Authored by Oliver Renick via LinkedIn.com,

Disclaimer: first of all, calm down. I’m not predicting anything. In fact mostly I’m just tying threads together between a bunch of market risks that have been highlighted by many for some time. Early perhaps they were, but not necessarily wrong. As investors become such increasingly one-sided in their macro outlook, these risks become more pronounced.

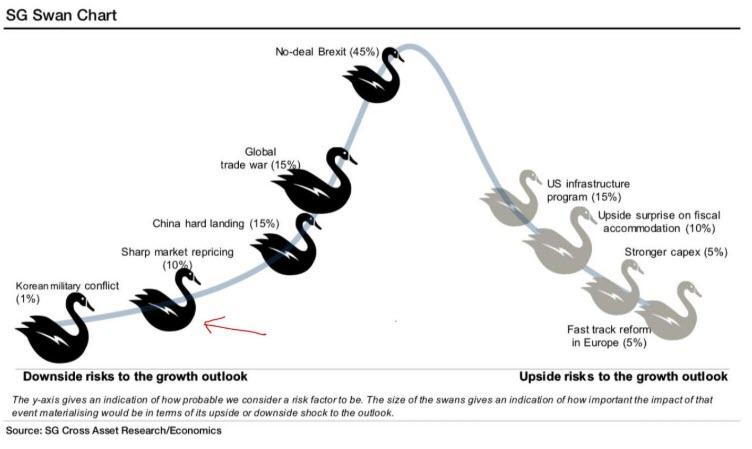

As stocks rallied last week and the U.S.-China trade itinerary got a nice-sounding update, U.S. economic data continued to beat expectations and is now surprising estimates at a positive rate. One graphic I saw on Twitter caught my eye: SocGen’s take on the biggest event risks, in which they describe the probability and potential scope of a “sharp market repricing” as being low and small.

It’s consistent with what I see elsewhere. There is a view more consensus right now than any I’ve ever seen: the world economy is slowing and the Fed and other central banks will continue cutting rates. Everyone agrees on the basics, they just have different views on how to play it. Among bulls, there is also a strong consensus view that relentless bond-buying momentum is innocuous and central banks will provide an adequate safety net for whatever risks may be associated with the forces behind this market action. Moreover, the general line of thinking I hear is that, even if there is a big bond selloff, stocks will be immune from blowback.

I disagree. A sharp market repricing should be the fattest swan on that diagram.

The greatest risk to investors, the economy, and the tenuous state of geopolitics, is the price of the S&P 500. That does not mean it is the most likely risk — what it means is that the ripple effect of a sizable selloff in stocks right now is monstrous. What’s disconcerting is that it’s remarkably easy to imagine a series of events that by nature should not necessarily pose great risk, but taken together could cause some major shocks to the S&P 500 due to current investor positioning. First, the logic for why the U.S. stock market right now is so pivotal to, well, everything:

1) The U.S. is ostensibly the most stable economy in the world right now.

2) That strength is increasingly tied to the consumer.

3) The most likely cause of imminent U.S. recession is consumer panic about an incoming recession, according to Bank of America CEO Brian Moynihan. We got a taste of this in 4Q18, when a big stock market selloff sent a chill through consumer activity during the holiday season, which led to a big dip in retail sales.

4) If consumer fear is the biggest risk to the economy, and a sharp drop in the stock market would heighten that fear, then a drop in the S&P 500 poses a massive risk to the U.S. economy, and by transition the global economy.

5) President Trump is using the relative strength of the U.S. economy to seek concessions from trading partners, so a sharp drop in the S&P 500 and thus the economy has the potential to upend the entire geopolitical paradigm.

