It almost comes second nature to us to pay via online methods these days. It’s part and parcel of how we make transactions these days and more and more people are starting to use it.

Of course, it’s a long way from the very beginnings of transactions, when the trade of goods and services would suffice. From there it moved to coins and currency and today there are dozens of variations of e-payments and it’s certainly making transactions easier than ever before, whether you’re ordering your groceries or playing games online.

It’s been an incredible evolution of online payments and below you’ll find some key moments in the evolution of online payments…

The Opening of the World Wide Web

Of course, it all started with the very beginnings of the world wide web. Without that we wouldn’t have the millions of sites, online stores and online games sites to spend money on.

The history dates back to 1969, but it was in fact Tim Berners-Lee who really got the world wide web started by inventing the ability to create pages and sites.

Berners-Lee made it easier than ever to publish content online, to the point today where anyone can create a site in almost just a few clicks.

The Beginning of e-Payments

By the 1990s, e-Payments were beginning to lift off, with the likes of Millicent, ECash and CyberCoin being the early leaders in payment technology.

The early years saw micro payment systems which were designed to work as electronic cash or tokens. The launch of Amazon was also a big player in the evolution of online payments, as well as it opening up opportunities for all manner of other industries to start operating online.

Pizza Hut started accepting orders online from 1994, while we also started to see the likes of online casinos and online bingo sites emerge, completely transforming the gaming industry.

The evolution of those has continued to the point where not only do millions of players worldwide enjoy playing the games, they are also often leaders of new advancements in payment methods, such as bitcoin and eWallets.

The Rise of eWallets

The rise of eWallets have been integral to the evolution of online payments and it’s now one of the most popular methods of payment across the world. The rise is significant and when it comes to online payments, it’s a method almost taking on credit cards.

In India over 50% of transactions are now made by eWallets, and across multiple industries it’s certainly one of the most popular.

Again, the bingo industry is one that many players use eWallets such as PayPal and Neteller, thanks to it’s quickness of deposit and withdrawal.

Playing on PayPal bingo sites will offer much quicker deposits than other online payment methods and the ability to make instant transactions has made it a real hit. Additionally, the simplicity of PayPal has opened online payment to a brand new audience. Where once it was only tech savvy younger adults who were confident enough to complete online transactions, the likes of PayPal have welcomed an older audience, which lends itself well to the demographic of bingo players.

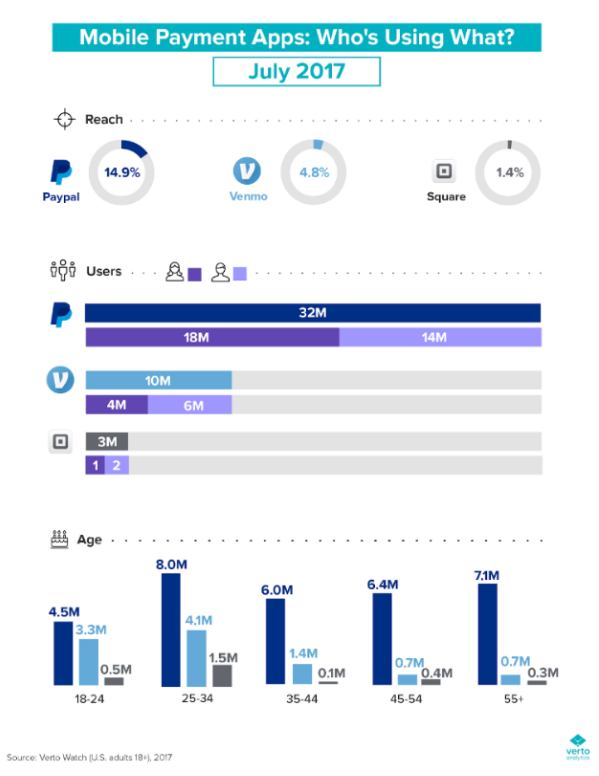

As you can see from this study by Verto Analytics, the vast majority of those aged 55+ use PayPal, which is why more and more businesses and entertainment sites are now accepting it as a method of payment.

The Rise of Mobile

Mobile payments has changed the game even further both online and when paying at real-life stores. The likes of Apple Pay and Google Pay have proven extremely popular and they are the new method of payment to grow into the norm.