via Zerohedge:

With the August payrolls report widely seen as disappointing, with less than 100k private payrolls added (despite accelerate wage growth), the last data point the Fed is waiting for to cement next week’s 25bps rate cut is this Friday’s retail sales data (assuming tomorrow’s CPI report is not a shock).

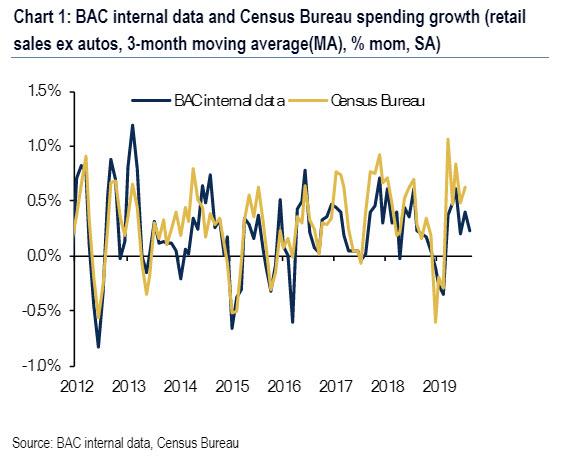

Luckily for the Fed, it appears that the August retail sales number is set to be the latest evidence of America’s rapid slowdown, if only based on Bank of America credit and debit card data, which shows that after a strong month of spending in July, consumers aggressively tightened the strings of their wallets in August.

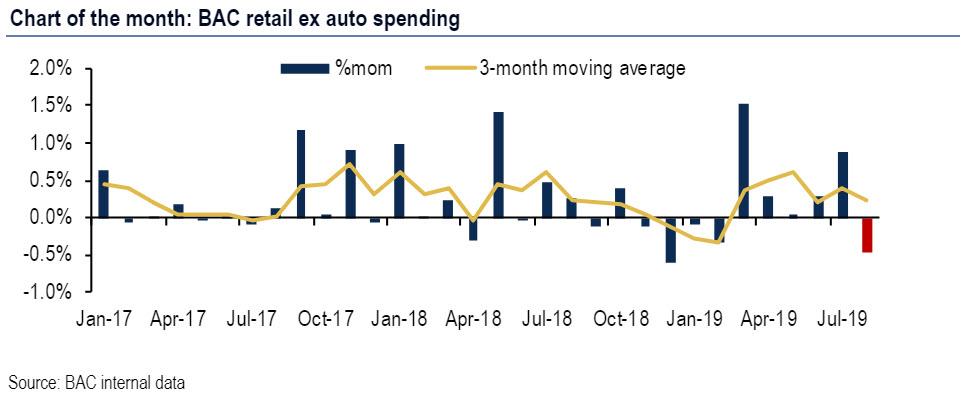

Specifically, BAC found that retail sales ex-autos fell 0.5% month-over-month, which reversed the 0.9% gain in July, and was not only the first monthly contraction since February this year, but was also the biggest monthly drop in 2019.

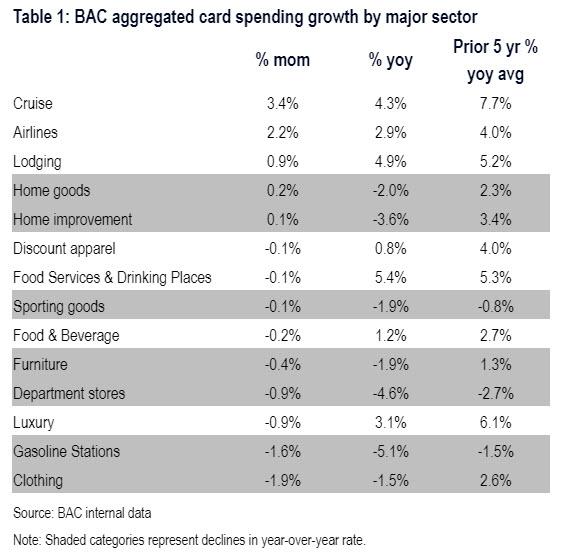

As BofA details, in August, spending for only 5 out of the 14 sectors increased in the month, led by strength in cruises and airlines. This was likely boosted by summer vacations, which usually take place in August. On the flip side, spending at clothing stores saw a 1.9% mom contraction accompanied by a 1.6% drop in gas stations. Luxury and department stores also posted losses. On a % yoy basis, 7 sectors posted negative growth. Excluding spending at gas stations, which is largely impacted by gas prices, spending at department stores continue to post the biggest % yoy loss, at -4.6%.

