via UPFINA:

The June Conference Board consumer confidence report is an example of a report going from great to good. The consumer confidence index fell to its lowest level since September 2017, which actually doesn’t sound terrible as the economy was doing fine then. However, what does sound bad is this monthly decline is the 5th worst since the financial crisis. The only worse declines were in October 2008, February 2009, February 2010, and August 2011.

Conference Board Index Declines

The decline in June was catalyzed by worries about the trade war. It makes sense confidence fell because the latest round of tariffs had a much bigger impact on consumer goods than the prior rounds. The big monthly decline was made worse by the negative May revision. The index declined from 134.1 to 131.3. In June it fell to 121.5 which missed the consensus of 132 and the low end of the consensus range which was 128.8.

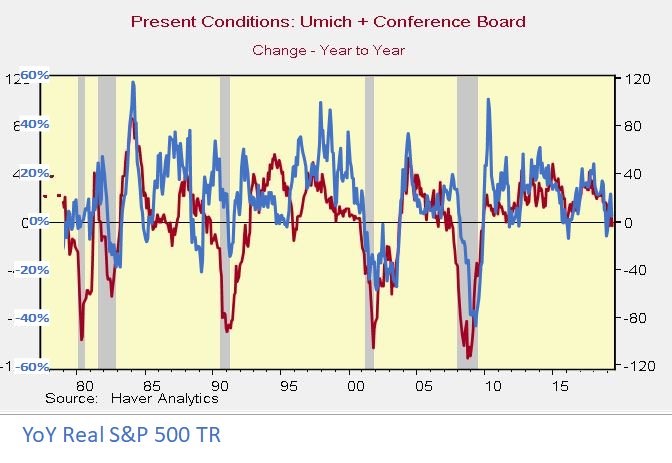

The present index fell from 170.7 to 162.6 and the expectations index fell from 105 to 94.1. To be clear, the Conference Board index is further off its cycle high than the University of Michigan survey and the Bloomberg Consumer Comfort survey. The weakness in the Conference Board survey was driven by a less favorable measurement of the business environment and the labor market. We will get into some of the details later on, but let’s not pretend that confidence isn’t driven by the stock market. As you can see from the chart below, in the past 2 cycles, the yearly change in present conditions is highly correlated with the yearly total return in the S&P 500.

With the internet, it’s easier than ever for consumers to check their portfolio’s returns.

Weakness In The Labor Market

Some economists believe the only valuable information from consumer sentiment readings is the consumer’s opinion on the labor market. The consumer’s opinion on the economy might be flippant and might not relate to actual spending. However, the consumer’s confidence in the labor market is directly related to spending and is something the consumer has first hand knowledge of. The consumer’s opinion on the labor market in this report showed cracks. Those saying jobs are plentiful fell from 45.3% to 44%.

Those saying jobs are hard to get increased from 11.8% to 16.4%. That’s a sharp increase. As you can see from the table below, previous increases similar to this amount were all during recession. However, this data doesn’t show what the rates increased to, so it doesn’t mean the economy is in a recession now. This report was still good. It’s just awful in rate of change terms which makes some fear worse data is coming.

Monthly Increase in Conference Board's "Jobs Hard To Get" is worth noting pic.twitter.com/I7UY4HKblH

— Not Jim Cramer (@Not_Jim_Cramer) June 25, 2019

The differential of jobs plentiful versus jobs hard to get fell 5.9% which was the worst reading in 12 months (not terrible), but the biggest decline since February 2009. Finally, the percentage of consumers expecting more jobs to become available in the next few months fell from 18.4% to 17.3% and those expecting fewer jobs increased from 13% to 14.8%.