Yesterday we looked at the way that the Governor of the Bank of England Andrew Bailey has managed to mishandle communications there. He has got himself into something of a spider’s web. Today we switch to a body the ECB that was already in a spider’s web and we see at least one policymaker heading in the opposite direction to Governor Bailey.

ECB’S VILLEROY: NO REASON TO RAISE RATES NEXT YEAR ( @ACEMarketU )

That is from the Governor of the Bank of France who has been on the wires. A somewhat curious statement although again he has got himself into that position with this.

Growth: “The latest figures confirm a strong recovery in the French economy,” assures the Governor of the Banque de France ( @FranceInfo )

Indeed he went further with France Info.

We had previously published growth forecasts of 6.3% for this year and 3.7% for next year. We confirm these forecasts”, announces François Villeroy de Galhau, who insists on the independence of the Bank of France in relation to the government.

Interesting that the independence issue is apparently a live one in France. As to the growth forecasts I they seem out of touch with reality. I will come to the wider issues on a moment but he gave reasons to doubt them about France!

There are two flashing lights that we are following closely, the supply difficulties, the rise in the prices of raw materials and energy and the recruitment difficulties”, warns François Villeroy de Galhau.

Indeed energy price issues will only be temporary.

Rise in energy prices: “Historically, it is often associated with recovery phases and these are always temporary tensions”, reassures François Villeroy de Galhau.

Always? If we stay with the inflation issue he is repeating a theme he established a week ago at a conference in New York. The emphasis is mine.

Inflation has also rebounded quite strongly, with headline inflation at 3.4% in September, according to the flash estimate, and inflation excluding energy and food at 1.9%. This rebound fuels a lively public debate, but we should be vigilant without being feverish: clearly, there is no such thing as stagflation. This rebound results mainly from several temporary factors, as already stressed by my ECB colleagues Philip Lanei and Isabel Schnabelii.

There is a bit of a word salad going on here. Let us start with “vigilant” which apparently means buying an eye-watering amount of government and other bonds as well as negative interest-rates. Only a few sentences later he assures us this is the plan.

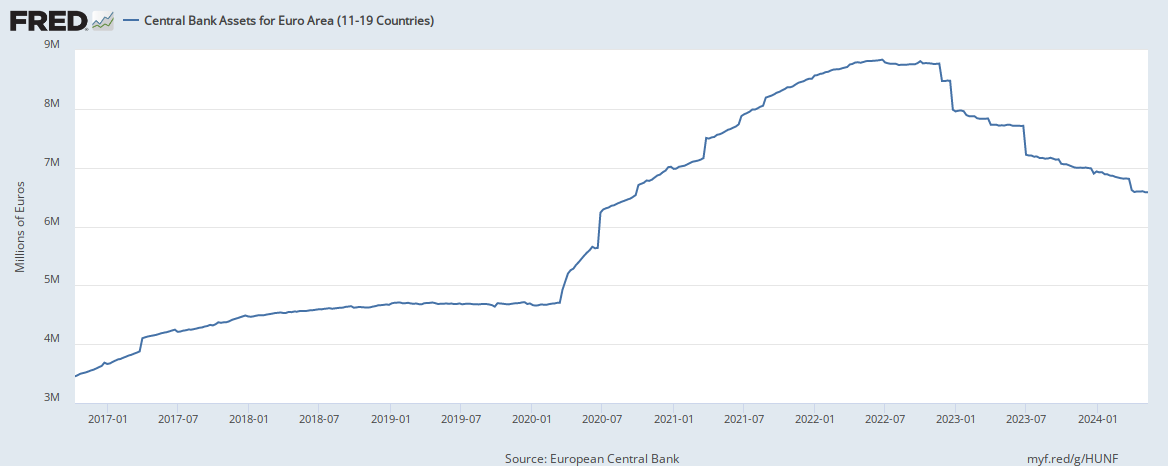

It is important, therefore, to stress that exiting from PEPP would not signal the end of our very accommodative monetary policy. Monetary policy will continue to provide accommodation through our quartet of tools, namely asset purchases and stocks, long-term liquidity provision, negative interest rates, and forward guidance.

So vigilant in fact means pumping it up as much as you can.

