- Jeremy Grantham expects stocks to tank, a recession to bite, and more financial disasters to occur.

- The S&P 500 will plunge by at least 27%, and could plummet by more than 50%, the GMO cofounder says.

- Grantham predicts stress on the financial system will lead to further disasters like SVB’s collapse.

Prepare for US stocks to plunge, the economy to slump, and more financial fiascos to emerge, Jeremy Grantham has warned.

The S&P 500 will dive at least 27% to around 3,000 points, and might only bottom out next year, the market historian and GMO cofounder said in a recent CNN interview.

The benchmark stock index could plummet by more than 50% to around 2,000 points in a worst-case scenario, he added.

Grantham has been sounding the alarm on a massive bubble in asset prices, and predicting a devastating market crash, for more than two years.

-

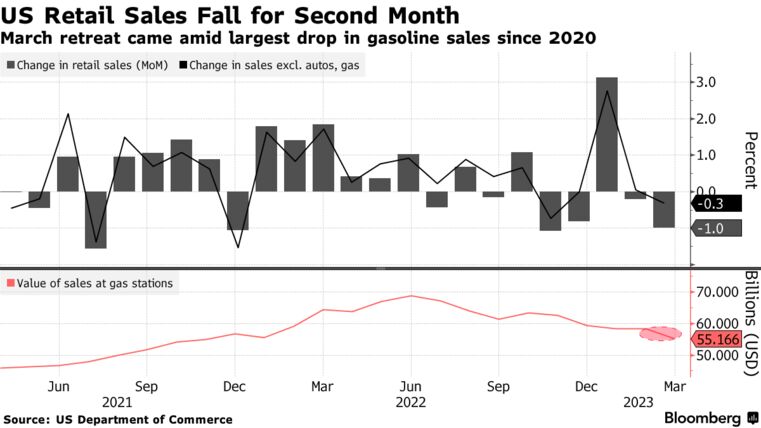

Retail sales slipped 1%, manufacturing output dropped 0.5%

-

Michigan data showed jump in year-ahead inflation expectations

The US economy moderated gradually as the first quarter drew to a close, with elevated inflation and borrowing costs restricting household spending and manufacturing activity.

March retail sales slid by the most in four months, largely explained by a slump in receipts at gas stations and a slowdown at auto dealers. A drop in factory output exceeded expectations, though upward revisions to the prior two months allowed production to squeeze out a modest advance in the first quarter.

Taken together with signs of moderating inflation, the latest batch of data is consistent with a steady cooling of economic activity late in the quarter rather than a more significant slump in light of stress in the banking sector. Traders still expect the Federal Reserve will opt for another quarter-point hike in rates at its next meeting, but some policymakers have recently hinted that they’d be open to a pause.

bullsnbears.com/2023/04/14/us-economy-is-cooling-steadily-as-consumers-factories-pull-back/

This will be like 2008 but 10x worse.

Yellen says US banks may tighten lending and negate need for more rate hikes

WASHINGTON, April 15 (Reuters) – U.S. Treasury Secretary Janet Yellen said banks are likely to become more cautious and may tighten lending further in the wake of recent bank failures, possibly negating the need for further Federal Reserve interest rate hikes.

www.reuters.com/markets/us/yellen-says-us-banks-likely-pull-back-credit-cnn-interview-2023-04-15/

Average Retail Investor is down 27% since November 2021 despite the S&P 500's rally in 2023 pic.twitter.com/AmIqDMsaor

— Barchart (@Barchart) April 15, 2023

h/t mark000