What was behind the sharp drop off in late-summer spending?

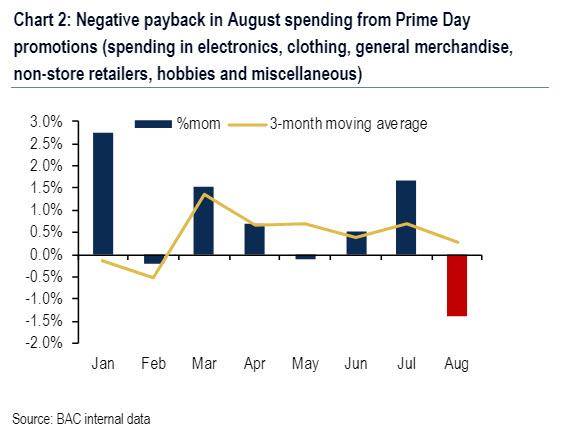

According to BofA, Amazon Prime Day and other retailers’ summer promotions in mid-July provided a significant boost to spending, in effect pulling forward consumer demand from the future, into July and out of August. Focusing specifically on discretionary spending categories likely impacted by the promotions, the bank’s economists found that it increased 1.7% mom in July but tumbled 1.4% in August

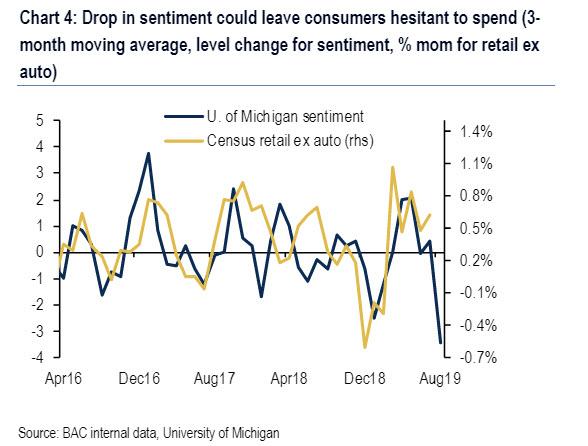

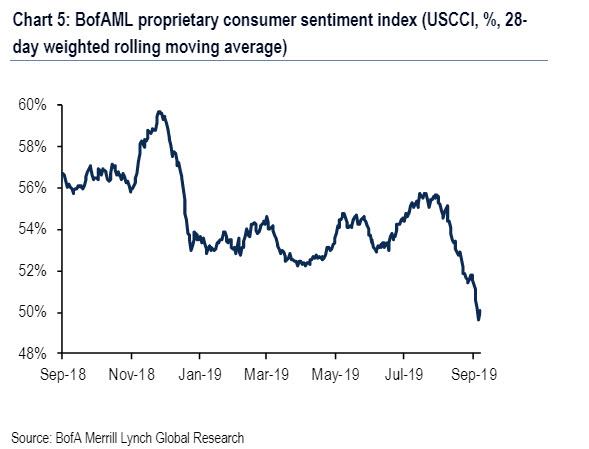

Outside of the promotion distortions, and more ominously, spending was likely dampened by overall weakening sentiment. As reported previously, the latest University of Michigan consumer sentiment survey found that consumer sentiment in August fell by the most since 2012 and the third biggest since the recovery started.

Also, BofA’s own proprietary “Word from Main Street” index showed that the BofAML US consumer confidence indicator (USCCI) dropped in recent weeks, tumbling to the lowest level in years. It briefly dipped below the 50% breakeven level before rebounding, signifying that respondents, on balance, are more pessimistic. BofA suspects that the drop in sentiment left consumers a bit more hesitant to spend this month.

