Stocks are exploding higher!

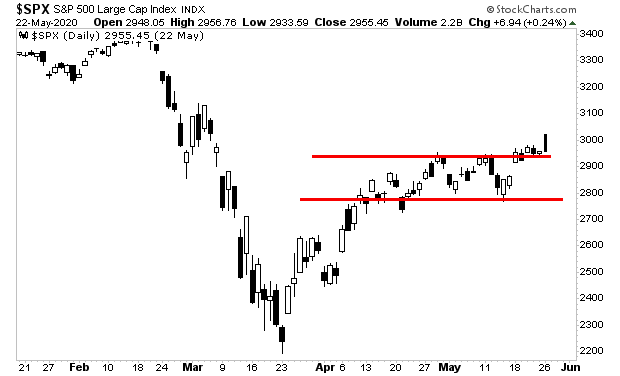

The S&P 500 broke above 3,000 over the weekend. The market looks to have definitively broken out of the channel of the last month and is now starting its next leg up.

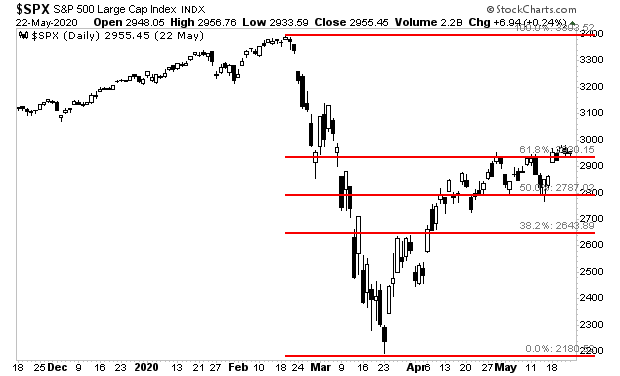

In the larger picture, stocks have now staged several closes above the 61.8% retracement level of the March meltdown. Historically, a move such as this has indicated that the rally is no longer a bear market bounce but is start of a new bull market.

And why wouldn’t they?

Central banks have pumped $4 trillion into the financial system over the course of the last two months.

To put that into perspective, it’s nearly as large as the GDP of JAPAN… and represents a greater monetary intervention than the one global central banks employed during the 2008 Financial Crisis!

This is great news for stocks, but BAD news for the world… Because money printing doesn’t create jobs or economic growth. All if does is keep the system afloat, while potentially unleashing a tsunami of inflation.

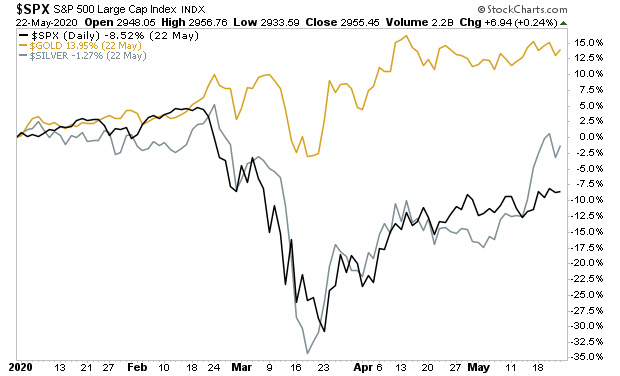

This is why silver, gold and other inflation hedges are rapidly outperforming stocks. They KNOW big inflation is coming.

Both gold and silver are UP year to date. Stocks remain down 10%… and that’s after one of their sharpest rallies in history!

If you want to make REAL money from your investments, this is where you need to be looking right now.