by Dana Lyons

Stocks are entering the best stretch of the 4-year Presidential cycle, historically speaking.

When it comes to investment decision-making inputs, seasonality is typically pretty low on the hierarchy for us. However, as we have written on occasion in the past, there are some seasonal tendencies that have proven to be rather consistent throughout the market’s history. Some tendencies are short-term patterns around month-end or holidays. Others are longer-term in nature, such as the 4-year Presidential cycle.

As we have noted in the past, the Presidential cycle has proven to be quite reliable over the years. At this particular time, bulls are hoping that’s the case since the cycle is entering its best stretch of the entire cycle, historically speaking.

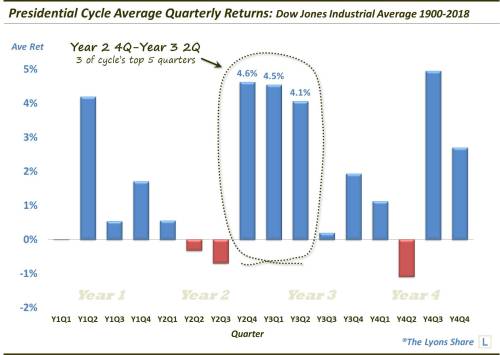

As the chart shows, the next 3 quarters represent 3 of the top 5 quarters in terms of average returns in the Dow Jones Industrial Average since 1900.

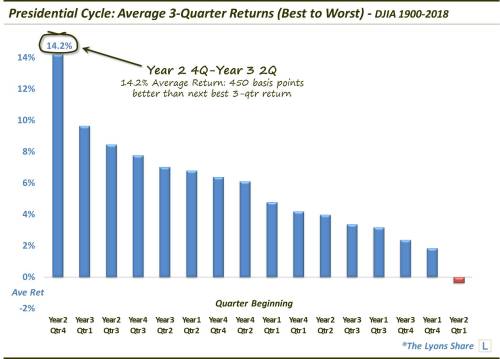

And, at an average return of +14.2%, the upcoming 3-quarter stretch has been, on average, more than 450 basis points better than the next best 3-quarter stretch.

Now, as we always note, seasonality is but a complimentary headwind or tailwind for stocks. There are certainly other more important factors in determining the path of the stock market. Thus, the historically “average” path does not always play out. Indeed, the 2-quarter stretch that just ended is historically the worst of the cycle. Yet, the stock market suffered little ill effects this time around.

So how will the recent out-performance (versus the average cycle) effect the upcoming “best stretch”? In a Premium Post at The Lyons Share, we take a historical look at prior cycles when the typically weak stretch performed well – and what the returns were during the best stretch. We also lay out just how much “stock” we are putting into this data point in light of all the other present factors.