by Peter Smith

European and Asian markets offer better EPS over time, but investors sticks with the US.

Image Source: Twitter @leadlagreport

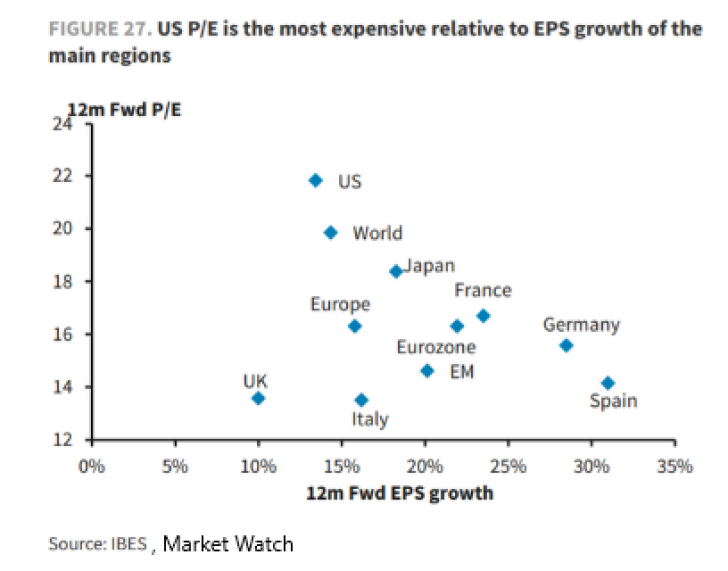

US Market Is Still Trade at a Premium

Apparently, investors prefer the relative stability of the US market to large potential returns from European and Asian exchanges.

According to Michael A. Gayed, US stocks trade at a premium relative to the rest of the markets, even if they offer higher earnings per share (EPS).

What Is P/E Ratio?

The analysis is carried out based on the P/E indicator. The Price-to-earnings ratio is the measurement for valuing a company. It compares the current share price with its per-share earnings. The higher the ratio, the longer the investment in the company will pay off. The indicator is suitable for comparing companies, industries, or even entire stock markets.