by Andre Bothma

Higher taxes are coming to America — and if you’re a high income earner, you’ve now got a target on your back. Below, we unpack two of the proposed tax increases that could likely affect you — being individual income tax increases, and capital gains tax changes.

CAVEAT: The below information is not personalized tax advice, and is intended as general information on the topic only. Always talk to a qualified tax advisor who is familiar with your particular situation before taking any actions.

Proposed Tax Changes in the US: What you need to know…

The US House Ways and Means Committee’s Build Back Better Act (BBBA) aims to spend $3.5 trillion dollars on various social programs.

To try fund these expenses, the Act also contains multiple provisions aimed at raising taxes for the rich — one of Biden’s main presidential campaign promises.

The bill is somewhat “less bad” than we anticipated, and most of the tax hikes and restrictions would apply only to those earning over $400,000 a year.

But even if only a portion of these new provisions survives, it can still affect you in a serious way.

Proposed changes: What can you expect, and by when?

Despite being “better than expected” if passed as proposed, these changes will still impact almost every aspect of your personal and business life.

That’s why you need to know about these, and explore the possible ways to mitigate them.

Our Sovereign Man: Confidential members just received a deep-dive report covering ALL the potential incoming tax changes, along with information on potential ways to mitigate them.

Let’s get into the details on the proposed Individual Income and Capital Gains tax changes below…

Worried about the way things are going in your country?

Download our FREE Ultimate Plan B Guide to discover how you can build your own robust Plan B and thrive – no matter what happens next…

