by WARREN MOSLER

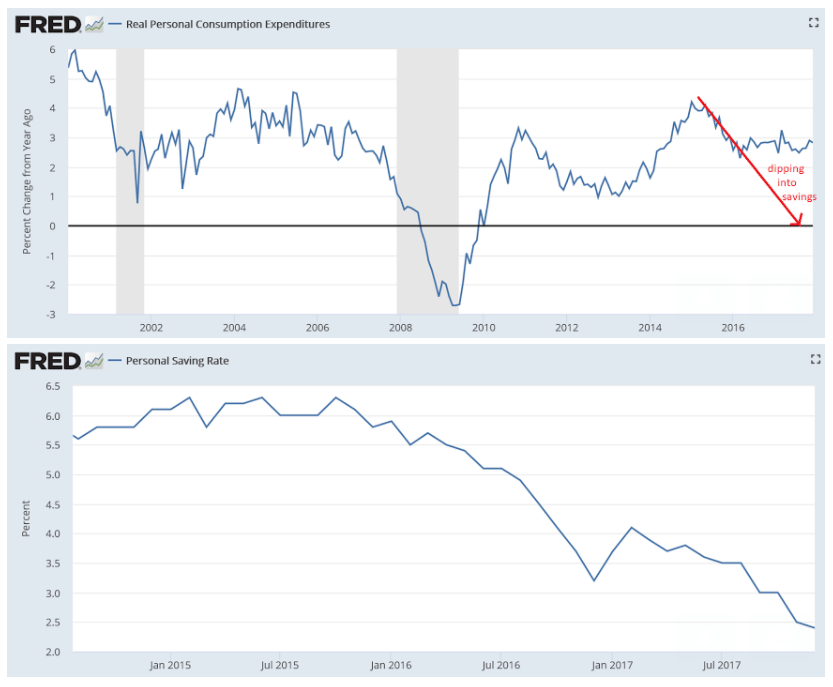

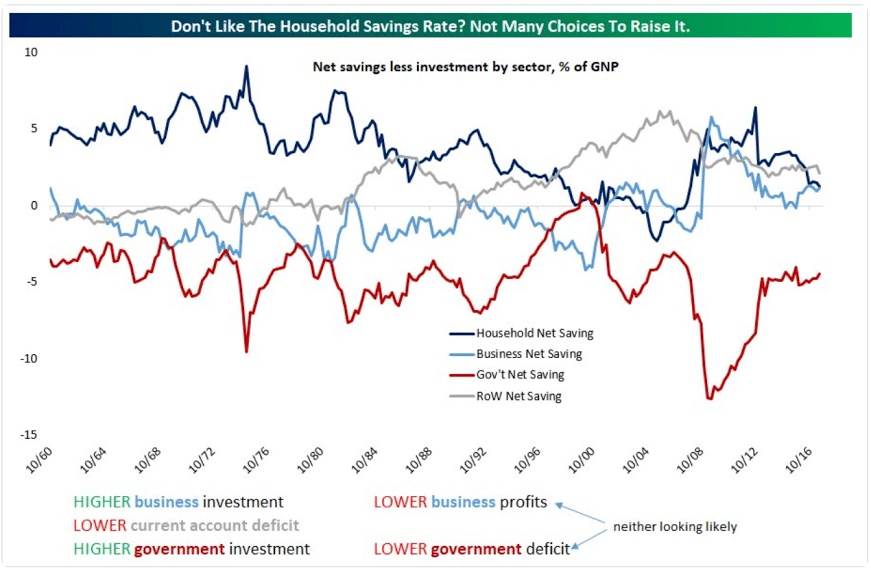

Seems to me this divergence has been stretched to the limit:

