Authored by Phillip Marey, senior US Strategist at Rabobank

- The tone of Fed Chairman Powell’s remarks in Zurich was similar to that of his speech in Jackson Hole. Powell repeated the statement that the Fed will ‘act as appropriate to sustain the expansion,’ which indicates that he is leaning toward a September rate cut.

- Earlier today, the Employment Report for August showed that the weakness in the manufacturing sector and business investment has spread to employment growth. This strengthens the case for an insurance cut in September, although Powell said that the labor market remained in quite a strong position.

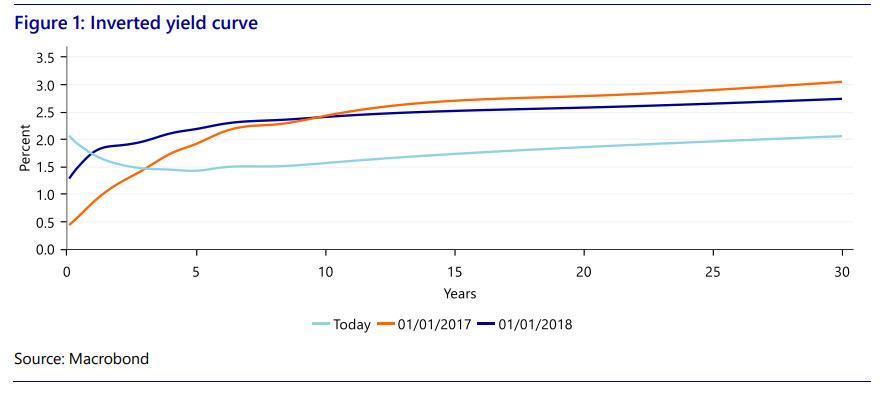

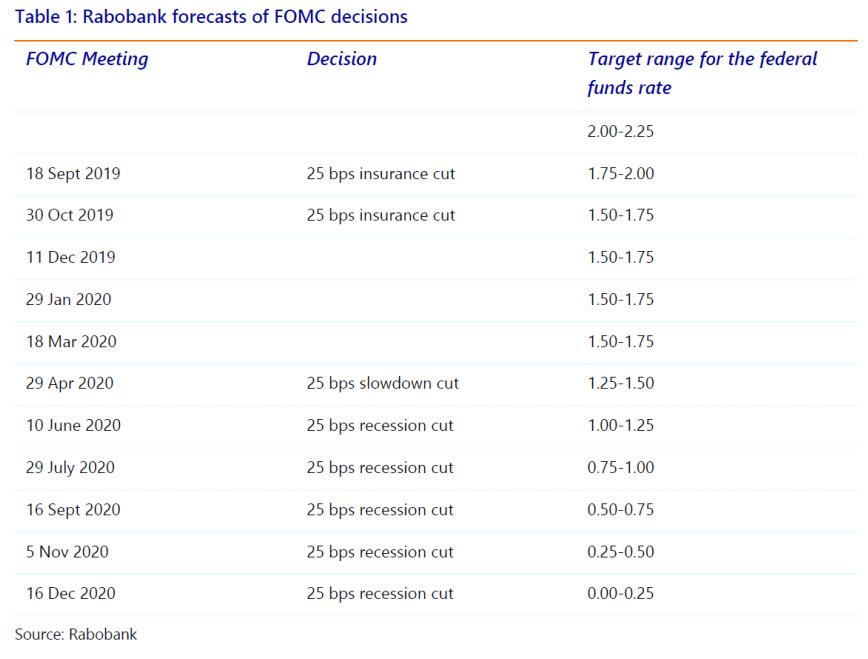

- In our view the feedback loop between trade policy and monetary policy is likely to lead to another insurance cut, probably in October. Meanwhile, the inverted yield curve points to a recession in 2020 that will force the Fed to cut rates all the way to zero before the end of 2020.

