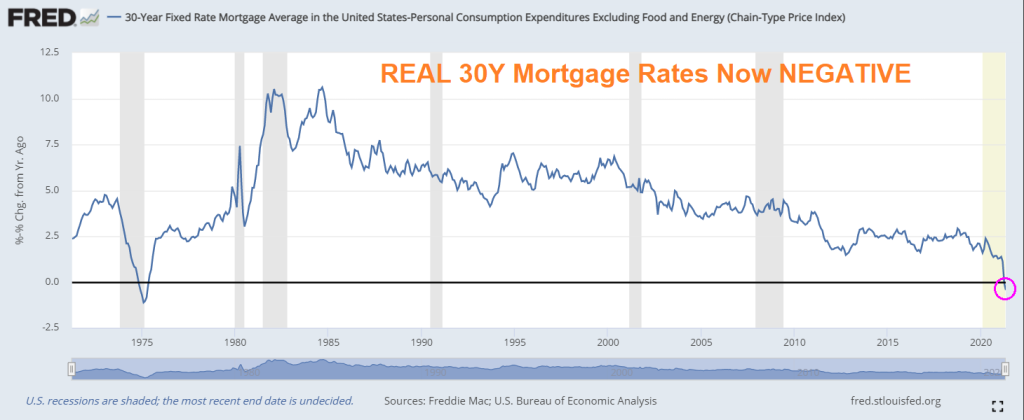

The ramp-up in inflation with relatively low mortgage rates has resulted in NEGATIVE real 30-year mortgage rates. Once again, the lowest since 1975. The Federal Reserve chair was Arthur Burns and the President was Gerald Ford.

The University of Michigan consumer survey points to crashing buying conditions for housing and soaring bad times. The reason? Skyrocketing home prices.

Limited available inventory of housing, bottlenecks in new housing construction and The Fed’s massive monetary stimulation has produced … a disaster.

I wonder if Fed Chairman Powell is quoting Urkel “Did I do that?”