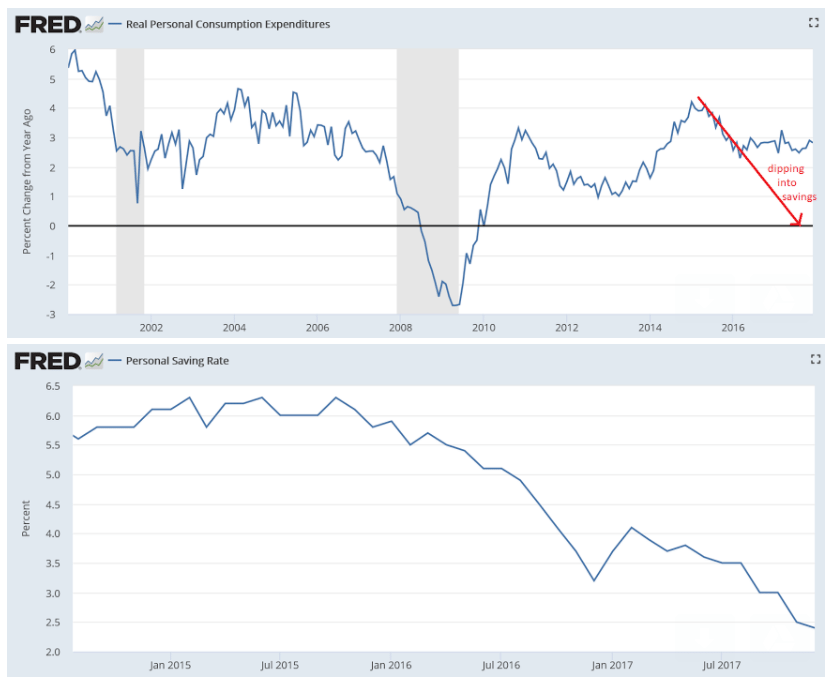

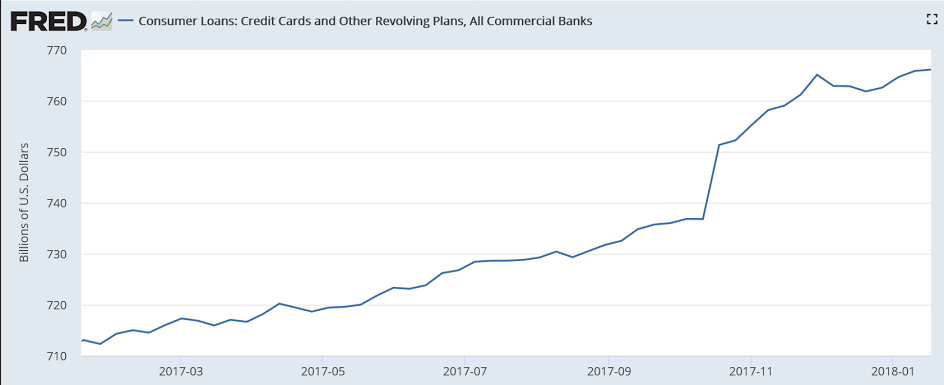

And this chart from Daniele Della Bona shows how dipping into savings via borrowing adds to interest expense that further reduces savings when other personal income is lagging:

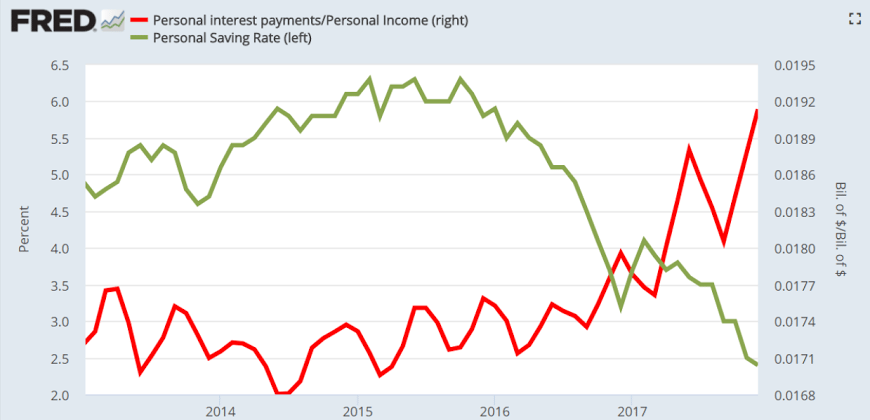

And this shows the gap:

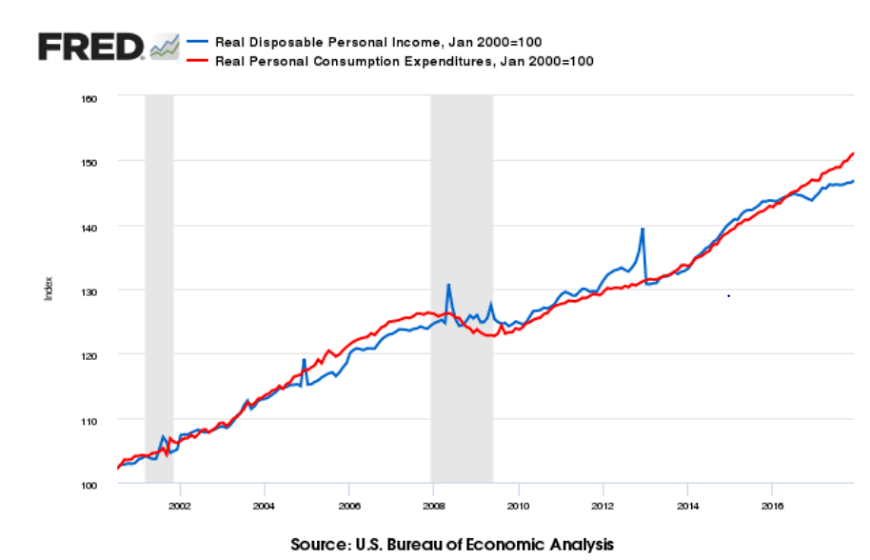

And from a different angle:

