Overvalued US tech stocks and freefalling US Dollar, and not Coronavirus causing causing violent markets

The root cause of the significant correction for the world stock market is not the Coronavirus. What caused the correction to begin on February 19, 2020 was the following:

- Stock indices in the US, Canada and Germany reaching their all-time highs. Japanese Nikkei also closed near a 30-year high. See ______.

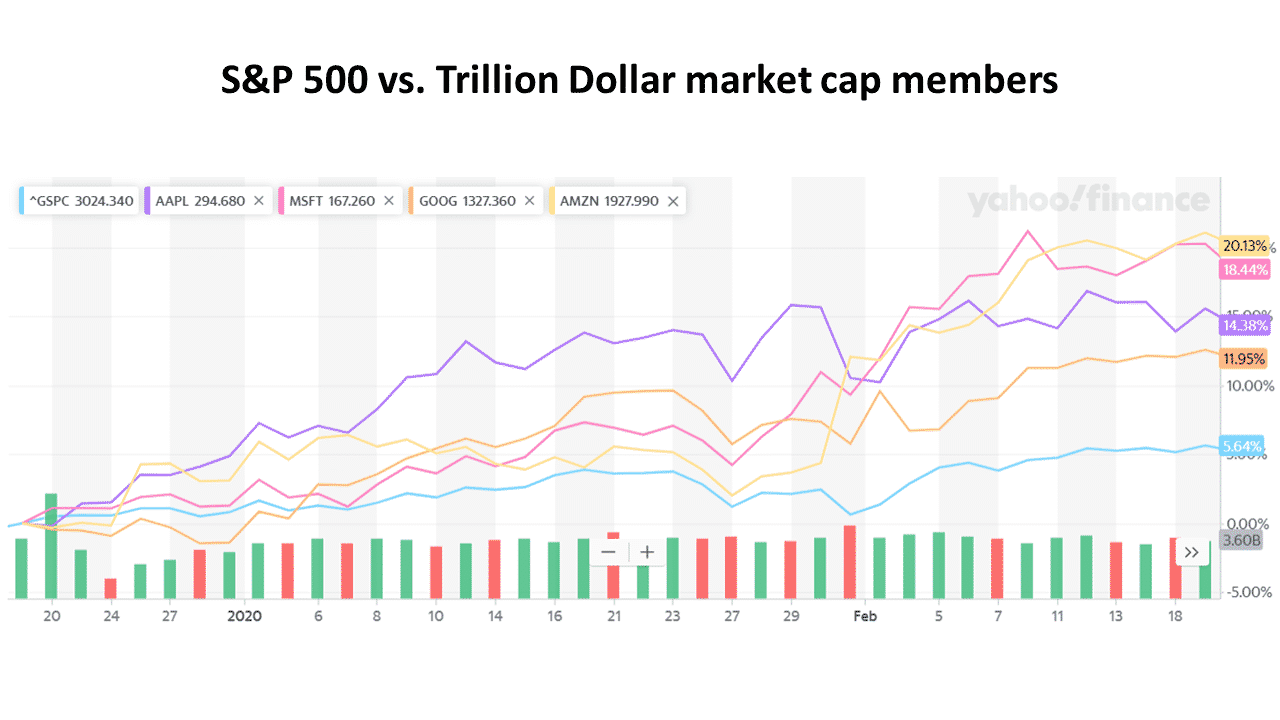

- The shares of the world’s four trillion-dollar valued companies, Apple, Microsoft, Google and Amazon reaching new all-time highs between February 10 and February 19.

- US dollar beginning a free fall on February 20, 2020, after reaching a one year high on February 19th.

For the 60 days ended February 19th the rate of appreciation for the four trillion-dollar companies was 100% to 400% higher than the S&P 500’s.

The tech company perception began to unravel after Microsoft and Apple both issued warnings in February about their financial results being negatively impacted by the Coronavirus. After the virus started to spread virally and globally investors began to realize that the US stock market had not been adequately discounted.

The valuations for the five largest market cap members of the S&P 500 reaching levels not seen since the 2000 dotcom bubble, was also a factor. The chart below depicts the price to revenue multiple for the S&P 500 at the end of 2019 being higher than the year 2000.

