via confoundedinterest:

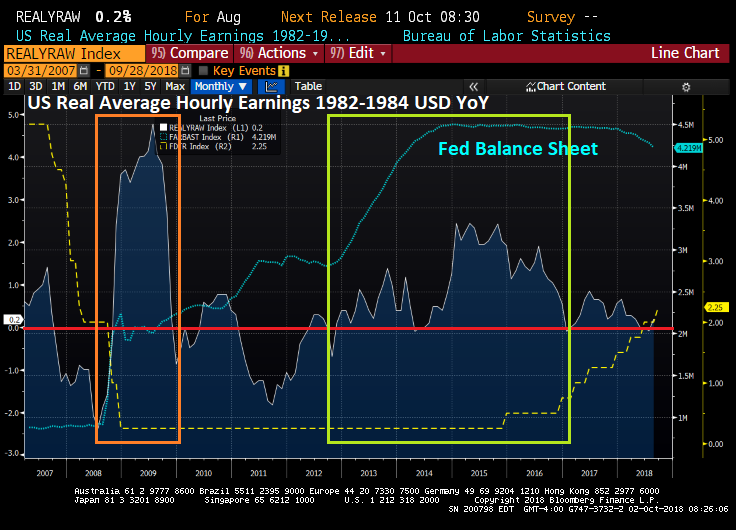

Following The Great Recession and the financial crisis, The Federal Reserve enacted their zero-interest rate policy (ZIRP) and started buying Treasury Notes and Agency MBS. QE1, the first round of asset purchases by The Fed starting in late 2008, was like a block of sugar for the economy and real hourly wages. Real Average Hourly Earnings growth YoY shot up in 2009 (orange box), but then suffered a “sugar crash” but rose again with QE3 that also died out. As Powell and The Fed began to “normalize” interest rate policies (unwinding their balance sheet and raising The Fed Funds Target rate, Real Average Hourly Earnings have slumped to near zero growth.

The flaw with The Fed’s model of real earnings growth is that it is not organic growth, but a massive block of sugar. And a sugar crash invariably follows.