by Sven Carlin

Nike has returned more than 25% per year to shareholders over the past 35 years.

Great businesses deliver great returns. We share 5 factors that make Nike a great business.

However, it currently trades at an exuberant valuation alongside slowing down revenue growth. A risky combination.

The management is doing expensive buybacks and other financial engineering moves to keep the perspective of a growth stock.

At the bottom of the article, there is a video version for those that prefer watching.

Nike (NKE) is not a good buy because the market is pricing in the expectation that future growth will be similar to past growth. That is very exuberant due to the concerns related to current and future growth. However, Nike is definitely a great business and you never know how such stocks are going to be priced over the long term.

In this Nike stock analysis, we are going to discuss:

- The 5 key factors indicating why Nike is a great business and, consequently, has been a great stock to own. It rewarded shareholders that bought in 1985 with more than 700 times their money.

- How Nike might not be a great investment in the coming decade as it has been over the last decades due to a slowdown in growth and an increase in financial engineering that usually leads to mostly short-term benefits.

- Within the investment thesis conclusion, based on the discussed fundamentals, we’ll share the key factors you have to watch if you are a Nike investor.

Nike stock – 5 Fundamentals that make Nike a great business to own

The 5 characteristics a great business has are the following:

- A growing dividend

- No need for much capital

- Extreme financial stability

- High return on capital employed (ROCE)

- Fast-growing revenues and faster-growing profits

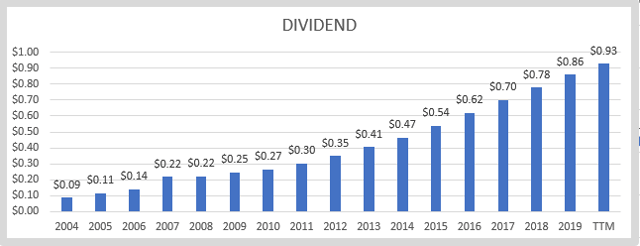

Dividend

Nike’s dividend has been constantly growing as the business and earnings expand.

Nike’s dividend since 2004

A growing dividend is an indication of great business as growth comes alongside increased profits, confirming the quality of the business model. It also shows how the company has enough free cash flow to reward shareholders.

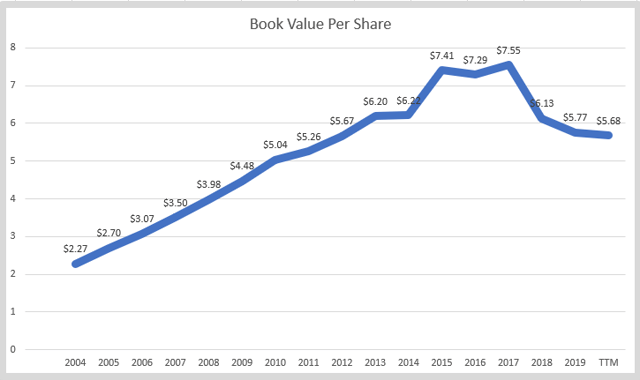

Book Value

This might be counterintuitive, but low book value is another great business indicator. A low book value shows how Nike doesn’t need much capital to do business and grow where the earned money is to reward shareholders.

Nike stock book value

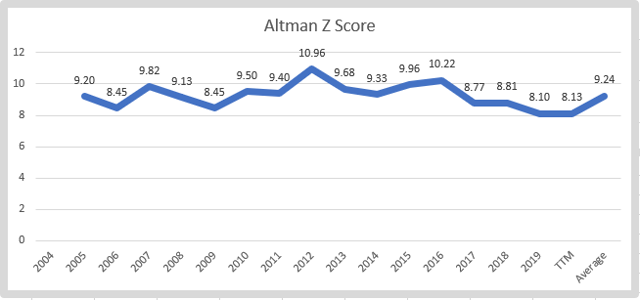

Nike’s financial stability

Despite the relatively low book value, Nike is not in financial distress. Its Altman-Z score is far from a level below 1.81 that would indicate distress.