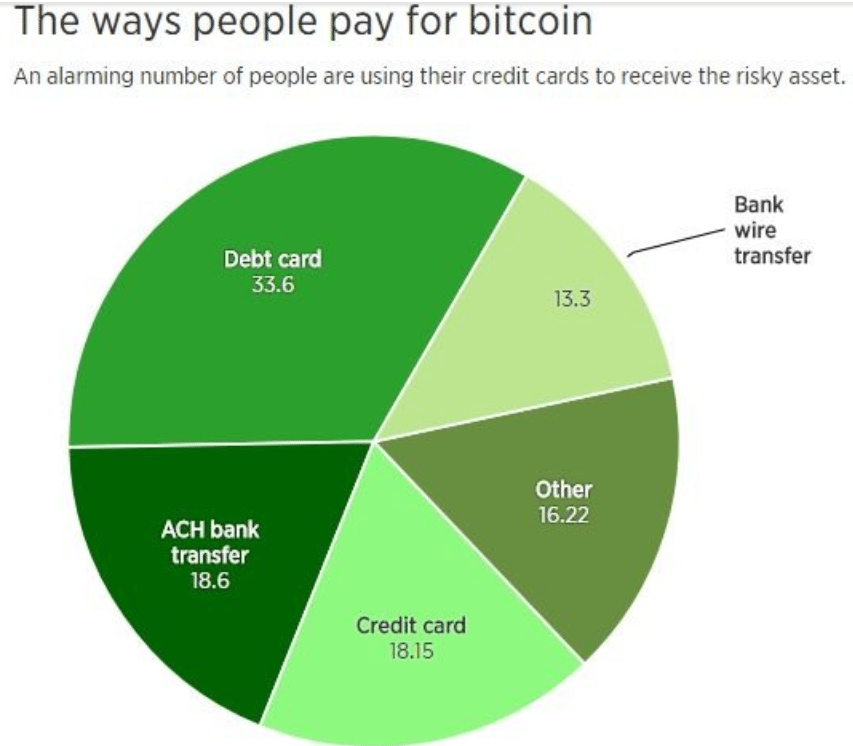

And this was also part of the consumer’s year end credit card binge that contributed to GDP? And would that be consumption or investment? 😉

From WardsAuto: U.S. Forecast: January Sets Stage for Anticipated Year-Over-Year Decline

The Wards Intelligence January forecast calls for 1.16 million LVs to be delivered over 25 selling days, resulting in a 46,430-unit daily sales rate compared with 47,442 in prior-year (24 days). The DSR is down 2.1% from like-2017.

…

The resulting seasonally adjusted annual rate is 17.24 million units, below the 17.75 million in the previous month and 17.34 million year-ago.

emphasis added

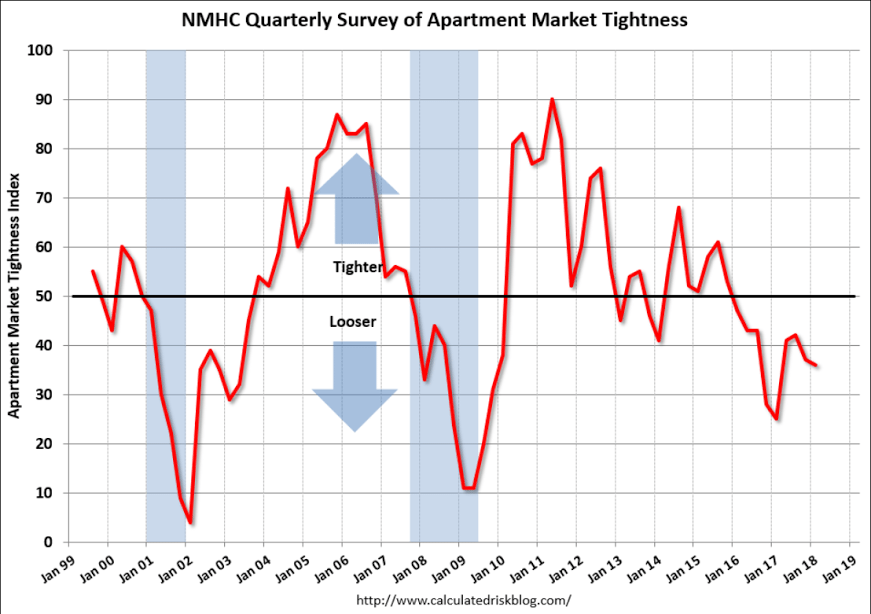

Read more at http://www.calculatedriskblog.com/#MKeJseaSX5tHpUiu.99