Airbnb was one of the most highly anticipated IPOs of 2020.

After a trading surge, the company’s market cap topped the $100 billion mark. Now that the dust has settled, here are some key numbers behind the company’s unique business model.

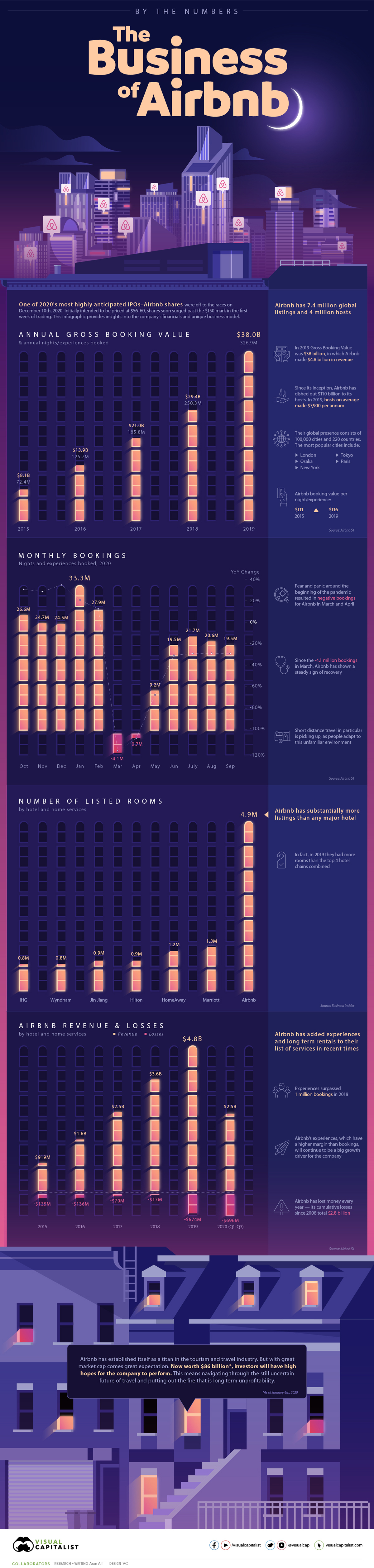

The Last 5 Years

Since 2015, Airbnb has had an epic run.

With a market cap of close to $90 billion, they are one of the largest businesses in the travel and tourism space. However, there is still plenty of room to grow: Airbnb identifies their total addressable market (TAM) to be worth $3.4 trillion.

| Metric | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Gross Booking Value ($ Billions) | $8.1B | $13.9B | $21.0B | $29.4B | $38.0B |

| Annual Nights & Experiences Booked (In Millions) | 72.4M | 125.7M | 185.8M | 250.3M | 326.9M |

| Revenues ($ Billions) | $919M | $1.6B | $2.5B | $3.6B | $4.8B |

Nights and experiences booked by customers have shot up 4.5x, from 72 million in 2015 to 326 million in 2019. At the same time, the gross dollar value of these bookings has surged from $8.1 billion to $38 billion.

No Shortage Of Space

Airbnb’s ability to scale its services is reflected by its room count, which is unmatched when compared to the hotel industry.

In 2019, Airbnb had nearly 5 million rooms available, a mammoth of a figure considering the next largest was Marriott at 1.3 million. The company is a giant thorn in the hotel industry’s side, and their room count is approximately the size of the five largest hotel chains combined.

A Shortage Of Profits

Despite a global presence and attractive numbers, the business of Airbnb is yet to be profitable.

Airbnb has lost money every year—and the company’s cumulative losses total $2.8 billion since 2008. Not surprisingly, those losses have been exacerbated during the pandemic, a common theme for all travel and tourism stocks. Airbnb had -4 million bookings in March, and these negative bookings helped lead to a -32% decline on their top line compared to 2019.

| Metric | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 (Q1′-Q3′) |

|---|---|---|---|---|---|---|

| Revenue | $919M | $1.6B | $2.5B | $3.6B | $4.8B | $2.5B |

| Net Income | -$135M | -$136M | -$70M | $-17M | -$674M | -$696M |

Airbnb’s net income losses so far in fiscal 2020 (Q1-Q3) are -$696 million, the largest of any year.

Silver Linings

Airbnb has demonstrated an ability to adapt during this time of uncertainty through the introduction of digital experiences. They also made the tough decision to cut 25% of their staff this year.

Monthly bookings and experiences have shown signs of recovery. Since the negative bookings earlier in March, figures have crept back up to the 20 million range, near pre-pandemic levels.

A resilient segment for the business of Airbnb is short-distance travel within 50 miles of guest origin. As the pandemic expanded, people are taking vacations from their abodes by visiting less densely populated neighboring communities.

Another Hot IPO

The Airbnb IPO was one of many headline makers of 2020. When it comes to initial public offerings, markets as of late have shown no shortage of exuberance. Company shares have had the tendency to surge once hitting the secondary market, reflecting investor appetite. The Airbnb IPO experienced just this: initially intending to be priced at $56-$60 a share, in just a few weeks they traded as high as $160 per share.

The Renaissance IPO Index, a returns tracker for U.S. public offerings, reports that IPOs are up roughly 108% in the last calendar year, experiencing one of the best years on record.

But the aftermath of an IPO can just as likely go sour. Public companies are subject to more strenuous regulation relative to the private markets. And with a near $90 billion valuation, future expectations are high for Airbnb. The company will have to woo shareholders in the coming quarters to keep momentum, which likely means showing strides in an uncertain travel and tourism landscape.