via JOHN RUBINO

So that recession I keep whining about still hasn’t arrived. What’s going on out there to keep “inevitable” from becoming “imminent”?

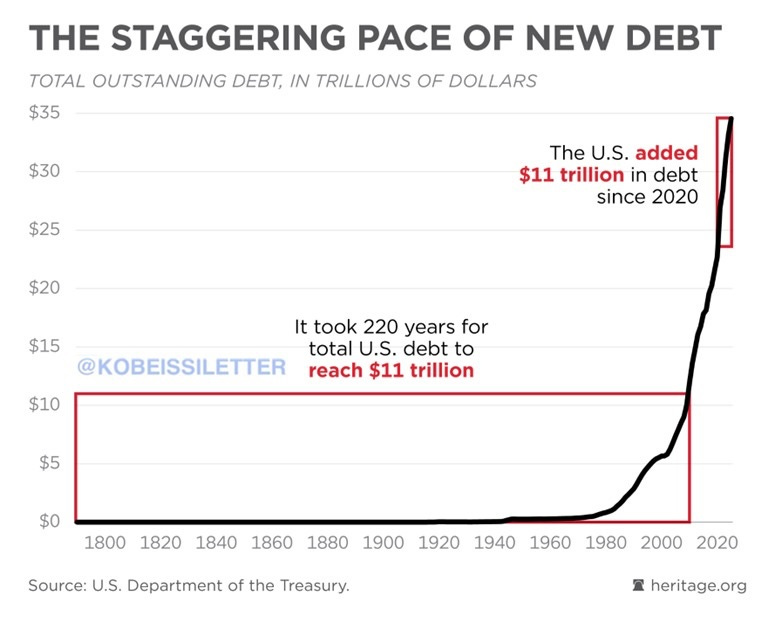

It might be as simple as a government borrowing insane amounts of money and giving it to arms makers, banks, and AI companies.

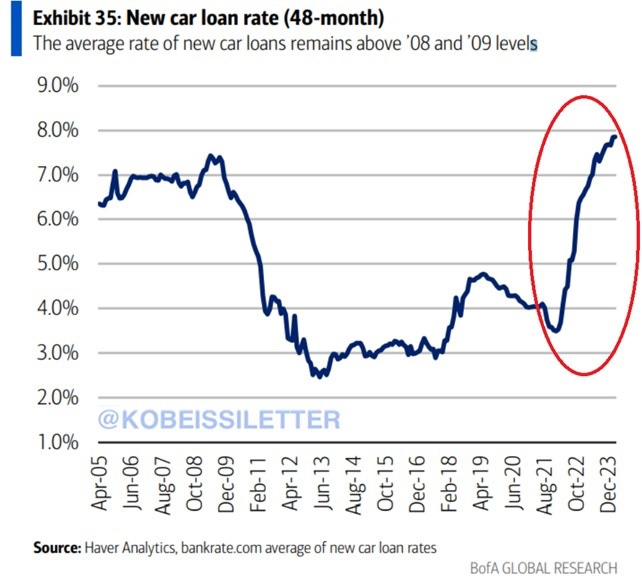

This “fiscal dominance” strategy invokes some serious unintended consequences, including stubborn inflation and rising interest rates. New car loans, for instance, are now more expensive than they were prior to the 2008-2009 crash:

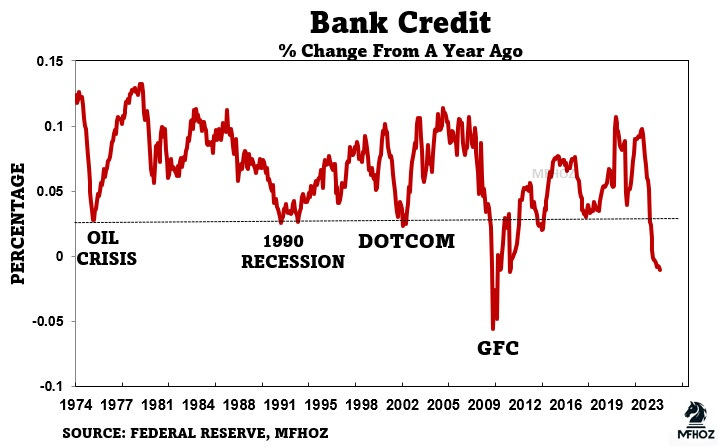

While bank credit is falling into pre-crash territory:

