Every week is eventful these days. But the most recent one stands out for sheer edge-of-the-abyss when-it-rains-it pours diversity. Some of the highlights:

US stocks fell for the 5th straight week “logging the longest weekly losing streak since June 2011.”

The US yield curve inverted decisively as long-term Treasury yields plunged. Past yield curve inversions have preceded downturns and acording to economist Gary Shilling, “US recession probably started in current quarter.”

In elections for the European Union parliament, both far-right and far-left parties made big gains at the expense of mainstream ruling parties. National Front leader Marine Le Pen beat French President Emmanuel Macron, while the UK’s brand-new Brexit party crushed both the Tories and Labour. The resulting legislature will be more fractious and therefore a lot less likely to set and pursue coherent policies – heading into what might be an imminent recession. See: “Power blocs lose grip on parliament”

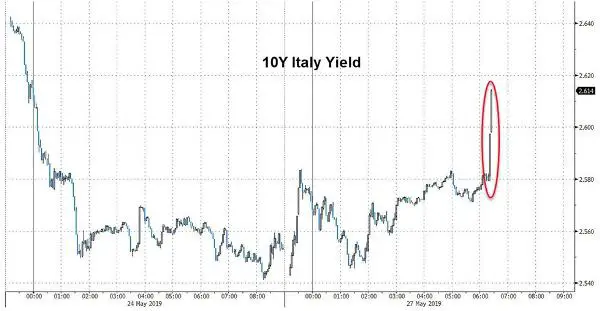

The EU threatened Italy with sanctions over the latter’s excessive deficits, causing Italian bond yields to spike.

In response, “Italian Deputy Prime Minister Matteo Salvini called for a new role for the European Central Bank, which should ‘guarantee’ government debt in order to keep bond yields low.”

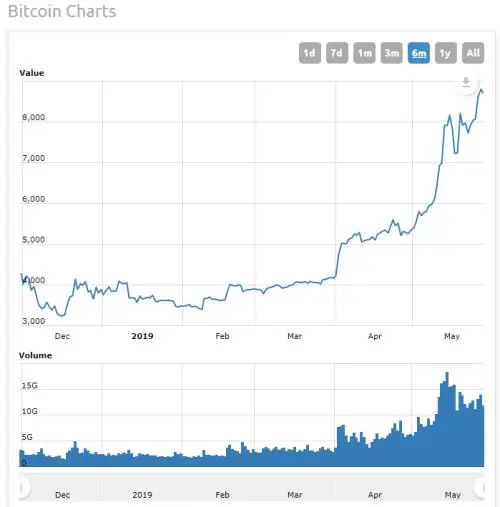

Bitcoin rebounded to almost 9000, possibly a sign that stress in the financial markets is reviving an interest in safe haven assets.

Floods decimated US agriculture. See Crop catastrophe in the Midwest – USDA indicates a nightmare scenario of plunging harvests, spiking food prices and mass farm belt bankruptcies.

Each of the above would be manageable if they were the only thing on the global financial system’s plate. Together they’re a bit more of a challenge.

But multiplying crises are to be expected as financial complexity increases. Rising leverage increases the number of things that can go wrong, so more things do go wrong.

The only question remaining is how many crises have to emerge simultaneously before the Fed, ECB, and Bank of Japan feel compelled to launch the next coordinated liquidity campaign. Another few weeks like the last one and they’re likely to conclude that they have no choice.