by TonyLiberty

The SEC banned short sales on ~1,000 financial stocks on September 19th, 2008.

The SEC’s ban on short selling was intended to prevent investors from driving down the prices of financial stocks by shorting them.

But, the S&P 500 index fell ~50% to its lowest point in the months following the ban.

Regulatory actions, like a short-selling ban, can have unintended consequences and may not always be effective in stabilizing markets during turbulent times.

The ban did not address the underlying problems that were causing the financial crisis. These problems included subprime lending, over-leveraged banks, and a lack of transparency in the financial markets.

The SEC’s ban on short selling is a reminder that government intervention is not always the best solution to financial problems.

Bankers Want an Emergency Ban on Short Selling

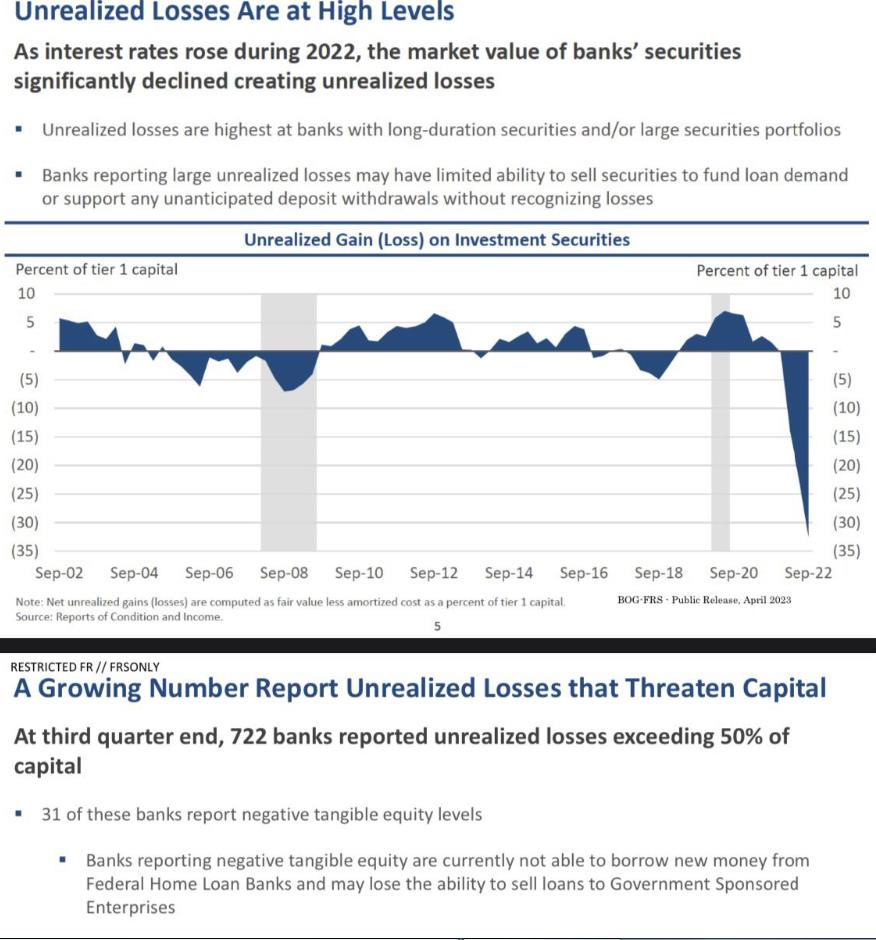

per Fed Reserve, 722 banks have unrealized losses exceeding 50% of it’s capital