via Zerohedge:

“neither institutional nor retail investors are currently underinvested in equities. In fact we find that the opposite appears to be true…”

— JPMorgan’s Nikolaos Panigirtzoglou

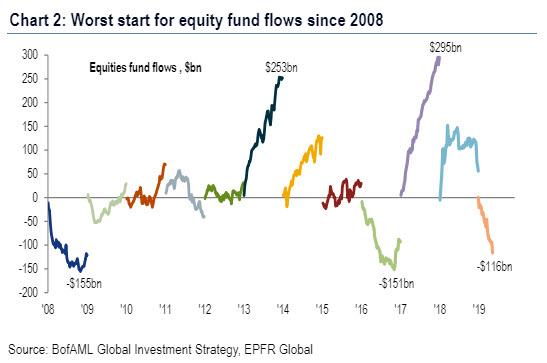

For much of 2019, when stock buybacks drove the bulk of market levitation, the recurring bullish refrain was that investors not only did not participate in the market upside, but had in fact redeemed the most money from equity funds since 2008…

… with some, such as JPMorgan’s Marko Kolanovic claiming that as a result of this delayed response, it was only a matter of time before the “bulls on the sidelines” capitulated, and rushed to buy stocks, and as a result, Kolanovic told CNBC one month ago that “the S&P could soar to 3,000 as soon as May.”

In retrospect, Kolanovic appears to have been overly optimistic once again, and just like last time when he predicted a ramp to 3,000 at the end of 2018, the smackdown to Kolanovic’s excessive bullishness comes from none other than his own derivatives strategy colleague at JPMorgan, Nikolaos Panigirtzoglou, who in his latest Flows and Liquidity report, dismantled the core pillar of Marko’s bullish thesis, finding that “neither institutional nor retail investors are currently underinvested in equities. In fact, we find that the opposite appears to be true.”

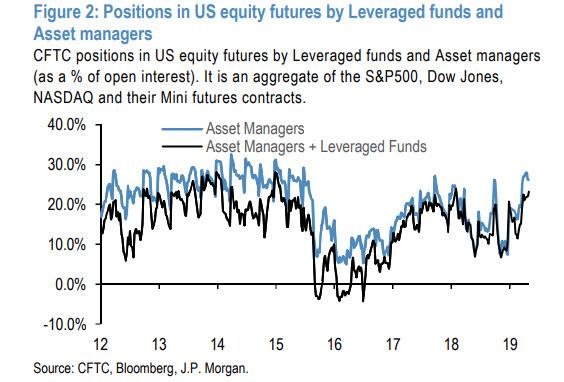

Defying conventional analysis of flows, the “bad cop” JPM strategist, who has traditionally clashed with Kolanovic at key market inflection points, writes that “daily hedge fund indices have been diverging from the monthly ones and have been depicting a misleading picture in our opinion of the true equity exposure of hedge funds.” Some more details:

In the US equity futures space, our preferred metric based on the futures positions by asset managers and leveraged funds… has risen back to the highs of last year. This suggests that asset managers and hedge funds are as long in US equity futures as they were at the market peaks of September or January 2018.

Similar to hedge funds, retail investors have also loaded up, and “have become significantly more overweight equities in tandem with the strong rise in equity prices this year, even as they refrained from buying equity funds.” In other words, even though retail investors may have been selling stocks this year, market gains alone have pushed them more overweight. In fact, JPMorgan estimates that retail funds entered this month the most exposed since the end of the third quarter last year… just before the Q4 crash.

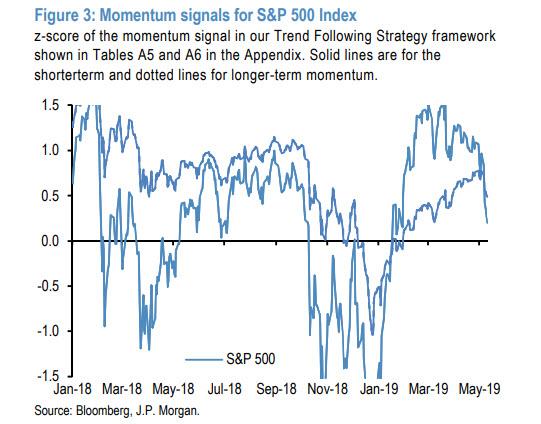

Stepping away from traditional investors, the JPM strategist claims that momentum traders such as CTAs have also been pretty long equities “as shown by the momentum signals of our trend following signal framework…. Figure 3 shows that both the short- and long-term momentum signals for the S&P500 futures contract stood at pretty high levels before this week’s correction, not far from last September’s levels. More importantly these momentum signals are now declining following this week’s correction and as explained in the next section these momentum signals have entered negative territory for non-US equity indices. Not only does this suggest that trend following investors, such as CTAs played a role in the week’s correction, but also that they pose downside risk for equity markets going forward if momentum signals decline further.”