Nike stock – Altman-Z

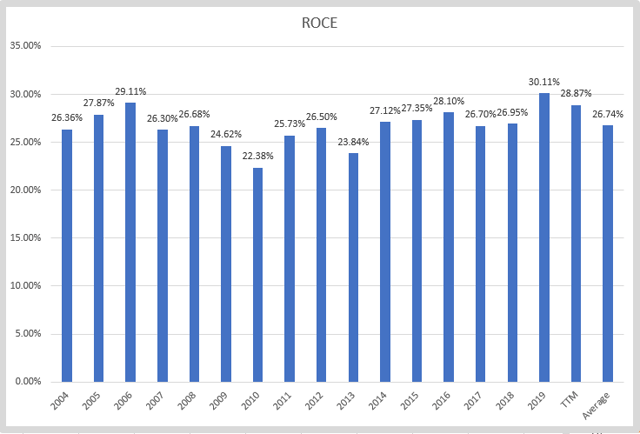

High ROCE

Great businesses have high returns on employed capital (ROCE) and Nike’s returns are staggering.

Nike stock – ROCE

With a high ROCE, a company that can grow revenues at high single digits, improve net profit margins over time, and, consequently, improve earnings at teen digits, as Nike did, can only result in a great investment over time.

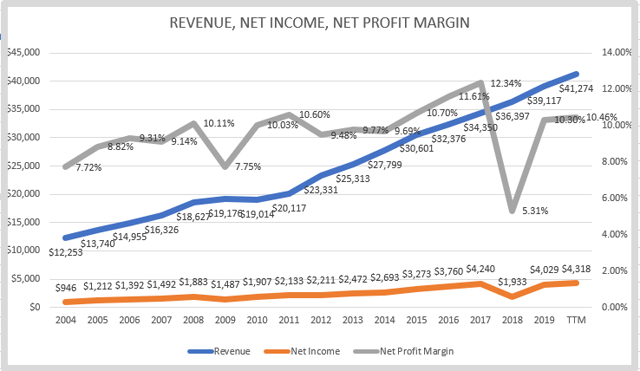

Growth in revenues, earnings, and margins

With the capacity of investing your capital with a high return, it pays to grow as fast as you can, which is what Nike has been doing. Plus, apart from expanding its business, the management has been capable of expanding margins and profits even more.

Nike stock – revenue growth, net profit margins, and net income

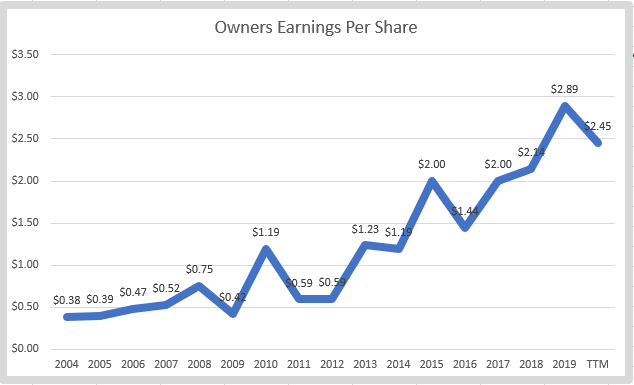

Nike’s net profit margin expanded from the high single digits in the 2000s to the low teens over the last few years. Just the margin expansion adds $1 billion to yearly profits. Further, thanks to buybacks, earnings and dividends per share grew at an even faster pace than revenues and net income which is good for the stock.

Nike stock – owner’s earnings per share

However, this was the past as it has been great. Let’s look at the future, a future that will most likely not be as great for investors as the last few decades have been.

