via Zerohedge:

The bear case for U.S. stocks is getting more compelling by the day, according to Bloomberg macro strategist Mark Cudmore.

Via Bloomberg,

There’s been a remarkable deterioration in the macro environment since my column last week, yet U.S. equities have gained in value. This divergence is unsustainable but it’s a reminder that bear markets take many months to play out.

Amid an intensifying tit-for-tat on trade, it should be increasingly clear to even the most optimistic of analysts that any deal between the U.S. and China will be very difficult to achieve and is by no means imminent.

Economists are starting to reduce their growth projections but there’s a great amount of global economic damage still to be factored in. Equity strategists mostly remain in denial but, at some point, they will speak to their eco colleagues and slash earnings forecasts, making overvalued U.S. stocks appear even more expensive.

Never mind the U.S. seems determined to also pick a fight with its second-largest trading partner (after China) with the threat of imminent tariffs on Mexico. They will be exceptionally damaging to U.S. companies if implemented, but harm has already been done either way, just by floating the idea after a trade agreement was negotiated and agreed. Policy uncertainty will linger, prompting business owners to hold back capital expenditure and encourage supply chains to bypass the U.S..

And then there’s the marginal negative of removing tariff exemptions on India, the world’s fifth-largest economy.

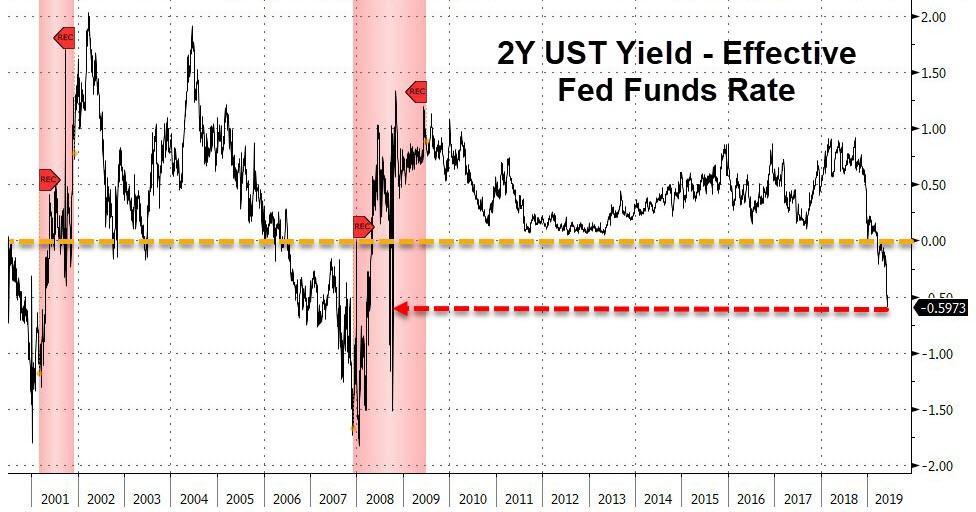

One of the reasons stock prices are higher is the rates market is now pricing even more exceptional easing, with 2-year yields trading more than 60 basis points below the policy rate. That’s the largest discount since March 2008 and will make it even harder for the Fed to dovishly surprise the market should risk aversion intensify later in the year.

Amid the slew of negative news stories, the ongoing data disappointment has almost been overlooked. JPMorgan’s Global Manufacturing PMI just declined for the 13th consecutive month, finally dropping into contraction territory. Citibank’s global economic surprise index has been in negative territory for 14 months, a streak previously unseen in the index’s 16-year history.

The credit market continues to deteriorate, which should further weigh on equity prices. Bank of America CEO, Brian Moynihan, is just the latest prominent name to warn of the potential for “carnage” from sectors of the corporate debt and leveraged-loan markets.

All this, and yet the S&P 500 has fallen less than 5% since I first turned bearish on April 30, via this column. And back then, an imminent U.S.-China trade deal was still the base case!

That size and scope is to make the point how much downside is still ahead of us — not that it will occur immediately nor in a straight line. Bear markets are always difficult to trade and bear market rallies can be savage.