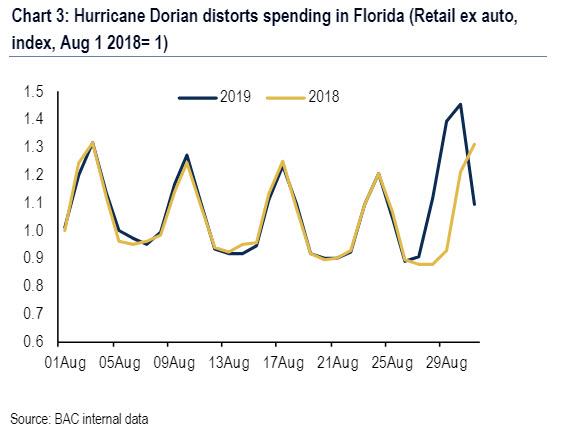

On the other hand, boosting consumer spending this month was Hurricane Dorian. The storm was expected to hit the shores of Florida, prompting people to prepare for the storm, stocking up on essentials. To this end, BofA saw a particularly large increase in spending in Florida in the last few days of the month. Indeed, the Hurricane-related spending added 0.2-0.3% to aggregated retail sales ex-autos. In other words, if not for proactive hurricane-related spending, aggregate retail sales would have been even worse, down 0.7-0.8% in August.

The bottom line: BofA card spending data show that August was a difficult month for the retailers, and the bank expects to similarly see a weak retail sales report from the Census Bureau on Friday.

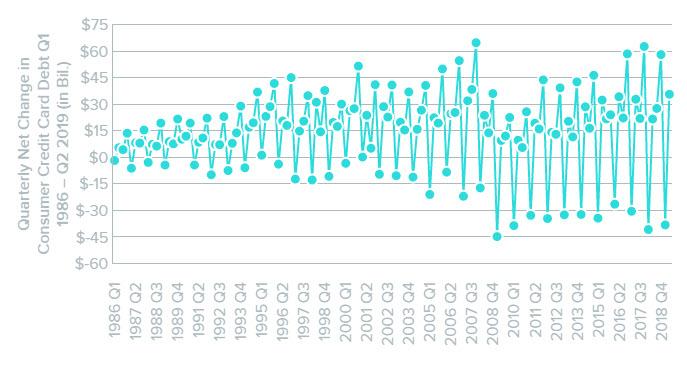

Finally, confirming the sorry state of US consumer finances, today WalletHub released a report, which found that consumers racked up $35.6 billion in credit card debt during Q2 2019 – the largest second-quarter build-up ever. The $35.6 billion in additional Q2 credit card debt is 64% higher than the Q2 2018 paydown.

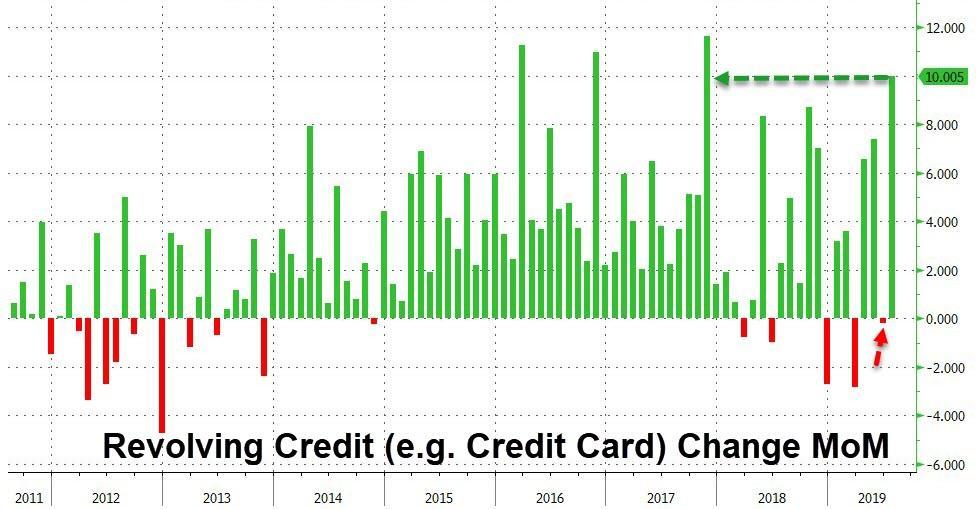

Incidentally, this finding was confirmed by the Fed’s own consumer credit report earlier this week which found that revolving credit in July soared by over $10 billion – the most since Nov 2017 – to the highest level on record.

Yet while one month does not make a trend and consumer spending may still remain strong on the year – recall that last week, Morgan Stanley said that the Only Question That Matters Now: “Will The US Consumer Hold Up” – BofA advises keeping a close eye on confidence measures as they will be critical to determining the willingness of the consumer to continue to spend.