via wallstreetonparade:

On Friday, March 4, 2022, the Dow Jones Industrial Average closed at 33,614.7971. Yesterday, one year later, the Dow closed at 33,431.44, a negligible loss of a fraction of one percent – but still a loss. The Dow is composed of just 30 stocks.

The S&P 500, a broader stock market index, includes the common stocks of 500 of the largest companies in the U.S. Over the past year, the S&P 500 fared even worse than the Dow. It went from 4,328.8729 on Friday, March 4, 2022 to yesterday’s closing price of 4,048.42 – a decline of 6 percent.

The tech heavy Nasdaq Composite, which consisted of 3,607 component companies as of yesterday according to Nasdaq, delivered the worst performance of the three major indices over the past year. It traveled from 13,313.438 on Friday, March 4, 2022 to a closing price of 11,675.737 yesterday – a decline of 12.3 percent.

While the average American’s investment money was shrinking over the past 12 months, inflation was eating away at the purchasing power of their disposable income.

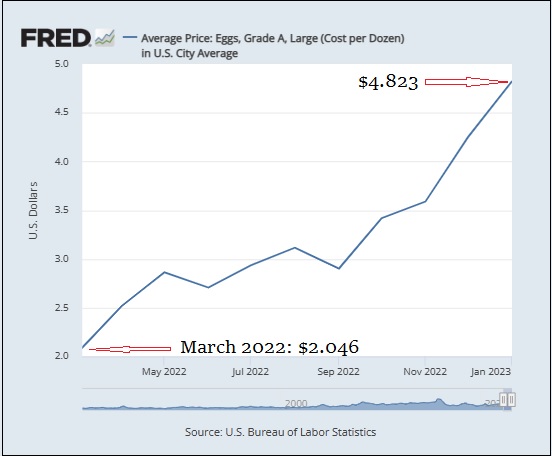

Among the most extreme examples of the toll of inflation on food costs was the price of eggs. As the chart below from the St. Louis Fed indicates, the average price of a box of Grade A, large eggs went from $2.046 in March of 2022 to $4.823 in January of this year.

The cold, hard facts on what the U.S. consumer’s money has been doing over the past 12 months raises puzzling questions about why consumer sentiment is holding up so well.

In June of last year, consumer sentiment, as measured by the University of Michigan Survey, slumped to the lowest recorded level since the University began collecting the data in November 1952. But as the chart below indicates, since that time consumer sentiment has made a puzzling climb back.