Stocks close lower in choppy session as higher rates snuff out rally

- The S&P 500 declined 0.1 percent to close at 2,821.98 after rising as much as 0.4 percent.

- The benchmark 10-year yield rose to trade at 2.784 percent, while the 30-year bond yield topped 3 percent for the first time since May.

- “Today we’re seeing these bonds approach levels we haven’t seen in a long time,” one trader said.

Dow posts best January since 1994 from CNBC.

U.S. equities pulled back on Thursday as investors worried about rising interest rates.

The S&P 500 declined 0.1 percent to close at 2,821.98 after rising as much as 0.4 percent. The Nasdaq composite fell 0.4 percent to 7,385.86. Earlier, the tech heavy index traded 0.4 percent higher as Facebook shares hit an all-time high. Facebook reported better-than-expected earnings and revenue on Wednesday.

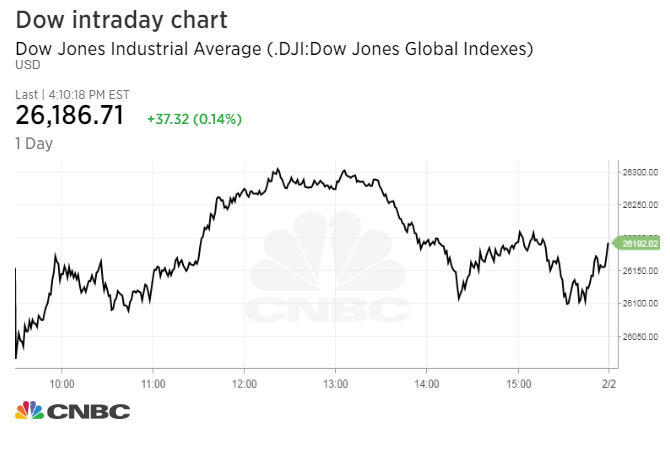

The Dow Jones industrial average closed 37.32 points higher at 26,186.71. It rose as much as 157.31 points and traded as much as 134.95 points lower.

Alphabet drops on earnings miss

-

Alphabet reported its Q4 earnings Thursday afternoon missing Wall Street earnings expectations but beating revenue estimates.

-

The company beat expectations on paid clicks and cost per click, two of Google’s most important advertising metrics.

Google parent Alphabet tanks after earnings miss from CNBC.

Alphabet stock initially dropped as much as 5 percent after it reporteddisappointing Q4 earnings, though it bounced back during the company’s earnings call to settle around 2 percent down.

Alphabet missed Wall Street expectations on the bottom line, but beat estimates on revenue:

- Earnings per share: $9.70 vs $9.98 expected by a Thomson Reuters consensus estimate

- Revenue: $32.32 billion vs $31.86 billion expected by a Thomson Reuters consensus estimate

Alphabet’s overall revenues increased 24 percent year-over-year, driven by Google’s swelling ads business, which posted $27.27 billion in revenue in Q4. Google’s other revenues, which includes its burgeoning enterprise business, hardware sales, and app store, posted $4.69 billion in revenue, bringing total Google revenue to $31.91 billion.

Apple Forecast Falls Short After iPhone Sales Miss Estimates

Apple Inc. forecast lower-than-expected revenue for the current quarter and reported iPhone sales from the crucial holiday period that missed analysts’ forecasts, suggesting waning demand for its most-important product.

The Cupertino, California-based company said revenue in the three months ending in March will be $60 billion to $62 billion. Analysts were looking for $65.9 billion on average, according to data compiled by Bloomberg.

For the final quarter of 2017, Apple said it sold 77.3 million iPhones, down 1 percent from a year earlier and below analysts’ projections of 80.2 million units. The average selling price was $796 — ahead of expectations — suggesting its flagship iPhone X handset sold relatively well, while cheaper versions weren’t as popular.

The numbers, which would be extraordinary for virtually any other company in the world, underscore the elevated expectations that investors have for Apple. They also highlight concern about lackluster demand for iPhones, sparked by recent reports of Apple cutting orders to suppliers and lower analyst estimates. Fewer new handsets means Apple has to work harder to sell related services, accessories and other devices. It also leaves less time for the company to create its next big hit, potentially in wearable technology, augmented reality or even transportation.