Submitted by Eric Peters, CIO of One River Asset Management

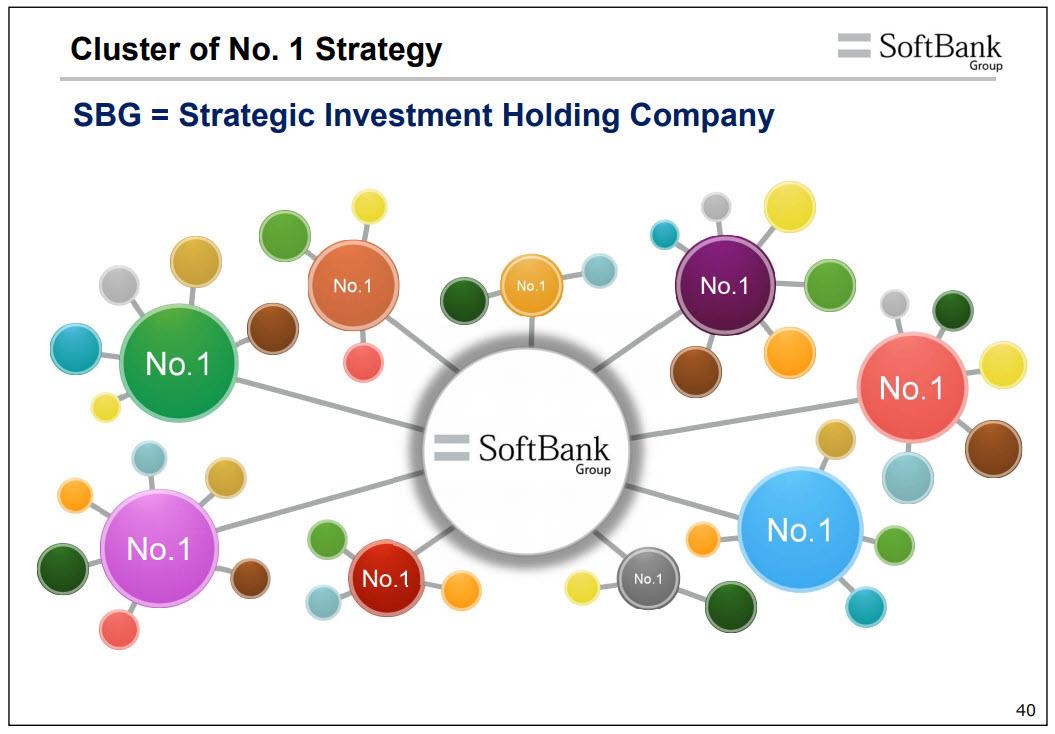

“The power to predict the future is about to emerge,” declared Masayoshi Son. “The amount of data will grow by a million times over the next 30 years,” continued the SoftBank Chairman, pitching his $108bln Vision Fund II which will target companies that facilitate an acceleration of the artificial intelligence revolution.

Microsoft, Apple, Foxconn, numerous Asian financial firms, and three Japanese banks will give their cash to Masayoshi Son (forgoing $14trln in negatively yielding global bonds).

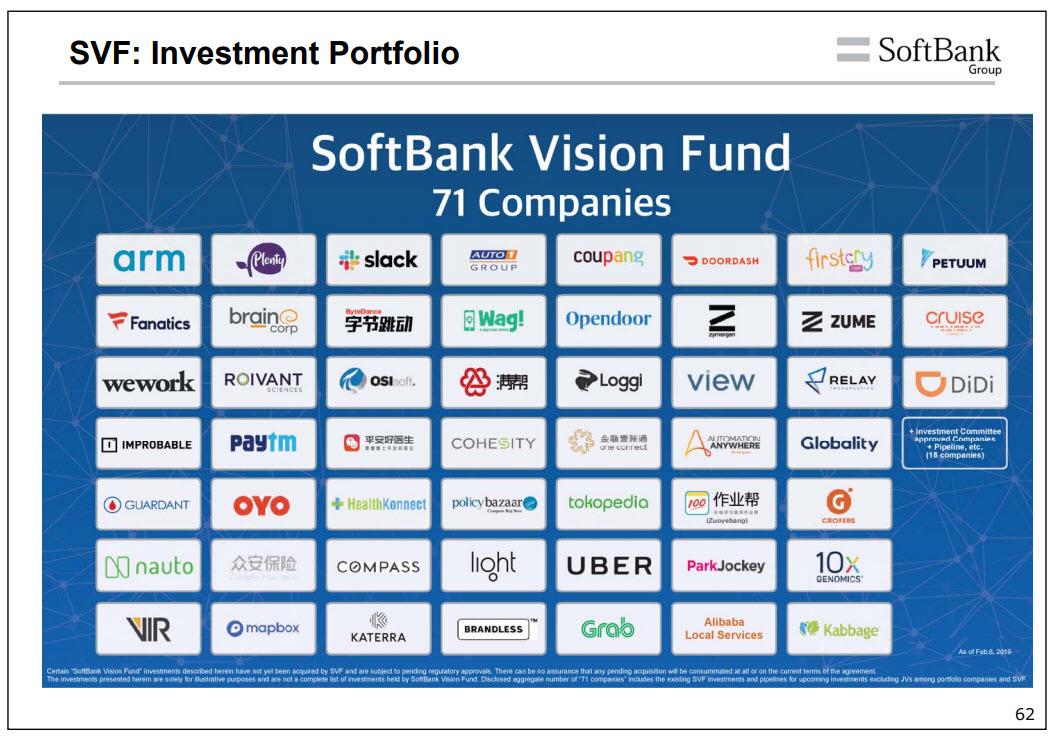

He launched his first $100bln Vision Fund in November 2016. It quickly used nearly all its working capital, buying stakes in companies like Arm, Uber, Didi, WeWork.

That first fund is leveraged, with $40bln of its capital in preferred securities that pay a 7% coupon. The remaining $60bln delivered a +29% annualized investment return (as reported by SoftBank using private valuations over which it has enormous influence).

You see, when you borrow money to buy shares in private companies then mark their valuations higher, the returns look extraordinary. But ‘extra’ ordinary returns are extremely difficult to deliver at scale, and then only in the most exceptional circumstances for brief periods.

Returns that exceed ordinary are reserved for smaller, niche opportunities. But if you deliver extraordinary in your first fund, then the speed at which you can attract money for your second fund accelerates.

This inspires others to copy your model either directly or indirectly. And in this way, purchases of private shares using leverage rises. Which of course lifts their price. And as prices increase, returns for leveraged funds appear extraordinary.

The process attracts fresh capital and is thus self-reinforcing, reflexive. Carried to its logical conclusion this leads to prices that are infinite.

Except that rallies to infinity never happen – prices rise inexorably, until they fall for no reason. And not even tomorrow’s most advanced AI, processing a trillion times more data, will ever change that.