The market continues to climb a wall of worry.

Stocks rose again yesterday despite widespread riots and violence in the US. I think this is ridiculous, but as I keep telling my clients, “it’s not what we think, but what the market thinks that matters.”

This is the single most important thing to remember if you want to make money in the markets today.

Having said that, the markets think stocks are going HIGHER.

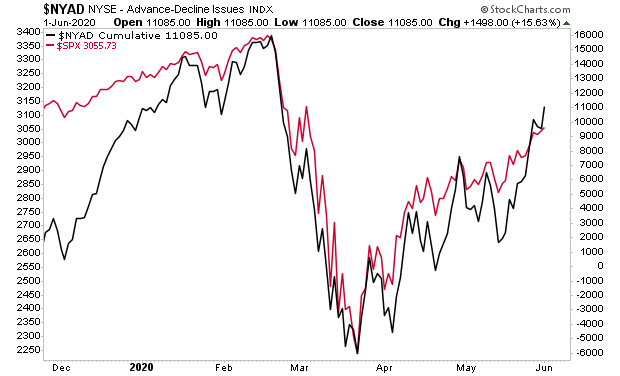

Breadth (black line) suggests the next leg up is here now. By the look of things stocks could hit 3,100 on the S&P 500 this week.

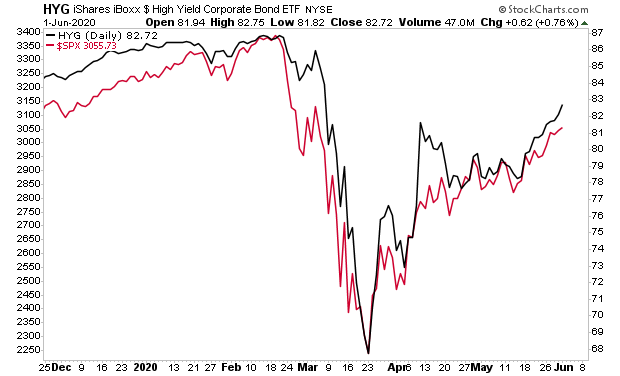

This is also where high yield credit suggests stocks are going.

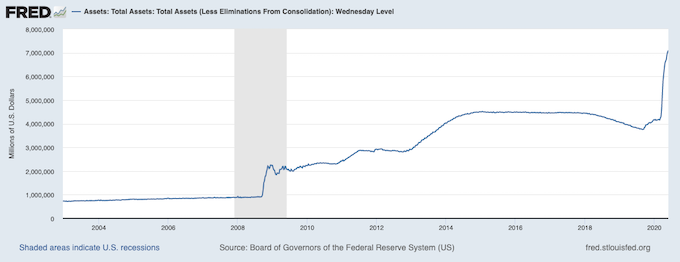

In simple terms, the market is telling us that it doesn’t care about riots, unemployment, or any of the other horrific headlines today. The market cares about only one thing: Fed liquidity.

With that in mind, the Fed balance sheet has broken above $7 trillion. It was at $4.1 trillion in late February 2020. So, we are talking about roughly $1 trillion in liquidity hitting the financial system every single month.

If we’ve learned anything from the markets over the last 12 years, it’s that stocks LOVE Fed money printing. Small wonder then that stocks are overcoming an economic depression, political turmoil and more.

Put simply, there is no reason to overthink this. The trend remains up for now. The key is to keep one eye on the exits for when stocks begin to care about something other than Fed liquidity.

If stocks can break above this level and hold it, then it will trigger a major flow of new capital into the markets as traders and institutions take this to indicate this is the start of a new bull market.