QUESTION: The Fed says it will raise rates two or three times more this year. My question is this: If the stock market is crashing, why are they still raising rates?

HW

ANSWER: The Fed is raising rates because they must be NORMALIZED given the pension crisis. They are trying to get then back up and if they could, they would jack them up to 8%. If you can imagine, a pension fund under normal conditions needs 8% annual. Even CalPERS came in at 7% and they were insolvent. Rates are rising because of the pension crisis, not because the economy is really heating up or the stock market is booming. The technical resistance stands at the Downtrend Line at the 3% level. Rates will double to reach that area faster than people suspect.

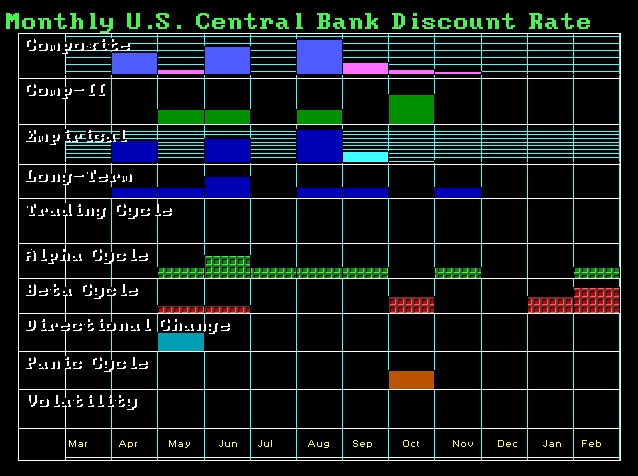

We have a Directional Change due in May and look at the August/September period where we also have a Panic Cycle. Things are not going to be as smooth-sailing as many believe. We have a very RARE Double Monthly Bullish Reversal at 2.25%. A monthly closing above that level and 5% will be seen in a matter of months.