Proposed Individual Income Tax Changes

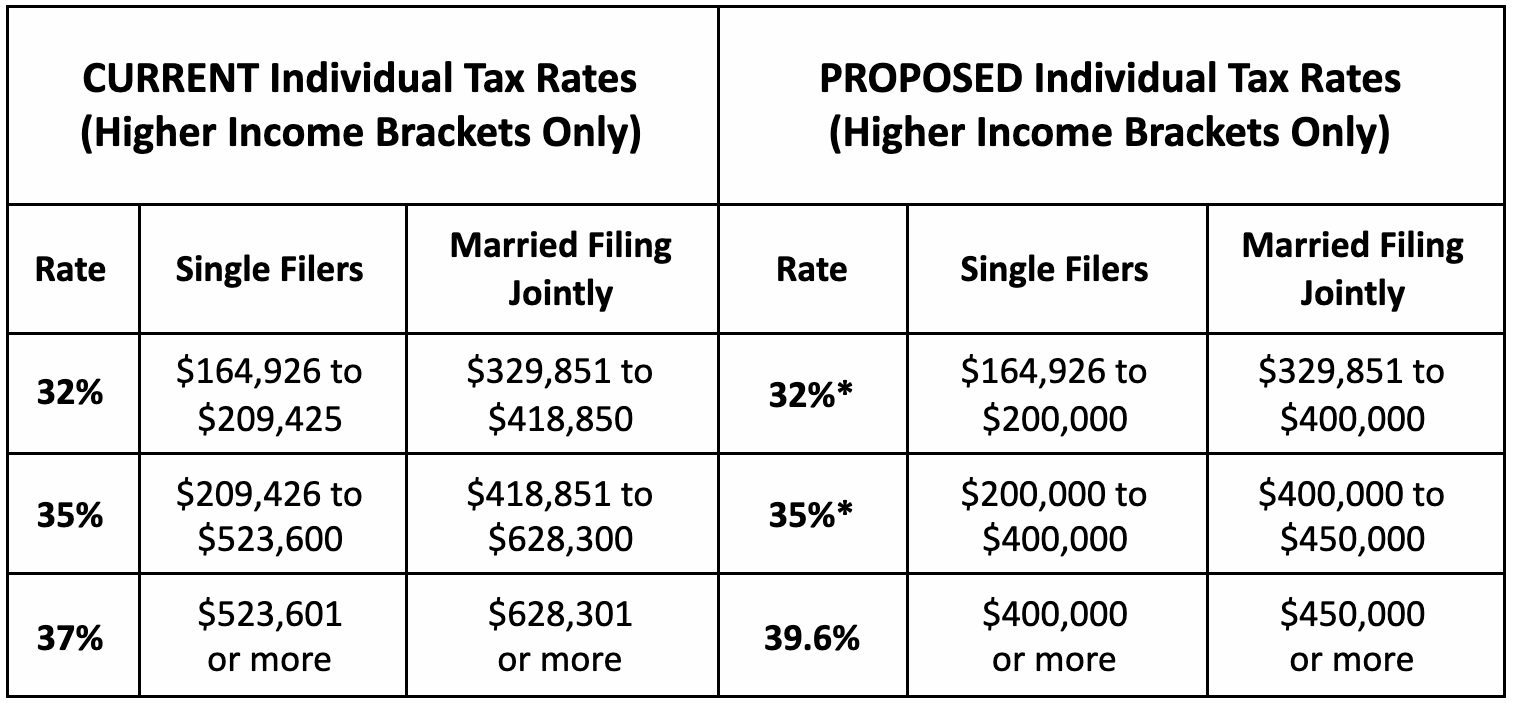

One of the most discussed proposals is the increase in income tax rates (see Section 138201 of the bill), raising the top individual tax rate to 39.6% for ordinary income. All other rates remain unchanged.

If the bill is passed as is, we will end up in a position similar to where we were prior to the 2017 tax reform — but that’s before accounting for inflation over the past four years.

Add the applicable state income tax to it, and the total tax rate may get truly disheartening.

Here are the current and proposed individual tax rates and brackets for high earners on personal income:

* The 32% and 35% tax rates do not change, but their applicable income levels change as reflected in the table.

These income levels will be adjusted annually for inflation.

When will these changes take effect?

January 1, 2022 (even if the bill passes after that date).

What can you do about it?

- If you live in a high-tax state, consider moving to a state with no income tax. This will not help you with potentially higher federal taxation, but it would still save you a big chunk on state taxes.

- Consider moving overseas and take advantage of the Foreign Earned Income Exclusion (FEIE). If you’re married, between you and your spouse, you can earn $217,400 free of federal income tax per year.

- Slash your eligible business income to just 4% by moving to Puerto Rico. You can learn more about their “Export Services Incentives” (former Act 20) here, or join Sovereign Man: Confidential to access this Black Paper for step-by-step guidance on how Puerto Rico can help you.

Proposed Capital Gains Tax Changes

Long-term capital gains tax applies to appreciated assets sold after holding them for at least one year.

