by UPFINA

Small businesses are in dire shape even though small cap value stocks exploded in November. There is a massive difference between a $500 million publicly traded company and a small firm with 15 employees. In a survey of 1,000 entrepreneurs from July to September done by Bank of America, 39% of small firms expected their local economy to improve in the next year which was down from 51% at the start of the year. It’s surprising how negative they were at the start of the year.

Hiring plans and sales expectations are at the lowest point since 2012 and 2013. 7 in 10 firms expect to keep staffing the same in 2021 which isn’t that great because we need these firms to rehire the workers they fired in 2020. 24% of small firms retooled operations because of the virus and 61% developed new products and services. The problem is these additional costs only clawed back sales they would normally get. It’s not like these costs grew their businesses. Think of restaurants that made outdoor additions. They needed to buy heaters, outdoor furniture, and build tents just to serve their existing customers. They probably made less sales and had more expenses.

As you can see from the chart below, 45% of small restaurants are at risk of closing for good.

Risk of economic scarring… @Alignable survey finds that 48% of #SmallBusinesses are at risk of closure by the end of 2020 (based on revenues being below what they needed to stay in business)

via @SoberLook pic.twitter.com/ANhwbeuoza

— Gregory Daco (@GregDaco) December 3, 2020

It’s 61% for gyms which makes sense because there aren’t outdoor workout areas like there are for eating. Even many of the bigger gyms have gone bust. Gold’s Gym filed for bankruptcy in May. The worst hit industry in this survey was travel and hospitality. We think there will be a boom in travel spending in the 2nd half of 2021. The problem is many small firms won’t make it that far. Overall, 48% of small firms are in trouble which is categorized as having sales below where they need to be to stay in business.

According to Homebase, about 3% fewer businesses were open in November compared to July. There was a 3 point drop in the percentage of employees working compared to October which was the first monthly decline since the recovery started. Every region saw a decline, but the worst was the Great Lakes which had a 6.6% drop. Entertainment and education were the hardest hit in the past month as they had 9.2% and 6% fewer businesses open.

Reopening Metrics

Goldman Sachs is measuring the reopening of America which has hit a standstill or even reversed in some areas recently. In the week of December 2nd, the reopening index was at a 4 out of 10 which was up from a 3 reading in the week of November 23rd. The composite score in the week of November 23rd rose 2 points to 67 which is still below the peak of 74 in August.

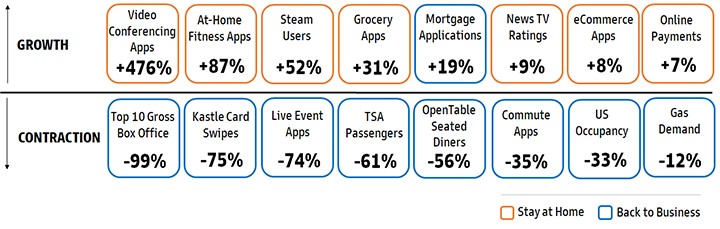

This index hasn’t done much since July. It should improve after the vaccines become widely available early next year. The graphic above shows the difference between the stay at home categories and the back to business ones. Live event apps are down 74%, while video conferencing apps are up 476%. As you can see, at home fitness is hugely popular which is in tune with all the in-person gyms going bust.

ADP Misses Again

We are in a weird scenario where the ADP readings keep missing estimates, but actual job growth keeps coming in very strongly. ADP’s data is starting to be looked at less. The main reason we review it is because it comes out two days before the BLS reading. It’s like a preview which lately hasn’t been effective at previewing anything. The November ADP reading was weaker than expected again as private sector job creation fell from 404,000 to 307,000 which missed estimates for 420,000 and the lowest estimate which was 350,000.

As you can see from the chart below, ADP payrolls are now down 7.5% from before the recession which is slightly worse than the -7.4% trough in the financial crisis recession. In other words, the past 7 months of strong job gains only got us back to the worst point of a bad recession. The good news is we should get an acceleration in job growth after the vaccines go out.

ADP reported a gain of 307k jobs in November vs. consensus estimate of 420k. October was revised higher from 365k to 404k.

Total private sector jobs are 7.5% below their February high. Max % off high in last recession ('08-09) was -7.4%.

Chart via @ycharts pic.twitter.com/kujFN4mYhP

— Charlie Bilello (@charliebilello) December 2, 2020

Small firms created 110,000 jobs which is much better than the data we presented earlier in this article suggested. Mid-sized firms added 139,000 jobs and large firms added 58,000 jobs. We talked all about how well publicly traded firms have been doing versus small firms, yet small firms created almost double the number of jobs in this survey. Goods producing firms added 31,000 jobs. The most was construction which added 22,000 jobs. This might be too low because housing is still doing really well. Services added 276,000 jobs with leisure and hospitality adding the most at 95,000. The November BLS report is expected to show 590,000 private sector jobs added (500,000 overall).

Tech Can’t Grow

Tech can do no wrong in 2020. There are many firms trading at negative or triple digit PE multiples. Investors are expecting a lot of growth, but maybe they should temper their expectations. As you can see from the chart below, only 4.4% of S&P tech firms from 1980 to 2019 were able to sustain greater than 5% earnings growth (consecutive years) for 5 years. Only 0.2% were able to do it for 10 years. Many of the hottest stocks are losing money. Investors are taking it as a given that they will become profitable just like Amazon even though Amazon is the exception not the rule.

Yup. Hard to pay 10x sales when this… pic.twitter.com/eSnxFT23By

— Loic LeMener CFA, CFP® (@CfaDallas) December 3, 2020

Conclusion

Small businesses are in deep trouble as 48% are in danger of closing. The reopening index has stalled since the summer. It should recover in February or March when the vaccines go out fully. ADP job creation missed estimates, but small businesses did surprisingly well. Tech investors are likely too optimistic if historical precedent continues. It’s very tough to grow earnings in a stable manner despite what SaaS investors will have you thinking.