The Fed lied to us.

If you’ll recall, on March 23rd 2020, the Federal Reserve stated that it would begin buying both U.S. Treasuries and corporate bonds with unlimited funds.

The announcement was historic in nature: never before in its 107-year history had the Fed bought corporate bonds before. IN fact, it was technically illegal for the Fed to do this as the Federal Reserve Act of 1933 expressly forbid the Fed from buying corporate bonds and other risk-assets.

The Fed got around that legislation by setting up a credit facility with the Treasury called the Corporate Credit Facility of CCF (there are actually two of these now, one for buying investment grade corporate bonds and the other for buying corporate junk bonds).

In its simplest form, the Fed would print new money and then funnel this money into the credit facility. The Treasury, not the Fed, would then take the money and use it to buy corporate bonds and corporate bond ETFs on the open market.

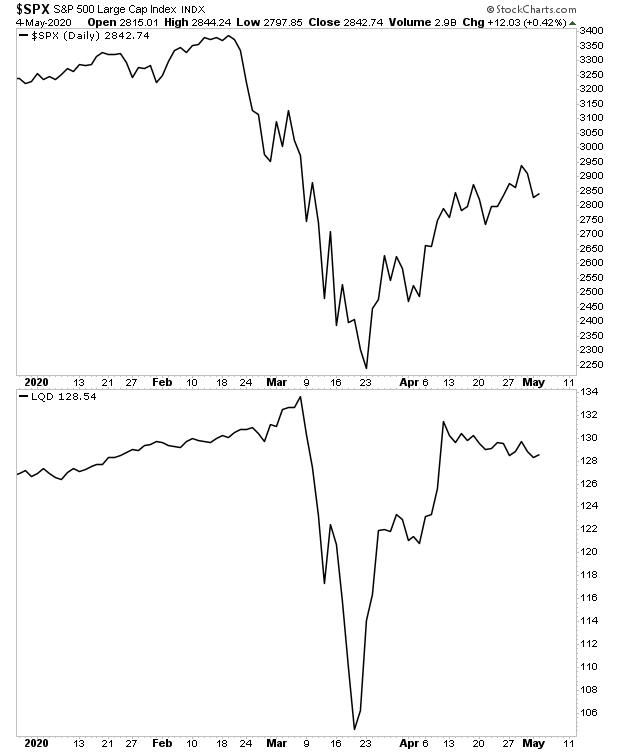

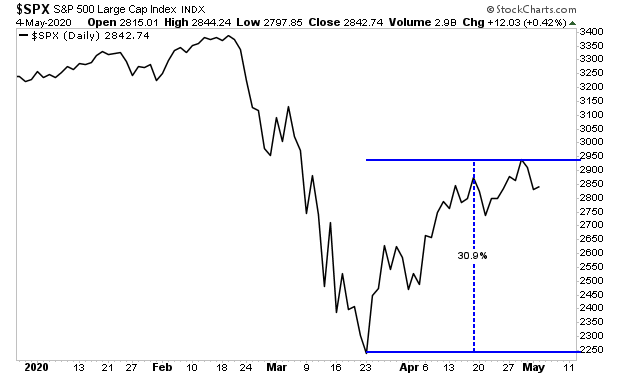

This was a HUGE development for the markets. And it is not coincidence that both stocks and corporate bonds bottomed the day the Fed made the announcement.

Except the whole thing was a lie.

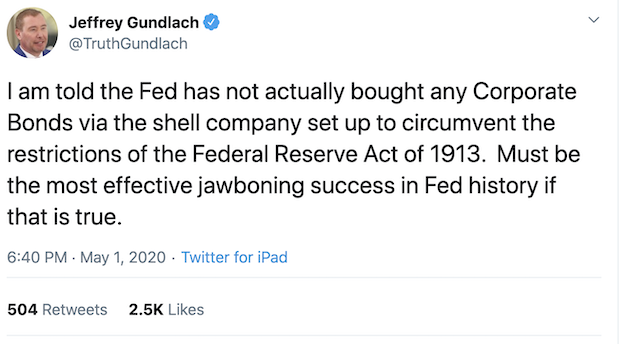

Jeffrey Gundlach is a self-made billionaire bond fund manager. As such he is one of the largest buyers of bonds in the markets. And last week on Friday, May 1st 2020, he tweeted the following:

The Fed responded to this accusation yesterday, Monday May 4th, posting on its website that it would begin buying corporate bonds in “early May.”

When will the CCFs be operational?

The SMCCF is expected to begin purchasing eligible ETFs in early May. The PMCCF is expected to become operational and the SMCCF is expected to begin purchasing eligible corporate bonds soon thereafter. Additional details on timing will be made available as those dates approach.

Source: The New York Fed

Remember, the Fed promised to buy corporate bonds back on MARCH 23rd… and it was announcement stopped the stock market meltdown… and it is now May 5th (six weeks later) and the Fed hasn’t bought a single corporate bond.

Stocks literally rallied 30% on a lie.

This begs the question…what else is the Fed lying about?

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

Today is the last day this report will be available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research