So, of course, the question is, what could make the S&P 500 go down fast enough to precipitate the above? No, it’s not the “everything bubble,” but it is something close; think *broad* short as opposed to *big* short:

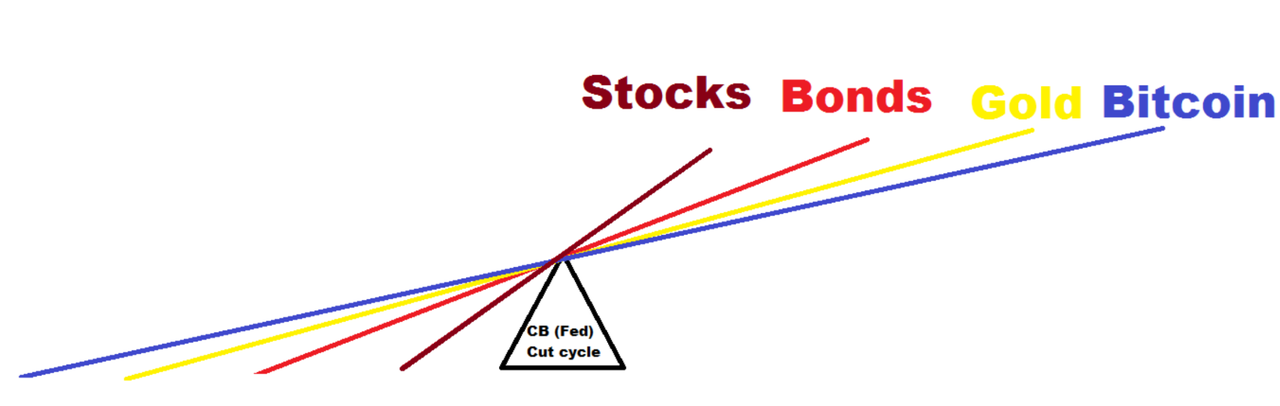

1) Almost every major asset class right now is to a varying degree pricing in the assumption that the Fed cuts three times before the end of the year, and that other central banks including the ECB are about to unleash big stimulative measures. Bonds are obviously reflecting this extremely high-consensus view, stock valuations have expanded as a Fed cut-cycle cemented in market expectations, gold bugs are ready for central banks to fire off their last bullet, and bitcoin devotees need the entire economic system to be upended, beginning with central bank futility.

I’ve described this before as the “Fed Fulcrum,” where the pivot point is the market’s assumption that it knows what the Fed and other central banks will do from here: cut, cut, keep cutting, and negative yields will continue to spread around the world. Each asset class depends on this to a varying degree, with bitcoin probably the most levered to this assumption, since bitcoin truly thrives in a Central Bank-free world. Gold at multi-year highs is expecting more and more negative-yielding assets. And stocks either need the Fed cuts to justify their valuation, or earnings to offset multiple contraction in the event of surprisingly hawkish interest-rate policy. Here’s the rough order of Central Bank sensitivity via the Fed Fulcrum:

2) So if the Fed doesn’t cut, or the economy is not as bad as thought, things get bad for some assets and very complicated for others: If the demise of central banks is in fact not imminent, bitcoin will be on life support. If negative yielding assets are near their peak, gold will struggle to maintain its momentum. If the economy doesn’t warrant emergency cuts, Jay Powell may choose to prioritize his institution’s independence over appeasing markets or politicians. And if the Fed doesn’t cut, stock valuations should come under pressure, and price action will depend on whether there is enough pickup in earnings to offset multiple contraction.

