing it closer to home in terms of what people are doing about it.”

One of the main causes for the “crisis” has been home prices and rents rising faster than the rate of inflation and wage increases.

The largest obstacle preventing renters from buying was “difficulty in saving for down payments and closing costs”, according to the survey. So rising prices and the inability to save are the problem. Is everyone at the Fed taking notes?

The issues are being felt by about 80% of millennials and Gen Xers and 71% of baby boomers who rent.

In addition, another government led great idea is also weighing down on millennials: student loans. Of respondents 23 to 29 years old, 51% said they made different housing choices due to their lingering loan debts. Another survey found that most millennials prioritize paying down debts before saving for down payments.

“I lived in a basement for 10 years. When my son was born, I didn’t want my son to grow up in a basement,” said Fabiola Morales, a 23-year-old single mother who works as an office administrator in Chicago and who recently bought her first home. She said she never would have had the money for a down payment had she not of qualified for a grant through a non-profit called Neighborhood Housing Services of Chicago.

Her mortgage payment is less than her rent, which is a common benefit of home ownership once down payments and closing costs are dealt with. 25% of homeowners surveyed said they spend more than 1/3 of their income after taxes on housing, compared with 34% of those who rent.

Both homeowners and renters also cited child-care costs as a key factor in their housing decisions.

Skylar Olsen, director of economic research at Zillow said: “The time an average earner needs to put together enough money for a down payment is now about a year and a half longer than it was 30 years ago. Home values have most certainly outpaced incomes.”

But some still prefer to rent so they are not tied to one location and don’t have to pay for the upkeep.

Karen Gillespie, a 55-year-old real-estate agent said: “Every time you turn around it needs money.”