The stock market is clinging to the ledge of a cliff.

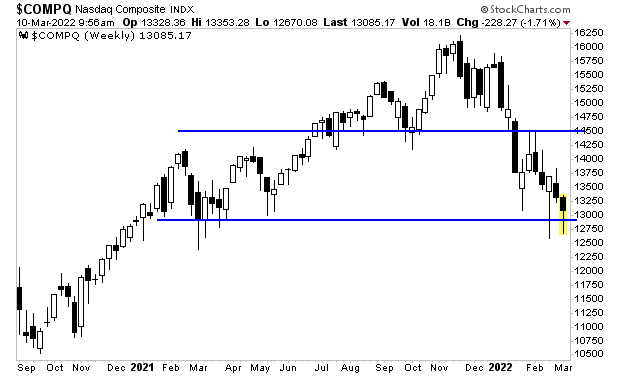

The weekly chart of the NASDAQ is truly. Tech stocks have been trading in a wide range since stocks peaked in November 2021. And they are just BARELY clinging to the lower line of this range on a weekly basis.

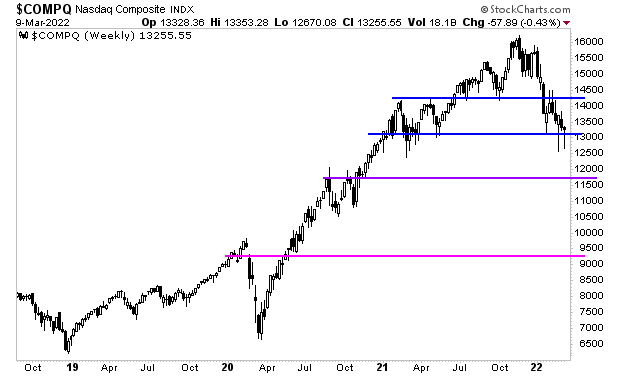

Why is this a big deal? Because if the NASDAQ closes below the lower line of this range on a weekly basis, it opens the door to an unwind of most if not ALL of the COVID-19 bull market. This would mean a 40%-50% collapse from current levels.

And all of this is happening right as the Fed ends QE and starts raising rates. Meanwhile, the economy is rolling over and the tech-heavy market is barely able to rally.

Sounds like the recipe for a crash to me!