February’s Core Personal Consumption Expenditures (PCE) price YoY grew to 5.4%, the highest since 1983. The spread between the PCE Core Deflator and The Fed Funds Target Rate (upper bound)

In terms of the spread, it is the highest since the 1970s.

The Taylor Rule (which Jerome Powell probably thinks is the New Jersey breakfast meat “Taylor Ham”) indicates that The Fed’s target rate should be 12.21%. This is using the Rudebusch specification of the Taylor Rule.

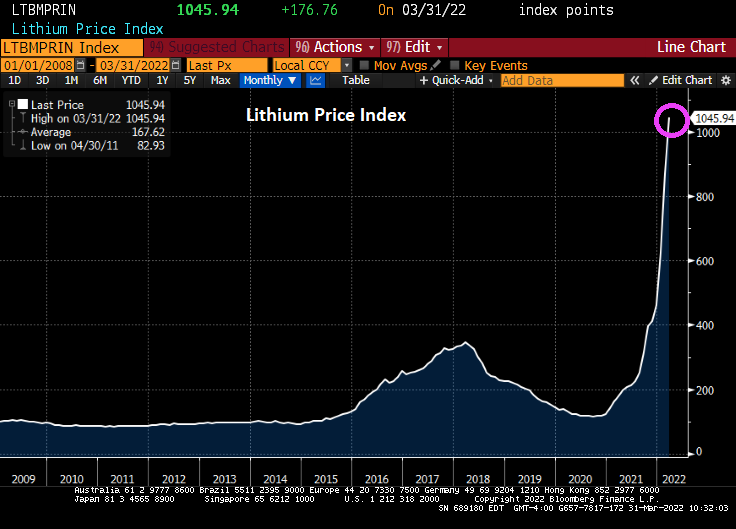

Now that the Biden Administration is going gangbusters on building electric cars, lithium prices are going through the roof.

The Federal Reserve’s new theme song is “Come Feel The Inflation!”

Noddy Powell?