Wall Street begins reporting earnings for the first quarter this week.

Everyone expects earnings will be a disaster. After all, the economy first slowed, then ground to a complete halt last quarter. The issue now, as far as traders are concerned, is whether the results surprise to the downside, meaning, things are in fact worse than everyone already assumes.

The markets are preparing for their next major move.

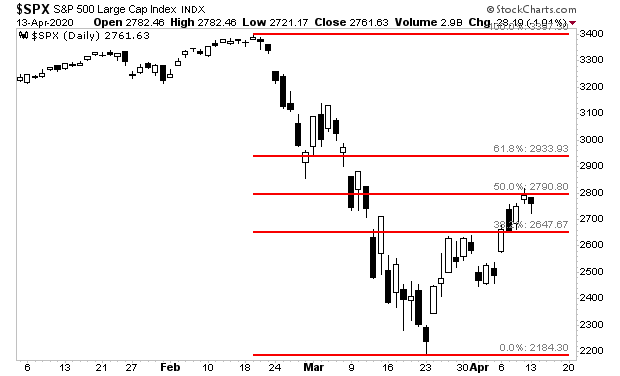

The S&P 500 is struggling to break above the 50% retracement of its collapse. If it cannot break above here and continue to rally, then we could see another collapse.

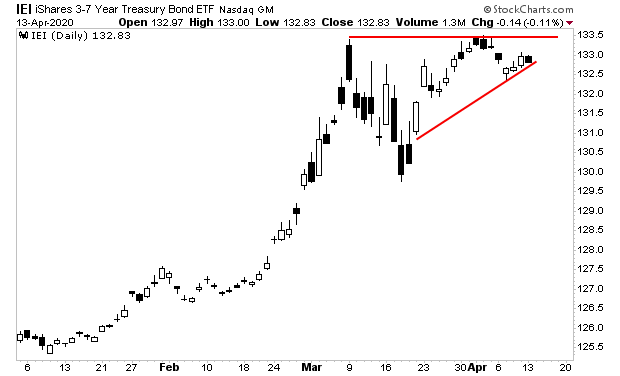

Similarly, Treasuries, which are a safe haven, remain extremely close to their all-time highs. Given that things are supposed to be improving… shouldn’t bonds be breaking down more? Are these bonds warning us there’s more trouble ahead?

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

Today is the last day this report will be available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research