by John Ward

What a fine thing indeed is the Federal Reserve Open Market Committee. First up, “committee” is an understatement: the list of attendees is bigger than the average football crowd. I assume they socially-distance, so Lord knows where they meet – Yankee Stadium perhaps, or maybe the Hollywood Bowl.

There are Big Cheeses all the way down to little shrimps – Governors, Assistants, Secretaries, Deputy Secretaries, Assistant Secretaries, a secretary to the office of the Secretaries, General and Deputy Counsels, grown up Economists and Assistant Economists.

Associate Economists, Open Market accountants, Gubernatorial secretaries, Operations Directors, Regulatory Directors, Statistics directors, Stability Directors, and even Supervisory Directors to keep an eye on what all the other directors do.

Advisers, Special Advisers, Deputy Advisers, Assistant Advisers, Asset Purchase Advisers, Monetary Advisers, and almost certainly some advisory advisers who sit on the window ledges outside and occasionally get invited in to advise in a purely advisory capacity on the dangers of clinging to the levers of power some forty storeys up.

Senior monetary Economists, Lead monetary information managers, and Fed vice Presidents from Cleveland, Richmond, Kansas City, San Francisco, St. Louis, Chicago, Philadelphia,

Atlanta, Boston, New York, New York, New York, New York and New York.

That’s it. The startling ommissions are Las Vegas and Hollywood – which, given that’s where all the insane gambling games and unlikely fiction are dreamed up, does strike the layman as rather odd.

So Thursday being Thanksgiving Day in the US, the Fed met earlier this month to give thanks for all the job creation it represents, and to take the counsel of advisers, the advice of associates, an update on operations for gall sydrome among accountants, solid testimony from stability directors, an audit of doors closed to the media in open markets, lots of invoices from counsellors and of course (just as a filler) some gossip about vice among the Presidents and new thoughts on how to keep the Dow at 29,872.42, given the global economy today consists of one Jewish deli in Taiwan selling heavily discounted Pfizer vaccines.

The System Open Market Account manager discussed developments in financial markets, announcing that financial conditions were little changed and remained accommodative. There was some debate as to the meaning of accommodative in this context, but the System Open Market Account manager reassured his audience that the distraction of millions of Covid cases causing chaos in left-luggage offices across Europe was more than enough to ensure accommodation: cases causing chaos, he opined, had a strong push to the upside of Covid19 and Q1, 2021 – even greater, in fact, than that of game shows like Pets Win Prizes.

The System Open Market Account manager closed with a demand to know why his position had not been recognised in the published list of attendees, and the secretary to the advisory Human resources sub-committee on petulance promised to look into the matter.

The Federal Reserve’s balance sheet increased modestly over the intermeeting period to $7.2 trillion, although the total amount did involve the use of twelve noughts and suggest a need for unfeasibly wide chequebooks.

Several participants noted the possibility that there may be limits to the amount of additional accommodation that could be provided through increases in the Federal Reserve’s asset holdings in light of the low level of longer-term yields, and they expressed concerns that a significant expansion in asset holdings could have unintended consequences. A long debate then ensued about what the intended consequences might have been in the first place, and these were duly struck from the record at the insistence of special advisers Soros, Gates and Zuckerberg.

Following a debate about the effective lower bound (ELB) and whatTF it might be, further pointless speculation ensued on bond-buying, with the member from Kansas City yelling, “We’re doomed I tell you – all doomed”. But his outburst was interrupted by the maniacal cackle of billiard-ball German Davos observer Herr Schwab, who stroked his long-haired white Persian cat, and observed, “Goodbye, US Bonds”.

So Happy Holidays US friends, enjoy the Thanksgiving weekend in the bosom of your families, and remember to give thanks that the Dollar is in the safe hands of a huge flock of Turkeys.

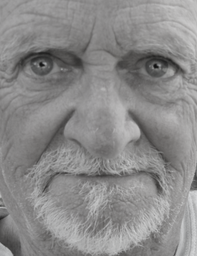

John Ward long ago gave up trying to take fiscal economics and corporate euphemisms seriously. He lives in the French low-profile rural space where the downside is banal conversation but the vast majority of feet are still attached to the ground.