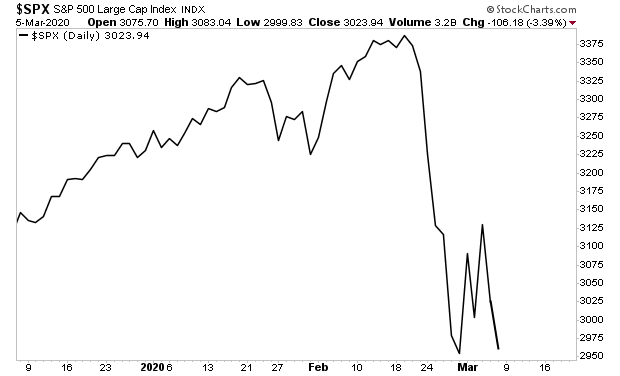

Stocks are going to revisit the lows.

This is completely normal behavior for markets: a consolidation period after a major downdraft. We could even take out the lows and still be bottoming. But that remains to be seen.

The real issue is NOT the coronavirus itself, but how much the PANIC around coronavirus will impact the economy. The media has incited a full-blown panic to the point that there are toilet paper and sanitizer shortages in major cities like New York.

This is for a disease that has infected 100,000 people globally, killing a little over 3,000. By way of contrast, the swine flu infected 61 million and killed 12,000… in the US alone.

Again, coronavirus has infected 100,000 globally and killed 3,000 globally, swine flu infected 61 MILLION in the US and killed 12,000 in the US alone (over 500,000 globally).

And yet, there were not toilet paper shortages or people freaking out like they are today. This is a media created panic. And it could have a very real impact on the economy. And that is why stocks are freaking out.

The other reason stocks are freaking out is because this is a situation the Fed cannot fix with monetary easing. Cutting rates, expanding QE, and the like won’t do anything to stop Americans from freaking out about their health. If the US panics to the point that people stop going out and spending money, the economy will grind to a halt no matter what the Fed does.

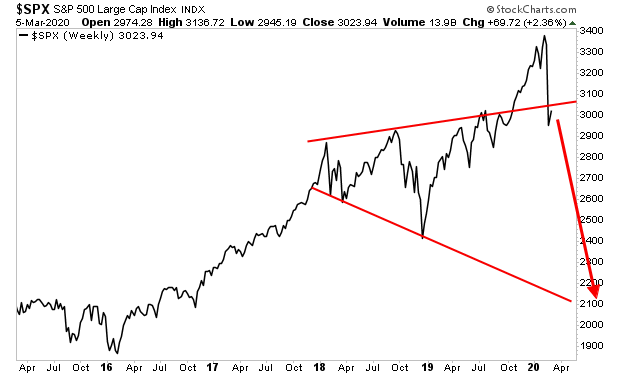

It’s early to predict this. But it is a possibility. And if it happens, we enter a recession and stocks CRASH.

This would render the upside breakout of the multi-year megaphone pattern a false breakout. That would mean stocks falling to 2,100 on the S&P 500.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments willperform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research