As Panigirtzoglou concludes looking at CTA exposure, “based on our calculations, a further cumulative decline of just 1% in the S&P over the coming week could be enough to turn our shorter-term momentum signal negative, which could prompt unwinds of longs by CTAs to spread to US equities.”

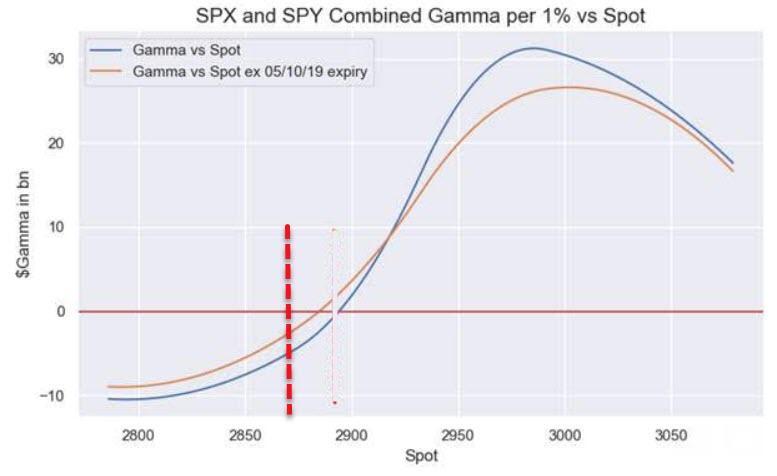

Welcome to the dreaded “negative gamma” world we discussed last week, where selling begets more selling, begets more selling.

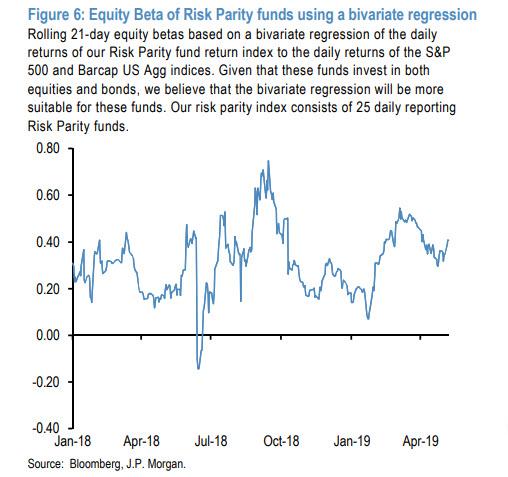

What about Risk Parity funds? By looking at Risk Parity funds, JPM also finds that investor positions are above average, and that Risk Par funds “have likely raised their equity exposure this year to above the average over the past year as volatility collapsed (Figure 6). Admittedly their equity beta appears to be still some way from last September’s high.”

Meanwhile, in the ETF space, there has been a wholesale capitulation by shorts, and JPM’s short interest proxy for the biggest equity ETF, i.e. the SPY US equity ETF, has collapsed this year from the highs seen at the end of last year and has been approaching the previous lows seen in September or January 2018 (JPM proxies the short interest on the SPY US equity ETF by its quantity on loan across prime brokers; this proxy suggests that the entire amount of the previous short base that was built up during Q4 of last year has been unwound this year).

So whereas before shorts would provide at least some buffer to sharp, downside moves as they covered, this time the relentless surge higher has eliminated this natural brake to any sharp market correction.

In other words, as the JPM strategist writes, with retail money, hedge funds and quants all quietly but aggressively ramping up their exposures to equities to levels last seen just before last fall’s crash, “the equity market rises over the

previous four months have made real money investors overweight in equities again, likely reducing the appetite by these investors to actively buy equities from here. Therefore, a previous important support for equity markets at the end of last year is now becoming a headwind.”

This, as Bloomberg notes, “bucks the recent refrain on Wall Street that light investor positioning has the potential to cap this intensifying sell-off.”

It also means that this violent, trade-deal sparked selling is coming at the worst possible moment: just as investors, who waited for 5 months to enter stocks, did so, and will soon be scrambling to exit if the selling does not reverse, adding even more impetus to the liquidation, and which – in our jaded view – should, but probably won’t (after all it comes from his own employer) be classified as “Fake news” by Marko Kolanovic if and when he publishes his next research report (always on an uptick), whose core bullish premise has now been demolished not by some tinfoil, fringe blog with an overly active commentary section, but by, drumroll, his very own company, JPMorgan.