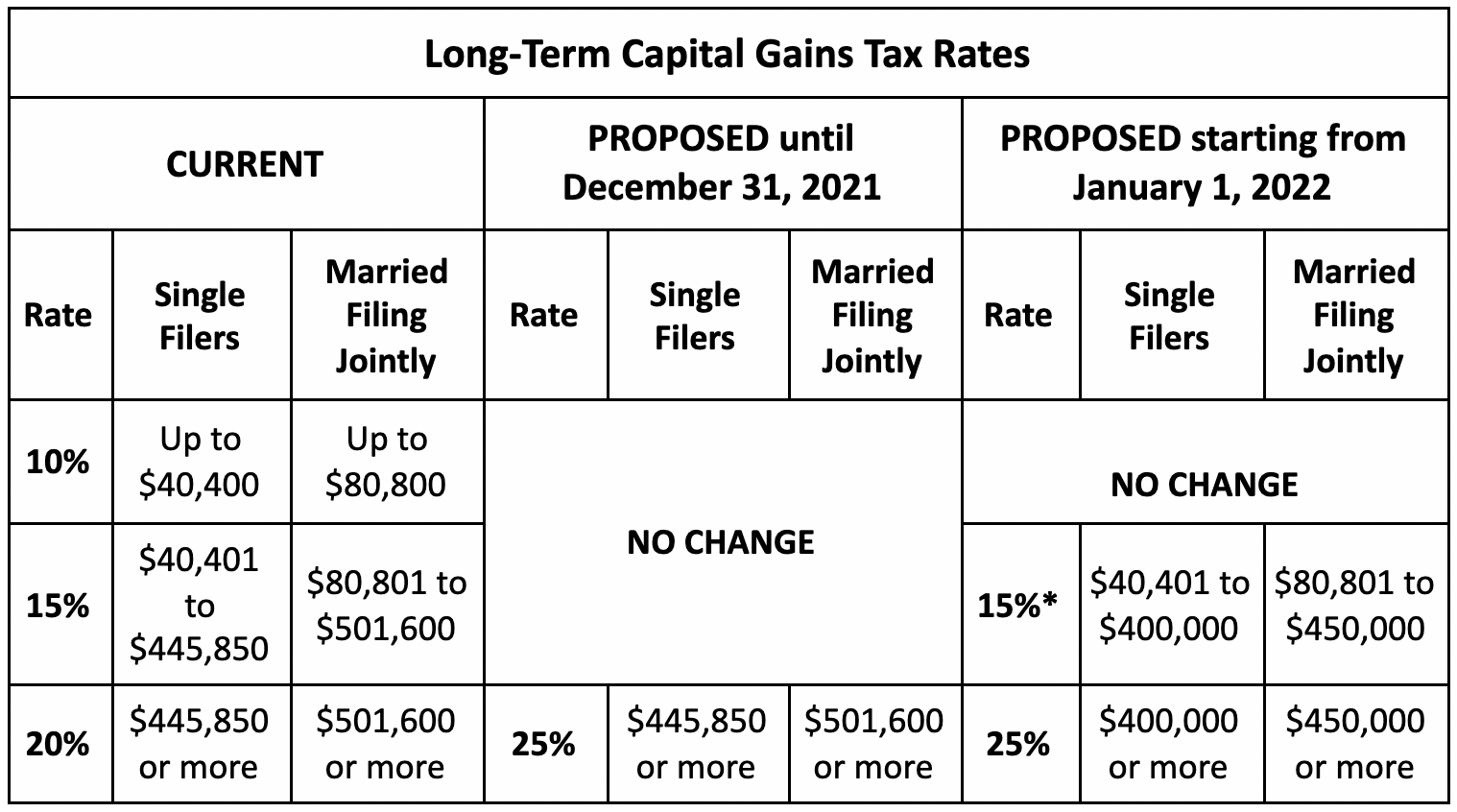

According to Section 138202 of the bill, the maximum tax rate on these would increase from 20% to 25%. The increased rate would also apply to qualified dividends (which is what US corporations generally pay their shareholders. These are currently taxed at more beneficial long-term capital gains tax rates.)

Add a 3.8% Medicare surtax on high earners to it, and the top capital gains rate goes up to 28.8%. (Also, a brand new 3% surcharge — which we cover in our most recent SMC Alert — can increase the total rate to 31.8%.)

The state you live in matters too. For example, if you’re a resident of California, the top state capital gains rate reaches 12.3%. Your total taxation could exceed 40% as a result.

Here’s a taste of what could be coming:

* The 15% tax rate does not change, but its applicable income level changes as reflected in the table.

When will these changes take effect?

The bill aims to increase the top capital gains rate AND prevent a rush to the exits while the rates are still lower. The new tax rates would therefore apply retroactively, from September 13, 2021, when Congress initially released the proposal.

And starting from January 1, 2022, the bill proposes to “realign” the top 25% capital gains rate threshold with the 39.6% personal income tax rate.

What can you do about it?

In short, there is nothing you can do now if the proposal passes “as is”.

But IF the effective date is moved into the future, you should be able to avoid the higher tax by:

- Selling your assets (or entering into an instalment sale agreement) before the new effective date.

- Taking advantage of your retirement accounts, which can help delay (Traditional) or even eliminate future tax liabilities (Roth) if you purchase assets through them.

The bottom line…

Forewarned is forearmed.

Study and discuss the proposed changes with your tax advisor to see which of the proposals can affect you personally if passed, and to determine which strategies you could utilize to mitigate them.

Also consider joining Sovereign Man: Confidential to discover more options available to you.

But you may need to hurry up. If passed, most of the proposed changes will become active in less than two and a half months.

Yours in Freedom,

Team Sovereign Man

PS: Enjoying the weekly Knowledge Series? Why not give us a star-rating below?

PS: If you can see what is happening, and where this is all going, you understand why it is so important to have a Plan B. That’s why we published our 31-page, fully updated Perfect Plan B Guide, which you can download here.

Inside you’ll discover…