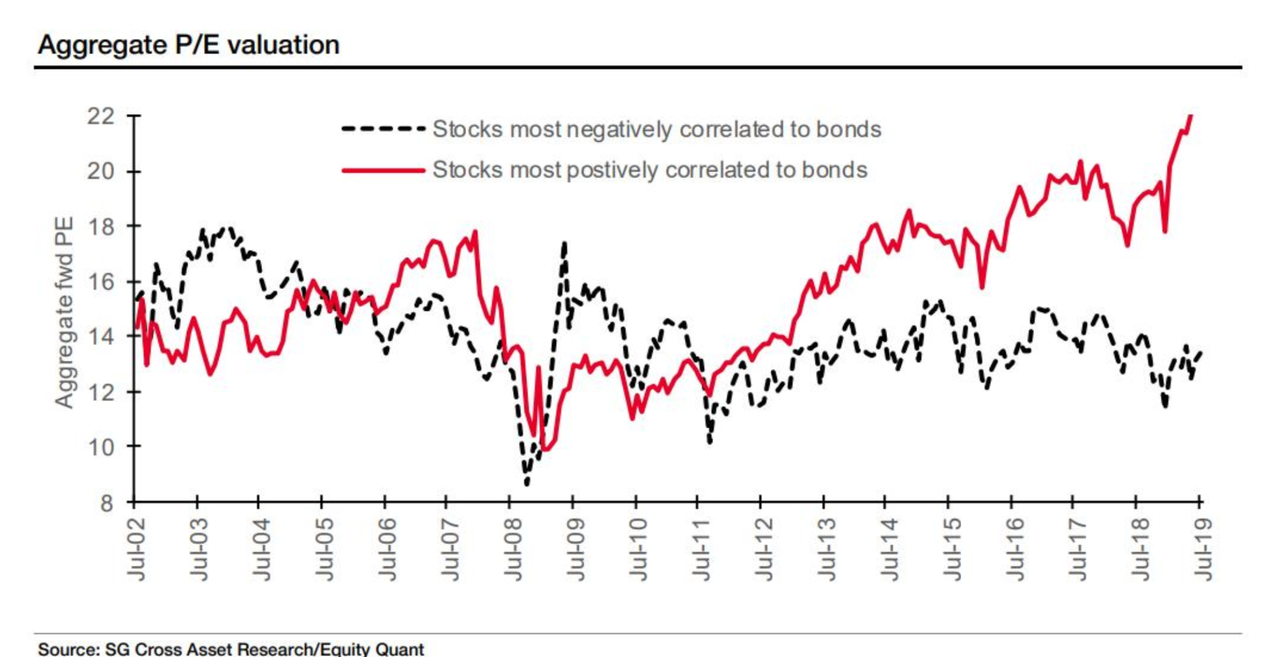

Because bond yields are so low, many believe stocks can absolutely absorb a big bond selloff (by virtue of relative yield models). That’s probably true to some extent, but it’s impossible to know how it plays out when some of the most in-demand stocks are those that trade like bonds. Withe the rally in utility and real estate companies lately, the valuation of these companies has surged in 2019:

The implication here is that a bond selloff is going to have a meaningful impact on stocks, even with yields as low as they are. Bond risk is increasingly equivalent to stock risk. And guess what, last week we just had one of the biggest bond selloffs of the decade, and all it took was a juicy trade rumor and a few solid data points from the economy. What if there’s a trade deal or inflation beat?

Yes, I’m aware it sounds crazy to say better-than-expected economic data could wreak market havoc, but it’s not just the actual events that create major market risk: it’s the positioning of investors and the degree of surprise between reality and expectations.

3) Because all these major asset classes are tied to the same event-series, investors who are predominately allocated in stocks, bonds and gold may be in major trouble if trends turn sharply enough to hit them all at once. Hedges won’t work in that scenario, making maneuvering out of these losing assets very difficult. Risk parity strategies and 60/40 portfolios will be in great jeopardy because “cash coming off the sidelines” is not a great saving grace if the sidelines are on fire too. This is probably the most important piece of this puzzle. What’s most likely is that these trades unwind in a more piecemeal, gradual fashion, and thus prevent a major collapse. But if they happen fast…

4) You guessed it: liquidity risk. The possibility that corrections in bonds, stocks, and gold happen concurrently heightens the chances of a December-type event in which the bottom falls out from the market and liquidity runs dry. In an environment where moves are being exacerbated (in both ways), by thin markets, that could mean nauseating swings. Whether or not the “ETF bubble” idea is bogus, what’s true is that this scenario of fewer interest rate cuts is most damaging to high-valuation growth companies, which are the predominance of market-cap weighted indexes. That won’t help.

Finally, if you think robust consumer activity and Beyond Meat up 500% this year mean mom-and-pop retail investors will scoop up on dips, you’re probably wrong. Retail euphoria peaked a long time ago.

If no one’s there to buy because they’ve already bought, hedges don’t work because they’re all tied to the same events, liquidity exacerbates swings and the President realizes his cow-prod is on the verge of breaking, watch out below. It’s a lot of “ifs,” and by definition is unlikely to happen. But the risk is rising the more one-sided the trade becomes.