(Pump it up) When you don’t really need it

(Pump it up) Until you can feel it ( Elvis Costello)

It is hard to know what he means by feverish as he is in fact perverting the use of the word vigilant. Also his use of inflation is classic central bank speak where he cherry picks the numbers ignoring the fact that the ordinary French and Euro area worker and consumer cannot.

Part of the rebound just offsets exceptionally low prices during the Covid crisis in 2020. Compared to September 2019, consumption prices have only increased by 1.5% on an annual basis, and prices excluding energy and food by 1.0%.

I bet they wish they could exclude food and energy prices! A cold and hungry winter hardly fits with the stellar economic growth figures promised earlier. But wait there is more.

A second cause can be attributed to the strong rebound of energy prices, in particular oil and natural gas, the latter having also a direct impact on wholesale electricity prices. It is of course very hard to forecast prices, but futures markets for natural gas are currently pricing a sharp decrease in the second quarter of 2022, once the current high demand related to stock replenishment and the winter season is over.

So once people’s need for energy is lower in the better weather it may be cheaper! I wonder if he really thinks he can get away with this. For a start it shows he does not understand futures markets where everyone is likely to be trading front months now and may move to the later months as time passes. The truth is he will clutch at any straw in an attempt to deny reality, which is that prices are rising and it is hurting people.

Actually he even confesses this is making people worse off.

At the same time, we see few signs of general wage increases, in line with subdued services inflation.

Then confesses to one of the economic problems of the Euro area which is its lack of flexibility.

Moderate wage increases in the euro area, in some sectors of the economy, would certainly be warranted to make jobs more attractive and reduce labour shortages. But there are few signs of a wage-price spiral at the current juncture.

The media never puts it like this but he is actually saying expansionary policy is making workers worse off.

The background

Only yesterday there was this.

BEIJING — China’s third-quarter GDP grew a disappointing 4.9% as industrial activity rose less than expected in September. ( CNBC )

There were several downgrades for economic growth in Germany last week but let us go back just over a week.

Assessment of the economic situation in Germany has worsened in the current survey.”

“Compared to the previous month, the outlook for the economic development in the next six months has noticeably deteriorated.” ( ZEW)

This is being driven by.

Further decline of the ZEW indicator of economic sentiment is mainly due to the persisting supply bottlenecks for raw materials and intermediate products.”

I am highlighting this because it must also be true in France whilst its central bank Governor seems to be doing a type of Comical Ali impersonation.

This sort of view mimics that from ECB President Christine Lagarde on Sunday.

ECB’S PRESIDENT LAGARDE: WE’RE SEEING GROWTH CONTINUE AT A MUCH FASTER RATE. ( @FinancialJuice)

Our valiant climate change warrior ( see below) was straight on the first plane to Washington to give the lecture and bask in the praise.

As the world heats up and climatic conditions become more extreme, we will face increasingly frequent ecological shocks.

Comment

This is an example of denying reality on two fronts which is rather awkward when you only have two. Inflation has risen above target and looks set to go higher. It is true that the main drivers are outside their control in this phase. For example energy prices have dipped due to better expectations for wind power this week. But I also note it is expected to get colder by the weekend. So with one hand it gives and with the other it may take away. But they have set policy to get inflation higher into this so they are guilty of making things more vulnerable. The various denials just confirm their guilt. Although the issue is wider as the Euro establishment have managed to get themselves under Russian Premier Putin;s thumb.

*RUSSIA SIGNALS NO EXTRA GAS FOR EUROPE WITHOUT NORD STREAM ( @DeltaOne )

Next comes the issue of growth which is plainly fading at the same time. In something of a crisis for theoretical models weak growth and inflation can come together and as well as a Beatles song it returns us to Britney.

With a taste of your lips, I’m on a ride

You’re toxic, I’m slippin’ under

With a taste of a poison paradise

I’m addicted to you

Don’t you know that you’re toxic?

And I love what you do

Don’t you know that you’re toxic?

What will they do? Well the mood music is about QE where a programme is set to expire next March. They are using the word “flexibility” which means that the other one will be put on steroids. Frankly if the economy continues to weaken it may be the PEPP in disguise.