Submitted by Elliott Middleton

Before 2009, the Fed did not pay interest on banks’ excess reserves held at the Fed. This practice was introduced as a taxpayer-funded subsidy to the banks during the crisis (taxpayer-funded because the Fed turns over any profit at the end of the year to the Treasury).

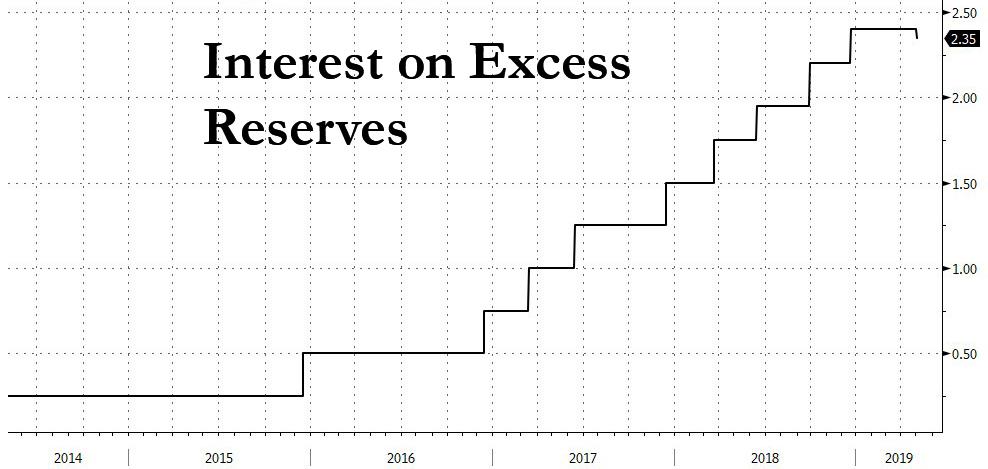

After beginning this practice, the Fed’s chief trader, Simon Potter, realized it could be used to raise interest rates without expelling excess reserves from the Fed, by sucking liquidity out of the short-term markets. In fall 2015, it began raising the interest rate on excess reserves, with the anticipated effect.

At a current rate of about $36 billion a year, this is a cost to the Treasury that is indefensible. This amount is about half the budget for food stamps, for example, which politicians want to cut. There is no provision for these funds ever to be paid back. It is welfare for the bankers.

If the banks had been required to take excess reserves back onto their books it would have required financial disclosure of their quality, which is probably toxic for many. However, with the Financial Accounting Standards Board recently promulgating Financial Accounting Statements 56 and, previously, 157, the “extend and pretend” statement, it would seem they feel less and less need for financial disclosure of any kind. FAS 56 states that the government does not have to disclose what it spends taxpayers’ money on because of national security concerns.

Finally, much akin to the situation in Europe, where trillions of dollars are held at negative interest rates (which are supposed to make people “spend,” but which in fact are an abomination and a crime against nature, IMHO), the Fed’s recent interest rate increases represent a far-from-equilibrium situation, that, much like a currency peg, may be subject to abrupt reversal.

Until a modicum of transparency is returned to financial accounting, both monetary and fiscal policy are flying blind. The world staggers under its load of bad (i.e., unpayable) debt being carried on banks’ books.

I provide a wonky exploration of these comments in “A Partial Equilibrium Analysis of Current US Monetary Policy with a Prediction“