Stocks continue to churn.

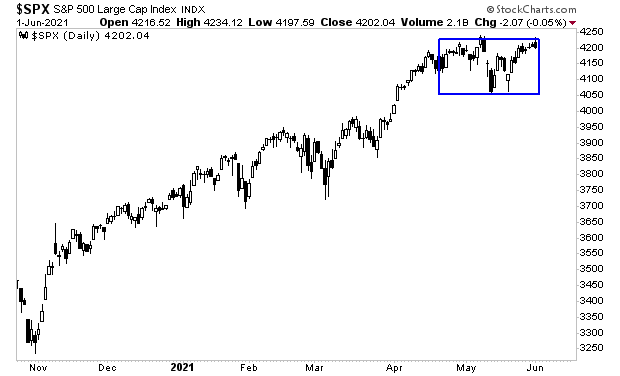

The S&P 500 has been in a consolidation phase since mid-April. Yes, we’ve had a few runs to new all-time highs, but as the below chart shows, most of the action has been sideways (see the blue box in the chart below).

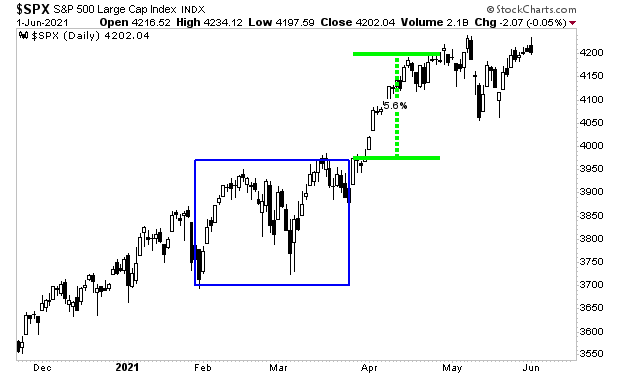

Whenever markets enter a consolidation phase, the eventual breakout tends to be violent. And the longer the consolidation, the more violent the breakout.

Considered the last market consolation which took place from February through late March 2021. Stocks chopped back and forth in a significant box pattern before finally breaking out to the upside. They then ripped higher by 5% in the span of a little over a week.

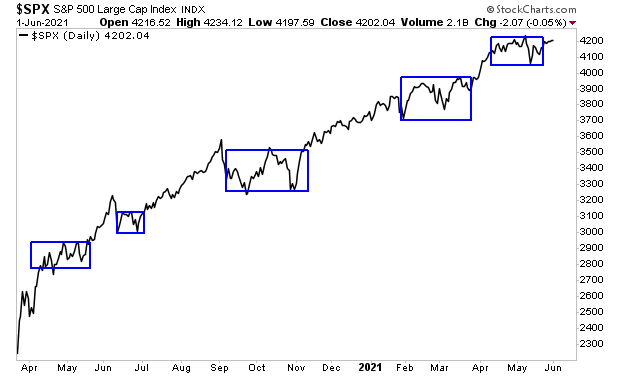

Indeed, this has been the hallmark of this bull market since the March 2020 lows: stocks rip higher, then enter a six to eight week consolidation phase before breaking out to the upside again. I’ve identified the consolidation phases in blue boxes in the chart below. All of them resulted in breakouts to the upside.

With this in mind, I see no reason to overthink the current consolidation. Until the Fed begins to tighten monetary policy, it’s difficult to see a reason why stocks should collapse. It is clear the Fed has decided to let inflation run hot, and as I’ve outlined multiple times in the past, stocks initially LOVE inflation.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research