by Usman Salis

Image Source: themarketear.com

Retail Army Seizes Control of the Stock Market

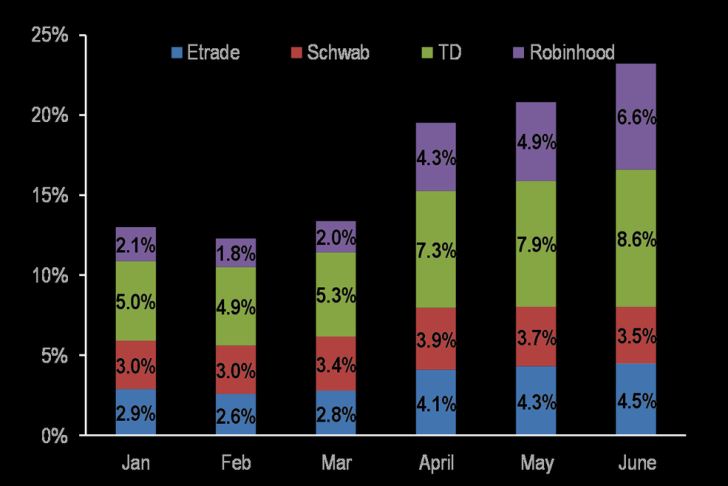

The volume of trade coming from retail investors is constantly growing and sets new records every month of 2020, according to The Market Ear Information.

Thus, only within 6 months, the army of retail investors has gone from 13% to 23% of total equity volumes. It is worth to mention that Robinhood, whose users are often accused of reckless behavior on the market by analysts, is the leading player in the market, consistently holding the first place in terms of the trading volume.

Retail Investors Are Increasing Market Volatility

Some experts believe that the growth in the number of retail investors may negatively affect the stability of the market. The fact is that during the summer rally, the market experienced a significant influx of retail investors into options trading.

They were using leverage to supercharge their stock market performance, but the growth of options activity leads to a significant increase in market volatility. Volatility, in turn, shakes the market, deprives it of stability, and threatens to turn into a trend change.