The Justice Potter Stewart Bubble: Wilshire 5000 To GDP Ratio At All-time High

US Supreme Court Justice Potter Stewart once stated that with regard to obscenity, “I know it when I see it.” The same goes for asset bubbles. I know one when I see it.

The Wilshire 5000 stock index to nominal GDP ratio is now at an all-time high.

Justice Stewart was referring to pornography, not asset bubbles.

Rife With Anxiety, Markets Are Churning at the Fastest Rate Since 2008

Once the hallmark of this bull run, complacency has made way for angst.

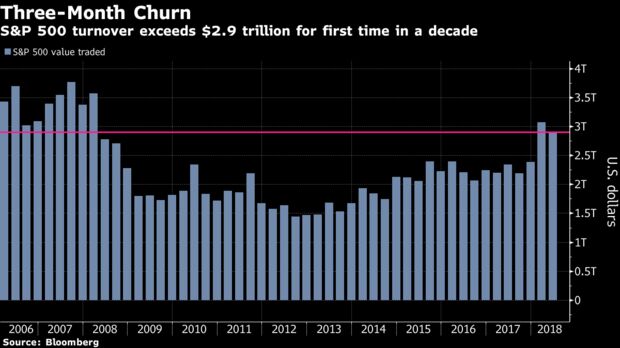

From junk bonds to emerging-market stocks, market turnover is through the roof, reaching multi-year highs. Within the S&P 500 Index, investors traded more than $2.9 trillion worth of shares in each of the past two quarters, a feat last achieved in early 2008.

Burgeoning uncertainty — from monetary policy and protectionism, to cracks in the synchronized growth story — has spurred elevated trading across assets.

Financials still look pretty bleak after snapping their worst losing streak on record

Financial stocks were thought to be the market’s darlings at the beginning of 2018, as a marriage between the Trump administration’s deregulation efforts and an increasingly hawkish Federal Reserve should have created the sector’s picture-perfect environment.

The price action couldn’t have been more different. Financials badly underperformed the broader market in the first half of the year. The financials-tracking XLF has been modestly positive in recent sessions, but only after posting its longest losing streak on record — 13 days.

Some see more pain coming. The technical picture is still rather “cloudy” for the XLF, said Craig Johnson, chief market technician at Piper Jaffray. He told CNBC’s “Trading Nation” why there appears to be pain ahead.

• Despite relatively positive stress test results last week, banks as a group closed lower on the week, and the charts remain dubious. The XLF bounced off support near the $26.50 mark, but it remains to be seen whether the recent bounce can hold.

• Breadth within the sector, or the number of stocks advancing relative to the number of stocks declining, is weak. Just 25 percent of stocks within the financials are trading above their 200-day moving averages, the lowest of any S&P 500 sector.

Companies buying back their own shares is the only thing keeping the stock market afloat right now

- Companies set a record for share buybacks in the second quarter, while investors set their own record for selling stock-based funds in June.

- On the corporate side, officials are finding that repurchases are the best use for investor cash now, while individual investors are fearful that a trade war could offset strong economic momentum this year.

- All in all, the corporate buying has won out, keeping the S&P 500 slightly positive for the year.

#LateCycle divergence pic.twitter.com/7d6QB50RAy

— OW (@OccupyWisdom) July 4, 2018