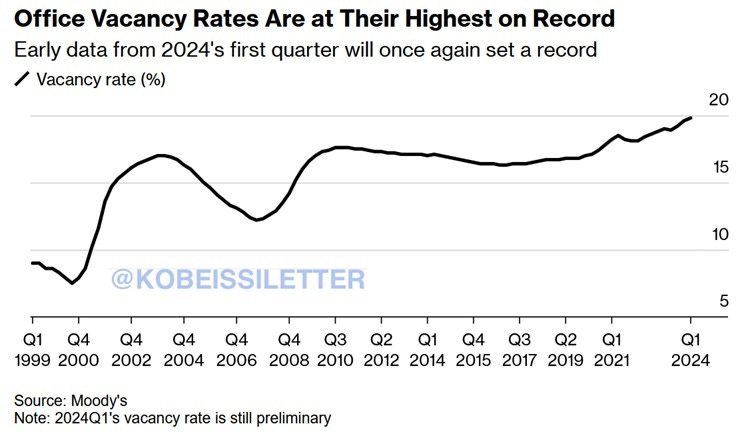

Offices are emptying out:

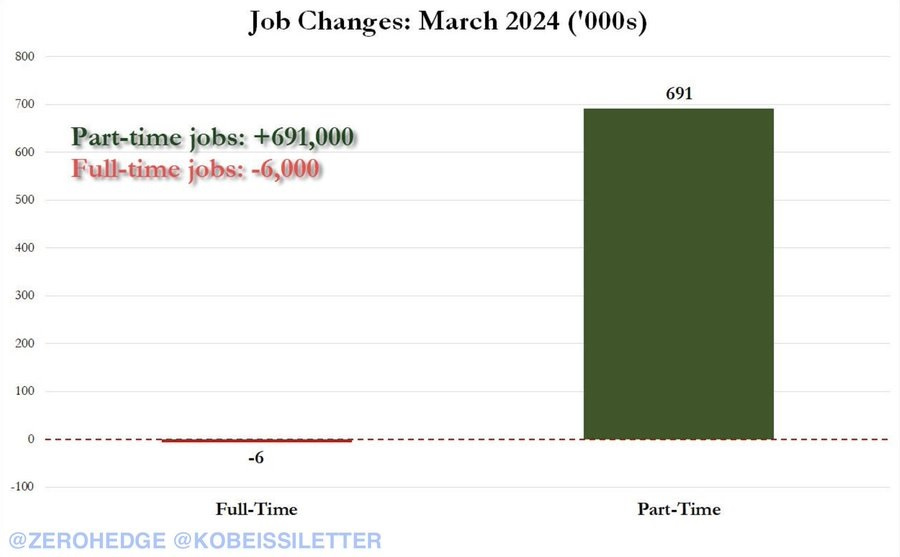

But unemployment is ridiculously low. With everyone working, how can growth possibly turn negative? Well, if everyone is working multiple part-time jobs and still unable to make ends meet, that might do it:

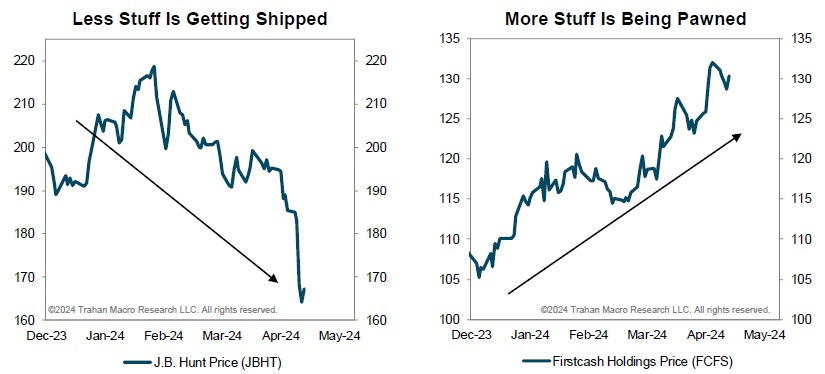

Meanwhile, lots of under-the-surface stats support the gloom-and-doom thesis. The next chart compares the stock prices of a major shipper and a major pawn shop chain:

According to financial analyst Danielle DiMartino Booth, we might already be in a recession: