Anyone who bases their investment decisions on economic data last year have lost fortunes.

I am speaking from experience here… I was almost one of them!

Throughout the first half of 2019, the data pointed to a recession hitting the U.S.. Time and again, the gurus appeared telling us, “a recession is just around the corner.”

Fast forward to today and no recession appeared. In fact the economy is booming. And the stock market has hit new high after new highs. Anyone who invested as though a recession was coming is now broke.

How did this happen?

The reason for this is not that these people are not intelligent or capable… it’s that the economic data in the U.S. no longer resembles reality.

If the data is garbage, your forecast will be garbage, no matter who clever you are, or how sophisticated your model.

Consider that most of these “hard data” economic pieces are based on surveys.

Who on earth wants to take time from their already busy day to answer a survey?

Once the survey is completed, it’s then analyzed/ manipulated by economists. We have already covered how little their work reflects reality.

Also, it’s worth mentioning that these people have political biases like everyone else. And those biases have become all too clear when comparing the outcomes under the Trump administration vs. those published under the Obama administration.

And then finally, there are “adjustments” made to the actual results. News flash… if your results require adjustments, they don’t actually reflect reality.

So to recap… the “hard data” is:

1) Based on filling out a survey.

2) Manipulated by economists.

3) Adjusted even after the manipulation is complete.

And people are supposed to invest their hard-earned cash based on this?

You’re much better off looking at the markets. That’s what saved me and my subscribers from falling for the “recession hype” in mid-2019.

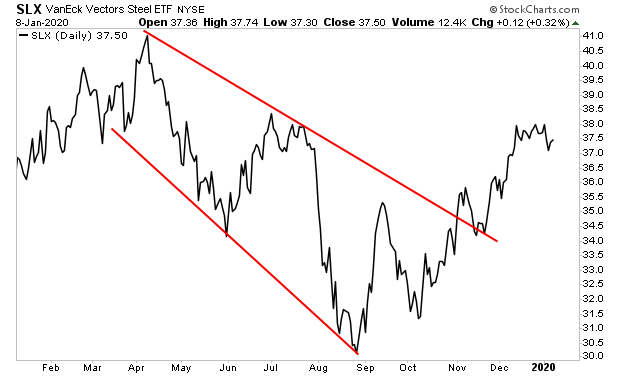

Take a look at Steel.

Steel is highly sensitive to the economy. And steel bottomed in late August and began shooting higher soon after. By October it was in an uptrend. And in November, it broke out of a 12+ month downtrend.

Put simply, steel broadcast as early as September that an economic rebound was underway. And by October it was clear it would be significant.

I used Steel’s chart along with other developments in the markets to warn my clients that the market was about to rip higher as the economy didn’t enter a recession. We’ve since loaded up on numerous double digit winners.

I hope you are doing the same. If you’re not, NOW is the time to do so!

Indeed, I’ve discovered a unique play on stocks… a single investment… that has already returned 1,300%. And we believe it’s poised to more than TRIPLE in the next 24 months as the stock market roars higher.

To find out what it is… pick up a copy of our report…The Last Bull Market of Our Lifetimes

Today is the last day this report is available to the public

Graham Summers

Chief Market Strategist

Phoenix Capital Research