Powell doesn’t change his tune

Fed Chairman Jerome Powell did not bring a prepared speech to the SNB event at the University of Zurich today, instead he took part in a moderated Q&A with SNB President Thomas Jordan on the economic outlook and monetary policy. Powell said that the US economy is still in a good place and the most likely outlook remains favorable. However, there are the significant risks to the outlook: global economic growth, uncertainty about trade policy and persistently low inflation. He said that ‘As we move forward, we’re going to continue to watch all of these factors, and all the geopolitical things that are happening, and we’re going to continue to act as appropriate to sustain this expansion.’

This was basically a repetition of the key phrase in his prepared speech at Jackson Hole. This confirms that Powell is still leaning toward a September rate cut. In fact, after another question on monetary accommodation he repeated his ‘act as appropriate to sustain the expansion’-mantra and said that he had nothing further to say about it this evening.

Weakness spreads to the labor market

Earlier today, the Employment Report for August showed that the impact of the US-China trade war is not limited to manufacturing activity and business investment. Nonfarm payroll growth slowed down to 130K in August from 159K in July (revised). And this is including 25K census workers boosting federal employment. Otherwise, nonfarm payroll growth would have been only 105K. At this rate employment growth should be just enough to absorb the inflow to the labor market. Unemployment remained unchanged at 3.7%. The slowdown in employment growth strengthens the case for an insurance cut. With employment growth weakening, and business investment and manufacturing activity declining, the escalation of the US-China trade conflict is a threat to the economic expansion. In fact, a deterioration in the labor market could hurt consumer spending, bringing us closer to a recession. However, during the Q&A Powell said that the labor market was in a good place and that today’s Employment Report was consistent with that outlook.

Meanwhile, average hourly earnings growth slowed down to 3.2% from 3.3% in year-on-year terms. But in month-on-month terms there was an acceleration to 0.4% from 0.3%. However, this is not enough to avert the Fed’s next rate cut. Year-on-year this is still a wage growth rate that the Fed back in 2015 imagined at the start of the hiking cycle, rather than after the end of the cycle.

Trump’s tweets less effective than his tariffs

Even before the Employment Report President Trump tweeted “I agree with @jimcramer, the Fed should lower rates. They were WAY too early to raise, and Way too late to cut – and big dose quantitative tightening didn’t exactly help either. Where did I find this guy Jerome? Oh well, you can’t win them all!” It is clear that Trump thinks the Fed is moving too slowly.

However, the central bank is adjusting monetary policy in the direction he prefers. While the Fed has been trying to ignore President Trump’s criticism on monetary policy, the central bank has managed to get itself entangled in his trade policies. As we explained in ‘Fed back to zero’, by taking a risk management approach to trade policy uncertainty, the Fed is amplifying the effect of trade policy on monetary policy. All Trump needs to do is raise tariffs or take another protectionist measure to get the Fed to cut rates further. In fact, the Fed is enabling the US administration to be tough on trade as the central bank has promised to offset any expected negative impact on the US economy by cutting rates in advance. This means that the Fed is bolstering Trump’s bargaining position in the ‘game of chicken’ between the US and China that we analyzed a few years ago in ‘The Trump Trade War Game’. But it also makes it more likely that President Trump will continue to escalate the trade war. And that makes it more likely that the Fed will have to make additional insurance cuts before the end of the year. Consequently, there is now a strong feedback loop between trade policy and monetary policy that will force the FOMC to make more insurance cuts in the near future, most likely in September and October.

From insurance cuts to recession cuts

What’s more, we think that this is only the beginning. The inversion of the yield curve points to a recession in 2020H2. While the Fed is downplaying this signal because quantitative easing is supposed to be distorting the yield curve, in our recent special Yield curve inversion: This time is not different we showed that the Fed’s argument is both flawed and contradicted by the data. Therefore, the recession signals given by the yield curve should be taken seriously. In fact, we have a recession in 2020H2 in our baseline scenario that will force the Fed to go all the way back to zero next year. Our full forecast of the Fed’s rate path is summarized in table.