Stocks Post Worst Year In Decade…

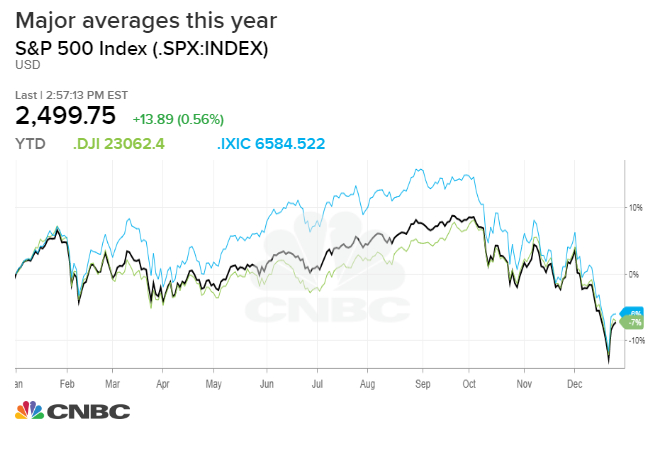

Wall Street concluded a tumultuous 2018 on Monday as the major stock indexes posted their worst yearly performances since the financial crisis.

After solid gains on Monday, the S&P 500 and Dow Jones Industrial Average were down 6.2 percent and 5.6 percent, respectively, for 2018. Both indexes logged in their biggest annual losses since 2008, when they plunged 38.5 percent and 33.8 percent, respectively. The Nasdaq Composite lost 3.9 percent in 2018, its worst year in a decade, when it dropped 40 percent.

The S&P 500 and Dow fell for the first time in three years, while the Nasdaq snapped a six-year winning streak. 2018 was a year fraught with volatility, characterized by record highs and sharp reversals. This year also marks the first time ever the S&P 500 posts a decline after rising in the first three quarters.

For the quarter, the S&P 500 and Nasdaq plunged 13.97 percent and 17.5 percent, respectively, their worst quarterly performances since the fourth quarter of 2008. The Dow notched its worst period since the first quarter of 2009, falling nearly 12 percent.

Stocks had a rough 2018 — Here’s what five strategists say to expect in 2019 from CNBC.

Best Investments? Art, Wine, Cars…

Luxury assets have outperformed stocks and bonds this year

Hedge funds miserable; Closures, mediocre performance…

This year was supposed to be when rising volatility and yields brought back the glory days. Instead, returns fell and investors fled

A year ago, the hedge fund industry was full of optimism.

After years of performance trailing the stock market, fund managers saw the end of central banks’ quantitative easing — and, by extension, an end to what many perceived as artificial asset valuations pumped up by government intervention — as the chance to return to the glory days of colossal market-moving bets and double-digit returns. With interest rates and volatility on the rise, it would soon be time to crow about record-setting profits.

But one record set in 2018 was a landmark few hedge fund luminaries cared to dwell on. Last October, in what industry insiders believe to be a first, three US-based hedge funds shut in the course of the same week. Tourbillon and Criterion were among those to cease operations, following an inability to generate sufficient money and capital.

Other hedge funds to have bitten the dust in 2018 include Omega Capital, run by industry veteran Leon Cooperman, and Cerrano Capital, whose backers included activist investor Dan Loeb, but which failed to last a year in operation.

Corporate Profit Crunch Looms…

Investors worry that the moneymaking outlook for companies will deteriorate further

Bezos fortune drops $40,000,000,000 from peak…

The markets may be tanking, but that hasn’t stopped plenty of mega-fortunes from being unearthed in 2018.

The popularity of Fortnite, the phenomenon that forced some into video-game rehab, gave gamemaker Tim Sweeney a $7.2 billion fortune this year. Autry Stephens has $11.4 billion after his closely held Endeavour Energy Resources LP attracted bids that valued the oil company at as much as $15 billion.

“It was a good year for wealth creation,“ said Michael Zeuner, managing part ..