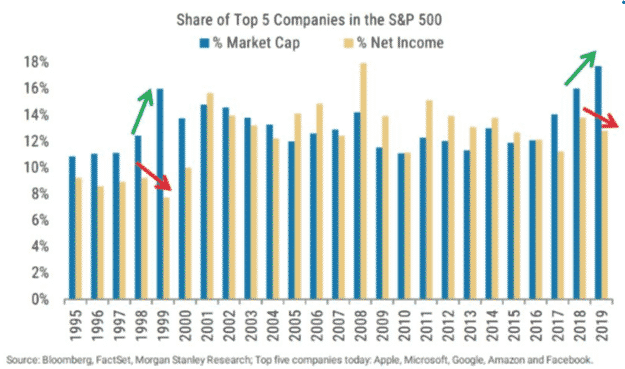

The chart below depicts that the aggregate market caps of the S&P 500’s five largest members including the four trillion-dollar companies and Facebook exceeded 2000’s 16%. The red arrows in the chart point to the declines in net income for the S&P 500’s five largest cap members as a percentage of total S&P 500 net income from 1998 to 1999 and from 2018 to 2019. The green arrows point to the increases in market caps for the same two periods.

The simultaneous double-digit declines for the stock markets of four of the world’s developed countries from February 20 to February 28, 2020 was an historic and ominous event. The fact that four of the five indices traded at historic highs on February 19, 2020 is extremely troubling.

My March 5, 2020 article “_______________” includes the statistics which support the 100% probability that the world’s major stock indices will decline by a minimum of 35% from their February 2020 peaks by sometime in April 2020. This would equate to additional declines of 23% for the S&P 500 and the NASDAQ compared to their March 5, 2020 closes.

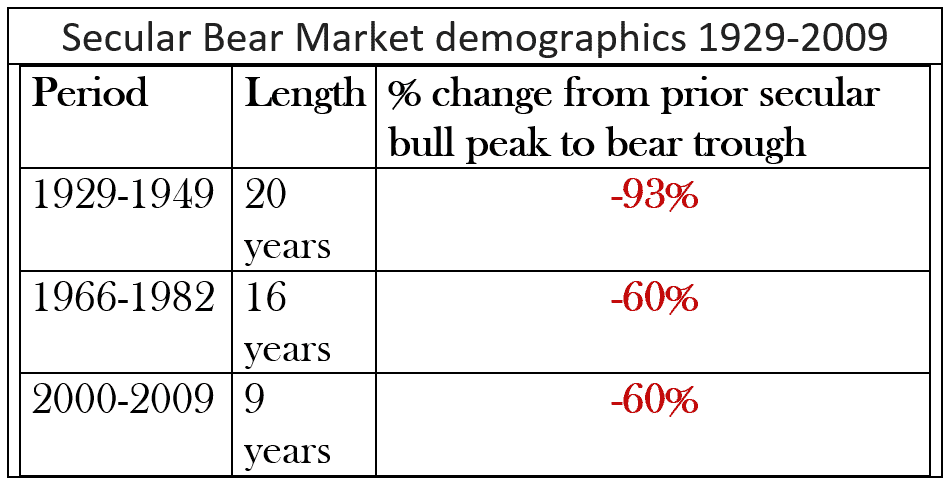

One of my predictions is the secular bull market which began in March 2009 ended on February 19th and a new secular bear began on February 20th. Based on the peaks of the last three secular bull markets as compared to the troughs of the of the three most recent secular bears, the S&P 500 could decline by an additional 49% to 82% from its March 5, 2020 close.

To become knowledgeable about secular bear markets view the video here of my “Secular Bulls & Bears: Each requires different investing strategies” workshop at the February 2020 Orlando Money Show. The video includes charts and graphs pertaining to a slowing US economy and the probability for a recession increasing.

Finally, since the new secular bear market is now underway a strategy to liquidate shares and mutual fund holdings should be deployed as soon as possible. Do not wait for a rally! Exiting 10% to 15% below the peak of an 11-year old secular bull market is a SLAM DUNK. Any losses can be recouped quickly by utilizing the Bull & Bear Tracker’s signals. The gains have been averaging 5% per month. See “Big story is not “Bull & Bear Tracker’s 5% gain vs S&P 500 loss” for January 2020”, February 2, 2020.