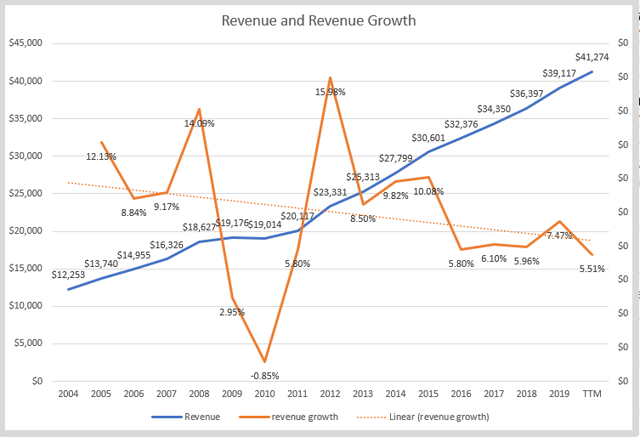

Nike stock price outlook – slower growth and valuation are the issues

Average revenue growth has been 6.17% over the last 5 years. It represents a significant decline from teen growth rates that were the norm in the past.

Nike stock analysis – growth rate

When we combine the slower growth rate with the exuberant valuation, it creates a high-risk investing situation. Let me use $3 per share as the owner’s earnings, which would be a likely level for 2020 without the coronavirus. At a price of $100 that would give a price to earnings ratio of 33. Thus, the investment returns investors can expect are around just 3%. Expectations for higher investment returns are based on growth.

Buying something with a lofty valuation just because of good growth prospects is risky because the stock gets hit very hard if the growth expectations aren’t met and we have already seen Nike’s revenue slowing down. Plus, Visa (V) is a business that I analyzed where the expected revenue growth is 15% per year but trades at a similar valuation to Nike’s.

Nike’s issue is the slower growth rate that is around 6%. The management is trying to do what is possible to ensure at least higher earnings growth. Over the last 10 years, the company has bought back around 20% of shares outstanding and, consequently, increased earnings per share. But, 10 years ago, the share price was below $20 which made it 80% cheaper to do buybacks and, consequently, improve investment metrics.

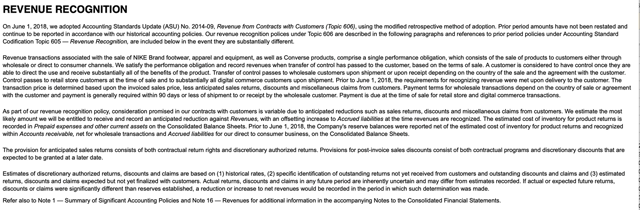

Further, the company changed its revenue recognition method in 2018. They decided to recognize revenue on shipment and not on delivery. Given that e-commerce is growing fast, recognizing revenue on shipment might keep the image of faster revenue growth as it doesn’t account for returns immediately.

Source: Nike 10-K 2019

The revenue recognition change might just be a curious fact, but it is one that raises an eyebrow and tells us we have to watch the amount of financial engineering the company will be doing in the future.

Investment Conclusion

When it comes to investing in great businesses, the question is always whether the future will be of resemblance to the past? Unfortunately, each company has a life cycle and that, in the best scenario, a growth company turns from a fast grower into a slow-growth cash machine. You can take Apple (AAPL) as a good example of that. The only difference is that, in 2016, AAPL’s price to earnings ratio was around 10 and not above 30 like it is the case with Nike now. The high valuation is the prime risk for the company as slight changes in the market’s perception on Nike’s future growth prospects could have a high impact on investment returns.

I will personally avoid Nike and look for better risk reward opportunities even if Nike is and will definitely remain a great business. The above doesn’t mean Nike’s stock will fall. In the current ‘free money’ environment, the market might remain exuberant about the 1% dividend yield that looks amazing compared to Treasuries and slow growth ahead. I just hope that this analysis gives you a different perspective on Nike, a new factor to carefully watch and that it helps you with assessing the value of the stock to your portfolio.

For those that prefer watching or listening, here is the video:

If you enjoyed the analysis and investment perspective, please consider subscribing.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.