The mother of all collapses is coming.

The Fed claims it can tackle inflation without triggering a crisis.

Good luck with that!

The Fed triggered a crisis with the Tech Bubble (a bubble in a single stock market sector) and the Housing Bubble (a bubble in a single asset class). And neither of those are remotely comparable to this last bubble.

This is the Everything Bubble: the bubble in every major asset class (stocks, housing, corporate debt, municipal debt, etc.)

Some of the most egregious signs of froth/ financial excess.

- Options trading volume (a sign of speculation) was exponentially higher than it was during the Tech Bubble which everyone on the planet now knows was an insane bubble.

- Crypto currencies that were invented as jokes (Dogecoin) were being valued at tens of billions of dollars.

- Tesla (TSLA), which sold ~300,000 cars in 2020, was worth more than the value of every other auto manufacturer on the planet combined.

- People were selling Non-Fungible Tokes (NFTs) of farts, toilet paper, New York Times articles and more.

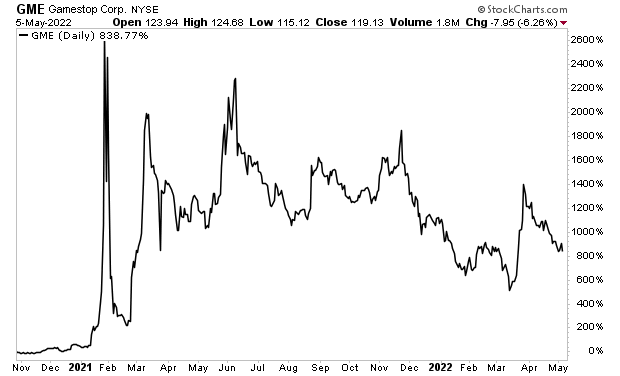

- “Meme stocks” or stocks that were traded for ironic/ humorous purposes were doing this:

- Former President Trump’s Special Purpose Acquisition Company (SPAC) rose to a value of $5 billion despite having no business or operations.

And the Fed believes it can somehow tackle inflation… AND dissipate this bubble without blowing things up?

Ok, I’ll bite.

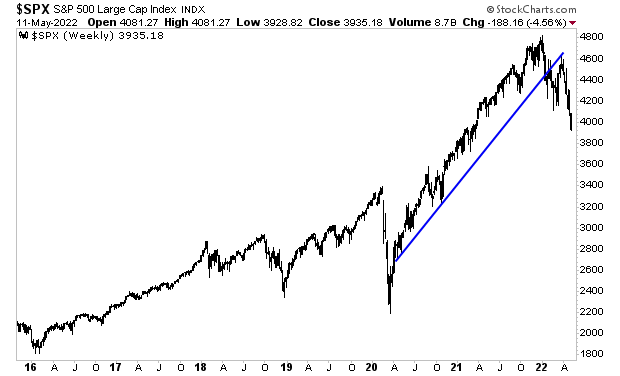

Inflation is at 8+%. The Fed has raised rates to 1%. It has yet to even begin shrinking its balance sheet. And stocks have done this:

What happens when the Fed is forced to raise rates to 5%? What happens when it tries to shrink its balance sheet buy $1 trillion+?

You get the idea.

The Mother of All Collapses is coming.