via Zerohedge:

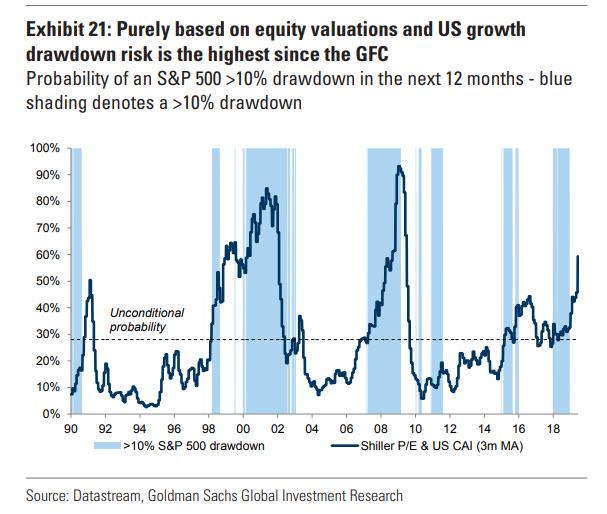

Earlier today, in a stark reversal from its traditionally cheerful demeanor, a Goldman Sachs strategist warned that “purely based on elevated equity valuations, as measured by the S&P 500 Shiller P/E, and current growth, according to our US Current Activity Indicator (CAI), the risk of an equity drawdown of more than 10%”, i.e. a sharp market drop, or for lack of a better word, crash, “is the highest since the GFC.”

Well, Goldman wasn’t the only one to see a major market selloff in the coming months.

Speaking at the Aspen Ideas Festival, billionaire investor and Elliott Management founder, Paul Singer, warned that the global economy is heading toward a “significant market downturn” cautioning that “the global financial system is very much toward the risky end of the spectrum.”

While Paul Singer’s traditionally downcast outlook is hardly surprising, as it permeates every investor letter published by the successful investor who has been particularly clear in the past decade that the Fed’s monetary experiment will end terribly, he sees two particular reasons why the economy is approaching a tipping point: “global debt is at an all-time high. Derivatives are at an all-time high and it took all of this monetary easing to get to where we are today and I don’t think central bankers, or policymakers or academics are in any better shape to predict the next downturn and I think we are the high end of the risk spectrum.”

He then ominously added that “I’m expecting the possibility of a significant market downturn.”

How bad would the crash be? According to the Elliott Management CEO, there will be a market “correction” of 30% to 40% when the downturn hits, although unlike Goldman – which gave a timeline of 12 months in which the next major market will materialize, Singer said he couldn’t predict the timing.

In the panel discussion, Singer also said the market meltdown late last year after interest rates spiked in the 4th quarter was the first hint of a pending slump, as it indicated that the Federal Reserve and other central banks were now victims of their policies, something he has been warning about for years.

“December supported the notion that they’re trapped,” he said. “What they should have done, and what they should do now, is try to restore the soundness of money. They should not be cutting rates right now. They should be calling on the congresses and parliaments around the developed world to take steps to deal with the economic slowdown in growth.”

He is, of course, right, but that same argument should have been made in 2009 – and we have been making it ever since – alas the Fed is now held hostage by the market, as any market drop – and a 40% crash would be devastating to not only America’s net worth, wiping out over $30 in household net worth, but its economy which has been financialized beyond the point of no return. It would also destroy what little confidence the Fed has left, and could result in a terminal damage to the dollar’s reserve status.

Needless to say, the Fed will never voluntarily agree to allow honest price discovery to emerge now, especially with Trump breathing down Powell’s neck every time there is a downtick in the S&P.

It wasn’t all doom and gloom however, as another investing legend on the same panel, Carlyle co-founder David Rubenstein, gave a somewhat more cheerful take, saying that nothing cataclysmic will happen to the U.S. economy until after the presidential election in 2020.

“Presidents who run for reelection in a time of recession or perceived recessions, don’t win,” Rubenstein said. “Everyone in Washington is focused on one thing, which is the presidential election and how long you have to keep the economy going to get through that.”

Which simply means that the long, long overdue correction will only be extended by another year, and will be that much more painful when it finally does hit, potentially smack in the middle of Trump’s second term, at which point it would unleash a massive recession and lead to Trump firing Powell, and ending even the false impression of the Fed’s independence for good.

Rubinstein also said that while the trade dispute between the U.S. and China is weighing on both economies, Rubenstein said he was “100%” certain a deal could be reached.

It sure can, although as we have repeatedly noted, the dispute with China is about much more than just trade, as the underlying issue is the question of sphere of influence and axes of global dominance rather than the economic one. As such it is a battle of two civilizations, one rapidly ascendant, the other in decline, and according to the Thucydides Trap, every such intersection has always resulted in bloody conflict.

While Singer did not predict that a global war is inevitable – although many others have – he did highlight that China has been able to grow in the past 30 or 40 years without any scrutiny on its effect on national security and intellectual property.

“This is the first pushback to China, and China is, at the moment possibly, very surprised and doesn’t really know how to deal with it,” Singer said. As for the answer how China will “deal with it”, we may find out this weekend, when the status quo is likely to be extended if only for a while, as Beijing – which is playing the “long game” in hopes of dispatching Trump in the 2020 elections – prepares to strike a blow that will cripple the US for good, allowing China to become the world’s dominant superpower. And since the US will never willingly concede global superpower and reserve currency status to China, what comes next will be truly unprecedented in modern economic and financial history.