What is Purchasing Power?

The purchasing power of a currency is the amount of goods and services that can be bought with one unit of the currency.

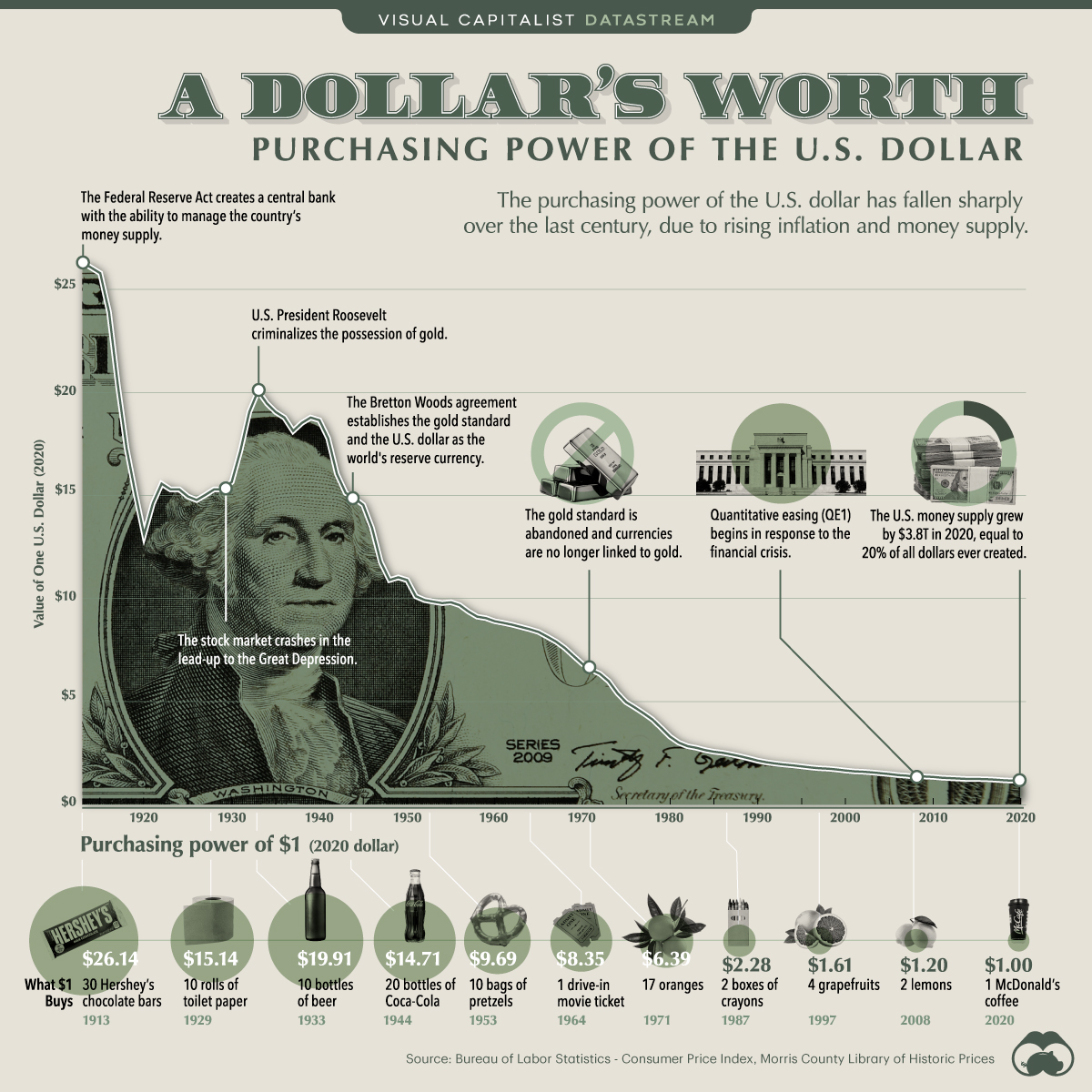

For example, one U.S. dollar could buy 10 bottles of beer in 1933. Today, it’s the cost of a small McDonald’s coffee. In other words, the purchasing power of the dollar—its value in terms of what it can buy—has decreased over time as price levels have risen.

Tracking the Purchasing Power of the Dollar

In 1913, the Federal Reserve Act granted Federal Reserve banks the ability to manage the money supply in order to ensure economic stability. Back then, a dollar could buy 30 Hershey’s chocolate bars.

As more dollars came into circulation, average prices of goods and services increased while the purchasing power of the dollar fell. By 1929, the value of the Consumer Price Index (CPI) was 73% higher than in 1913, but a dollar was now enough only for 10 rolls of toilet paper.

| Year | Event | Purchasing Power of $1 | What a Dollar Buys |

|---|---|---|---|

| 1913 | Creation of the Federal Reserve System | $26.14 | 30 Hershey’s chocolate bars |

| 1929 | Stock market crash | $15.14 | 10 rolls of toilet paper |

| 1933 | Gold possession criminalized | $19.91 | 10 bottles of beer |

| 1944 | Bretton Woods agreement | $14.71 | 20 bottles of Coca-Cola |

| 1953 | End of the Korean War | $9.69 | 10 bags of pretzels |

| 1964 | Escalation of the Vietnam War | $8.35 | 1 drive-in movie ticket |

| 1971 | End of the gold standard | $6.39 | 17 oranges |

| 1987 | “Black Monday” stock market crash | $2.28 | 2 boxes of crayons |

| 1997 | Asian financial crisis | $1.61 | 4 grapefruits |

| 2008 | Global Financial crisis | $1.20 | 2 lemons |

| 2020 | COVID-19 pandemic | $1.00 | 1 McDonald’s coffee |

Between 1929-1933, the purchasing power of the dollar actually increased due to deflation and a 31% contraction in money supply before eventually declining again. Fast forward to 1944 and the U.S. dollar, fixed to gold at a rate of $35/oz, became the world’s reserve currency under the Bretton Woods agreement.

Meanwhile, the U.S. increased its money supply in order to finance the deficits of World War II followed by the Korean war and the Vietnam war. Hence, the buying power of the dollar reduced from 20 bottles of Coca-Cola in 1944 to a drive-in movie ticket in 1964.

By the late 1960s, the number of dollars in circulation was too high to be backed by U.S. gold reserves. President Nixon ceased direct convertibility of U.S. dollars to gold in 1971. This ended both the gold standard and the limit on the amount of currency that could be printed.

More Dollars in the System

Money supply (M2) in the U.S. has skyrocketed over the last two decades, up from $4.6 trillion in 2000 to $19.5 trillion in 2021.

The effects of the rise in money supply were amplified by the financial crisis of 2008 and more recently by the COVID-19 pandemic. In fact, around 20% of all U.S. dollars in the money supply, $3.4 trillion, were created in 2020 alone.

How will the purchasing power of the dollar evolve going forward?