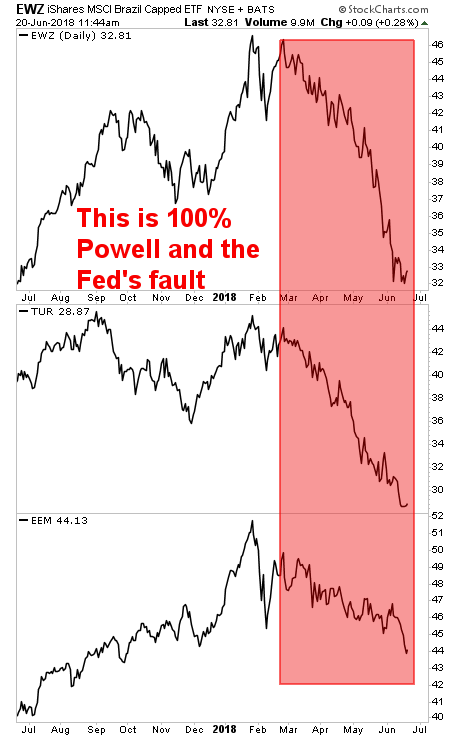

The financial media are euphoric that stocks are up today. However, they’re all ignoring the fact that the issue that triggered the recent sell-off (the Fed’s colossal policy error regarding the $USD) has not been resolved.

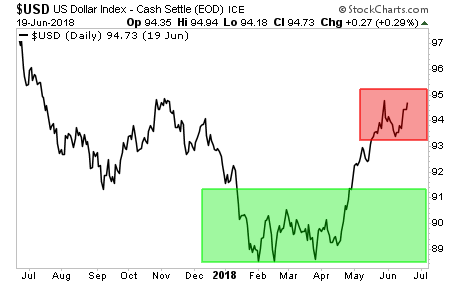

Put another way, until the $USD rolls over, stocks are in serious danger. We need to get out of that red rectangle area ASAP and back down to the green rectangle.

By the look of things, the Fed still hasn’t figured this out.

At a time when the ECB is still engaged in QE and the BoJ is printing yen by the tens of billions, the Powell Fed has decided it’d be a great idea to hike rates over 7 times over 24 months while withdrawing $600 billion in liquidity per year.

Understand, I’m not saying that rate hikes and QT are BAD. I’m saying that the PACE at which the Powell Fed is engaging in these policies is ridiculous. The market knows this which is why the yield curve is inverted and Emerging Market Stocks and Emerging market Currencies are imploding.

If the Fed doesn’t figure this out soon, we could very well see the carnage of the Emerging Markets space spread into the S&P 500. I remain VERY bullish in the intermediate term, but the Fed could make things NASTY in the short-term if it doesn’t fix this.

Ignore the bounce today. The markets are being propped up by pumping the five big Tech plays (AAPL, NFLX, MSFT, AMZN, FB). Underneath this facade, the US stocks are in SERIOUS trouble.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.